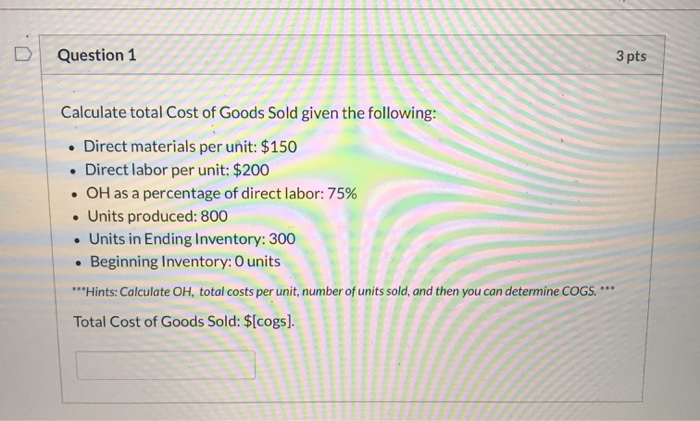

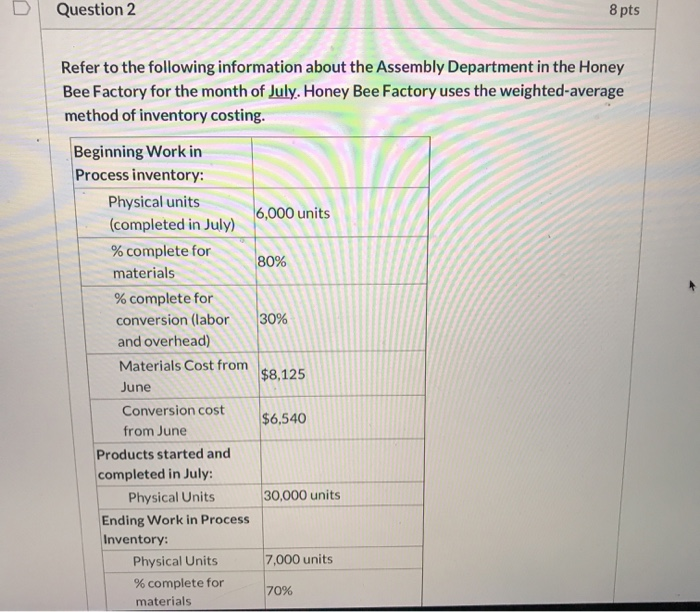

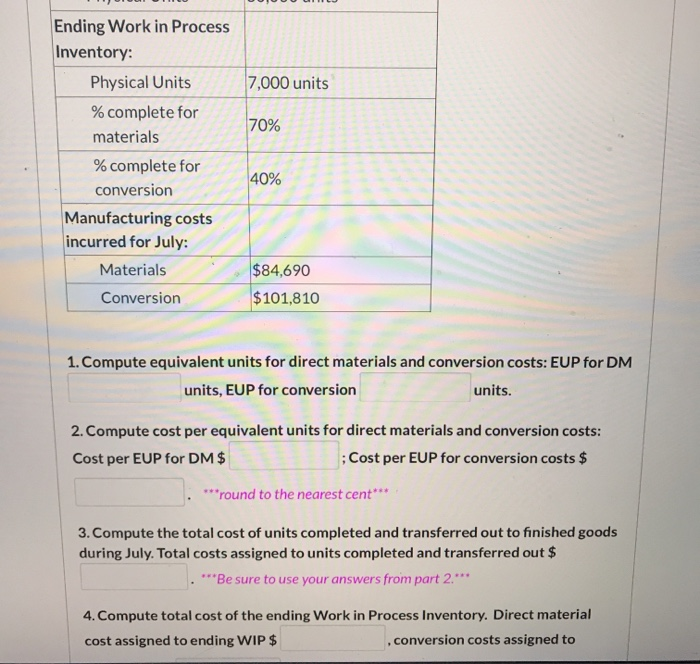

Question 1 3 pts Calculate total cost of Goods Sold given the following: Direct materials per unit: $150 Direct labor per unit: $200 OH as a percentage of direct labor: 75% Units produced: 800 Units in Ending Inventory: 300 Beginning Inventory: O units ***Hints: Calculate OH, total costs per unit, number of units sold, and then you can determine COGS. *** Total Cost of Goods Sold: $[cogs). . Question 2 8 pts Refer to the following information about the Assembly Department in the Honey Bee Factory for the month of July. Honey Bee Factory uses the weighted-average method of inventory costing. Beginning Work in Process inventory: Physical units 6,000 units (completed in July) % complete for 80% materials % complete for conversion (labor 30% and overhead) Materials Cost from $8,125 June Conversion cost $6,540 from June Products started and completed in July: Physical Units 30,000 units Ending Work in Process Inventory: Physical Units 7,000 units % complete for 70% materials 7,000 units 70% Ending Work in Process Inventory: Physical Units % complete for materials % complete for conversion Manufacturing costs incurred for July: Materials Conversion 40% $84,690 $ 101,810 1. Compute equivalent units for direct materials and conversion costs: EUP for DM units, EUP for conversion units. 2. Compute cost per equivalent units for direct materials and conversion costs: Cost per EUP for DM $ ; Cost per EUP for conversion costs $ ***round to the nearest cent*** 3. Compute the total cost of units completed and transferred out to finished goods during July. Total costs assigned to units completed and transferred out $ ***Be sure to use your answers from part 2.*** 4. Compute total cost of the ending Work in Process Inventory. Direct material cost assigned to ending WIP $ .conversion costs assigned to 1. Compute equivalent units for direct materials and conversion costs: EUP for DM units, EUP for conversion units. 2.Compute cost per equivalent units for direct materials and conversion costs: Cost per EUP for DM $ ; Cost per EUP for conversion costs $ ***round to the nearest cent** 3. Compute the total cost of units completed and transferred out to finished goods during July. Total costs assigned to units completed and transferred out $ ***Be sure to use your answers from part 2.*** 4. Compute total cost of the ending Work in Process Inventory. Direct material cost assigned to ending WIP $ , conversion costs assigned to ending WIP $ , and therefore total costs assigned to ending WIP $ ***Be sure to use per unit cost from part 2.*** Question 3 4 pts A company has two products: Cakes and Cookies. It uses activity-based costing and has prepared the following analysis showing budgeted costs and activities. Use this information to compute (a) the company's overhead rates for each of the three activities and (b) the amount of overhead allocated to Cakes. Total Product: Cookies 800 Activity Cost Pool Activity 1 Activity 2 Activity 3 Total Budgeted overhead Budgeted Product: Cakes Overhead Cost $60,000 700 $75,000 1,500 $90,000 800 1,500 1,500 3,000 1,700 900 $225,000 "'round to the whole dollar and use in your final calculation." Overhead rate for Activity 1 is $ Overhead rate for Activity 2 is $ Overhead rate for Activity 3 is $ Total overhead allocated to Cakes based on activity-based costing is $