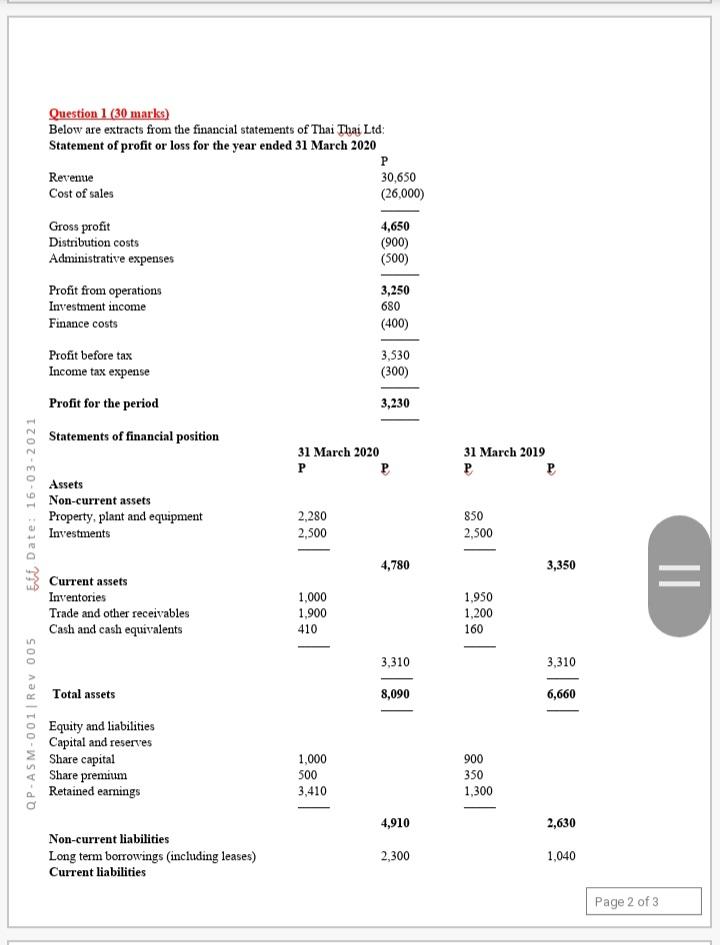

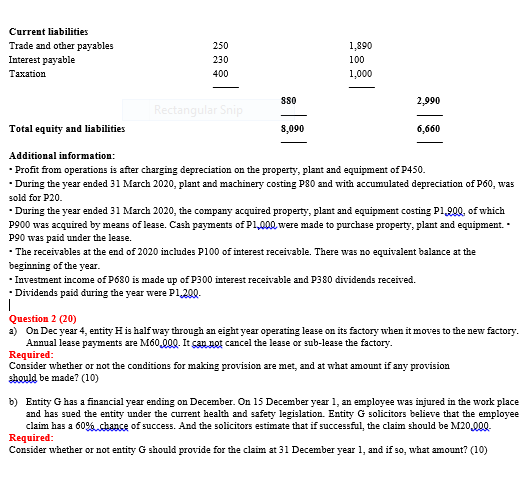

Question 1 (30 marks) Below are extracts from the financial statements of Thai Thai Ltd: Statement of profit or loss for the year ended 31 March 2020 P Revenue 30,650 Cost of sales (26,000) 4,650 Gross profit Distribution costs Administrative expenses (900) (500) 3,250 680 (400) Profit from operations Investment income Finance costs Profit before tax Income tax expense Profit for the period 3,530 (300) 3,230 Statements of financial position 31 March 2020 P 31 March 2019 P EL Date: 16-03-2021 Assets Non-current assets Property, plant and equipment Investments 2,280 850 2,500 2,500 4,780 3,350 = Current assets Inventories Trade and other receivables Cash and cash equivalents 1,000 1,900 410 1,950 1,200 160 3,310 3,310 Total assets 8,090 6,660 QP-ASM-001 Rev 005 Equity and liabilities Capital and reserves Share capital Share premium Retained earnings 1,000 500 3,410 900 350 1,300 4,910 2,630 Non-current liabilities Long term borrowings (including leases) Current liabilities 2,300 1,040 Page 2 of 3 Current liabilities Trade and other payables Interest payable Taxation 250 230 400 1,890 100 1,000 | 880 2,990 Rectangular Snip Total equity and liabilities 8,090 6,660 Additional information: Profit from operations is after charging depreciation on the property, plant and equipment of P450. During the year ended 31 March 2020, plant and machinery costing P80 and with accumulated depreciation of P60, was sold for P20 . During the year ended 31 March 2020, the company acquired property, plant and equipment costing P1.990, of which P900 was acquired by means of lease. Cash payments of P1,000, were made to purchase property, plant and equipment. P90 was paid under the lease. . The receivables at the end of 2020 includes P100 of interest receivable. There was no equivalent balance at the beginning of the year. Investment income of P680 is made up of P300 interest receivable and P380 dividends received. Dividenda paid during the year were P1.200- | Question 2 (20) a) On Dec year 4, entity His half way through an eight year operating lease on its factory when it moves to the new factory. Annual lease payments are M60.000. It cannot cancel the lease or sub-lease the factory. Required: Consider whether or not the conditions for making provision are met, and at what amount if any provision should be made? (10) b) Entity G has a financial year ending on December. On 15 December year 1, an employee was injured in the work place and has sued the entity under the current health and safety legislation. Entity G solicitors believe that the employee claim has a 60% chance of success. And the solicitors estimate that if successful, the claim should be M20.000- Required: Consider whether or not entity G should provide for the claim at 31 December year 1, and if so, what amount