Answered step by step

Verified Expert Solution

Question

1 Approved Answer

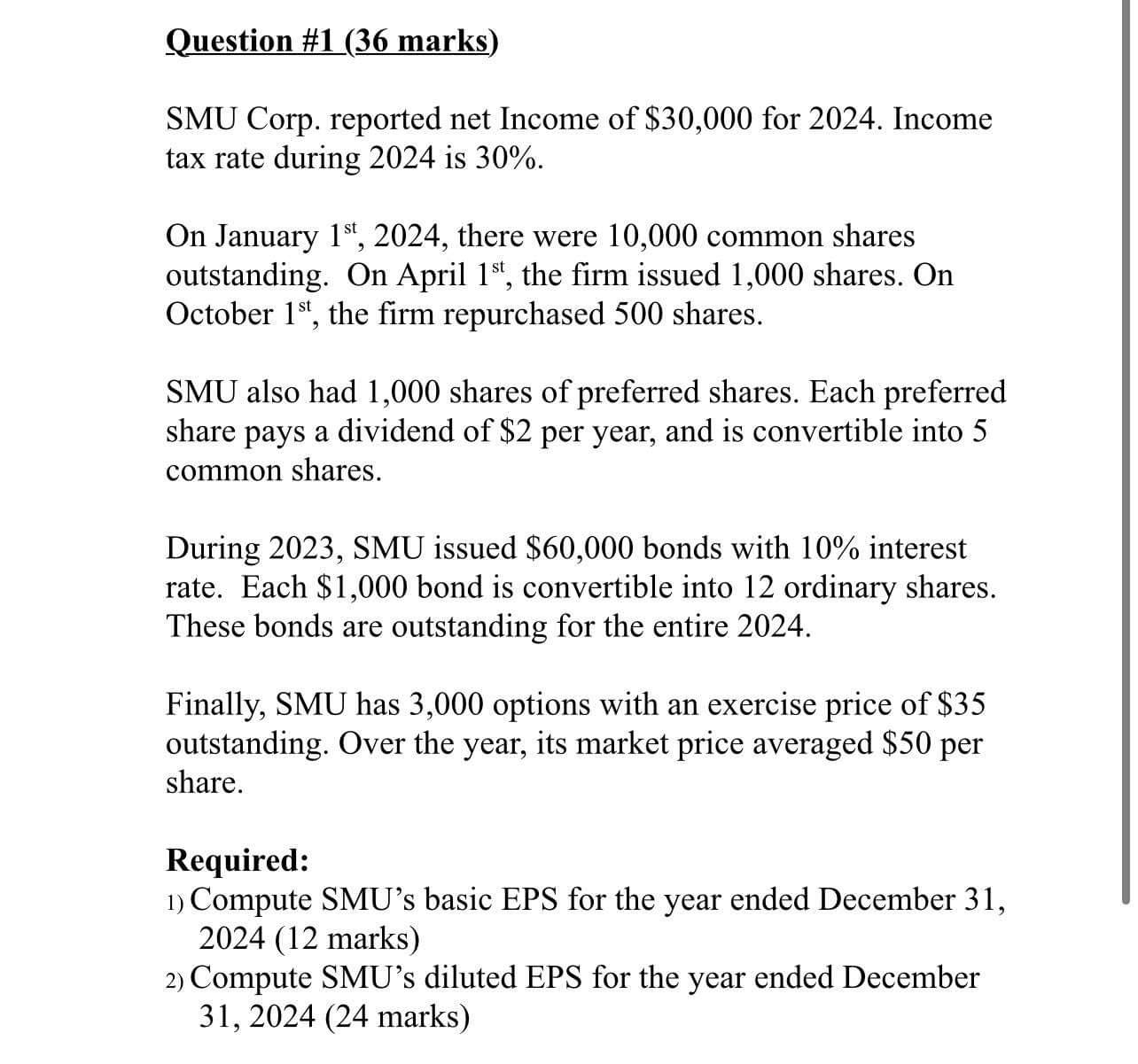

Question # 1 ( 3 6 marks ) SMU Corp. reported net Income of $ 3 0 , 0 0 0 for 2 0 2

Question # marks

SMU Corp. reported net Income of $ for Income tax rate during is

On January there were common shares outstanding. On April the firm issued shares. On October the firm repurchased shares.

SMU also had shares of preferred shares. Each preferred share pays a dividend of $ per year, and is convertible into common shares.

During SMU issued $ bonds with interest rate. Each $ bond is convertible into ordinary shares. These bonds are outstanding for the entire

Finally, SMU has options with an exercise price of $ outstanding. Over the year, its market price averaged $ per share.

Required:

Compute SMU's basic EPS for the year ended December marks

Compute SMU's diluted EPS for the year ended December marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started