Question

QUESTION 1 [30 MARKS] 1.1 Bread Ltd is a company based in Durban that make speciality cakes for weddings and special events. The company is

QUESTION 1 [30 MARKS]

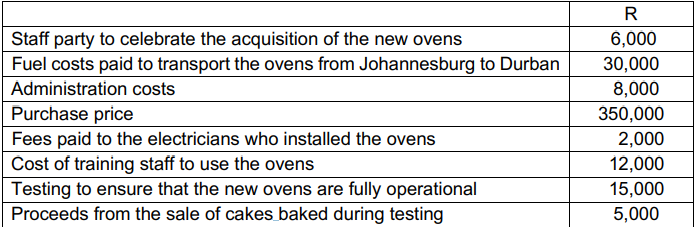

1.1 Bread Ltd is a company based in Durban that make speciality cakes for weddings and special events. The company is a registered VAT vendor and has a financial year-end of 31 March. It bought 10 industrial ovens from a supplier in Johannesburg on the 31 January 2022. The following costs were incurred with regard to these ovens bought, all exclusive of VAT.

Required:

1.1.1 Calculate the total initial cost to be capitalised to the baking equipment Account (5)

1.1.2 Explain, by referring to the definition criteria for property, plant and equipment (PPE), why the ovens bought should be classified as PPE. (3)

1.1.3 Refer to the recognition criteria to explain why it should be recognised as PPE by Bread Ltd. (2) (10)

1.2

1.2.1 Identify three regulatory influences on the preparation of financial statements of listed entities. (5)

1.2.2 Briefly explain the role of each and comment on the efficacy of the regulatory system. (15)

Use sub-headings to divide your answers. Include Introduction, Body and Conclusion

\begin{tabular}{|l|r|} \hline & R \\ \hline Staff party to celebrate the acquisition of the new ovens & 6,000 \\ \hline Fuel costs paid to transport the ovens from Johannesburg to Durban & 30,000 \\ \hline Administration costs & 8,000 \\ \hline Purchase price & 350,000 \\ \hline Fees paid to the electricians who installed the ovens & 2,000 \\ \hline Cost of training staff to use the ovens & 12,000 \\ \hline Testing to ensure that the new ovens are fully operational & 15,000 \\ \hline Proceeds from the sale of cakes baked during testing & 5,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started