Answered step by step

Verified Expert Solution

Question

1 Approved Answer

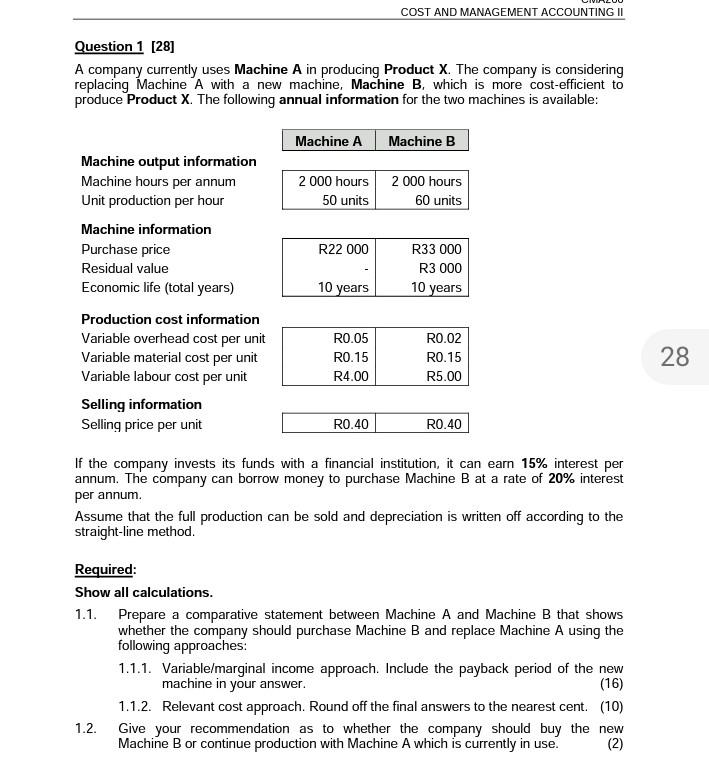

Question 1 [28] A company currently uses Machine A in producing Product X. The company is considering replacing Machine A with a new machine, Machine

Question 1 [28] A company currently uses Machine A in producing Product X. The company is considering replacing Machine A with a new machine, Machine B, which is more cost-efficient to produce Product X. The following annual information for the two machines is available: Machine output information Machine hours per annum Unit production per hour Machine information Purchase price Residual value Economic life (total years) Production cost information Variable overhead cost per unit Variable material cost per unit Variable labour cost per unit Selling information Selling price per unit \begin{tabular}{|l|l|} \hline R0.40 & R0.40 \\ \hline \end{tabular} If the company invests its funds with a financial institution, it can earn 15% interest per annum. The company can borrow money to purchase Machine B at a rate of 20% interest per annum. Assume that the full production can be sold and depreciation is written off according to the straight-line method. Required: Show all calculations. 1.1. Prepare a comparative statement between Machine A and Machine B that shows whether the company should purchase Machine B and replace Machine A using the following approaches: 1.1.1. Variable/marginal income approach. Include the payback period of the new machine in your answer. 1.1.2. Relevant cost approach. Round off the final answers to the nearest cent. (10) 1.2. Give your recommendation as to whether the company should buy the new Machine B or continue production with Machine A which is currently in use. Question 1 [28] A company currently uses Machine A in producing Product X. The company is considering replacing Machine A with a new machine, Machine B, which is more cost-efficient to produce Product X. The following annual information for the two machines is available: Machine output information Machine hours per annum Unit production per hour Machine information Purchase price Residual value Economic life (total years) Production cost information Variable overhead cost per unit Variable material cost per unit Variable labour cost per unit Selling information Selling price per unit \begin{tabular}{|l|l|} \hline R0.40 & R0.40 \\ \hline \end{tabular} If the company invests its funds with a financial institution, it can earn 15% interest per annum. The company can borrow money to purchase Machine B at a rate of 20% interest per annum. Assume that the full production can be sold and depreciation is written off according to the straight-line method. Required: Show all calculations. 1.1. Prepare a comparative statement between Machine A and Machine B that shows whether the company should purchase Machine B and replace Machine A using the following approaches: 1.1.1. Variable/marginal income approach. Include the payback period of the new machine in your answer. 1.1.2. Relevant cost approach. Round off the final answers to the nearest cent. (10) 1.2. Give your recommendation as to whether the company should buy the new Machine B or continue production with Machine A which is currently in use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started