Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (30 marks) Indio Inc. is a Canadian controlled private corporation (CCPC). All of the shares are owned by Jean Indio and his spouse.

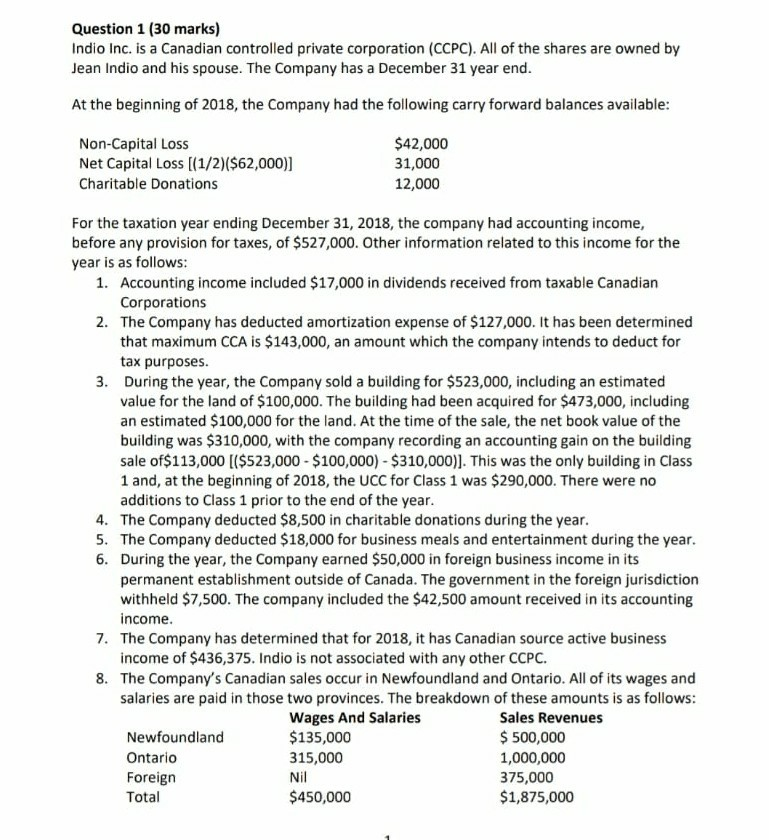

Question 1 (30 marks) Indio Inc. is a Canadian controlled private corporation (CCPC). All of the shares are owned by Jean Indio and his spouse. The Company has a December 31 year end At the beginning of 2018, the Company had the following carry forward balances available Non-Capital Loss Net Capital Loss [(1/2)($62,000] Charitable Donations $42,000 31,000 12,000 For the taxation year ending December 31, 2018, the company had accounting income, before any provision for taxes, of $527,000. Other information related to this income for the year is as follows Accounting income included $17,000 in dividends received from taxable Canadian Corporations The Company has deducted amortization expense of $127,000. It has been determined that maximum CCA is $143,000, an amount which the company intends to deduct for tax purposes. During the year, the Company sold a building for $523,000, including an estimated value for the land of $100,000. The building had been acquired for $473,000, including an estimated $100,000 for the land. At the time of the sale, the net book value of the building was $310,000, with the company recording an accounting gain on the building sale of$113,000 [($523,000 $100,000) $310,000)1 This was the only building in Class 1 and, at the beginning of 2018, the UCC for Class 1 was $290,000. There were no additions to Class 1 prior to the end of the year The Company deducted $8,500 in charitable donations during the year. The Company deducted $18,000 for business meals and entertainment during the year During the year, the Company earned $50,000 in foreign business income in its permanent establishment outside of Canada. The government in the foreign jurisdiction withheld $7,500. The company included the $42,500 amount received in its accounting income The Company has determined that for 2018, it has Canadian source active business income of $436,375. Indio is not associated with any other CCPC. The Company's Canadian sales occur in Newfoundland and Ontario. All of its wages and salaries are paid in those two provinces. The breakdown of these amounts is as follows 1. 2. 3. 4. 5. 6. 7. 8. Newfoundland Ontario Foreign Total Wages And Salaries $135,000 315,000 Sales Revenues $500,000 1,000,000 375,000 $1,875,000 $450,000 Question 1 (30 marks) Indio Inc. is a Canadian controlled private corporation (CCPC). All of the shares are owned by Jean Indio and his spouse. The Company has a December 31 year end At the beginning of 2018, the Company had the following carry forward balances available Non-Capital Loss Net Capital Loss [(1/2)($62,000] Charitable Donations $42,000 31,000 12,000 For the taxation year ending December 31, 2018, the company had accounting income, before any provision for taxes, of $527,000. Other information related to this income for the year is as follows Accounting income included $17,000 in dividends received from taxable Canadian Corporations The Company has deducted amortization expense of $127,000. It has been determined that maximum CCA is $143,000, an amount which the company intends to deduct for tax purposes. During the year, the Company sold a building for $523,000, including an estimated value for the land of $100,000. The building had been acquired for $473,000, including an estimated $100,000 for the land. At the time of the sale, the net book value of the building was $310,000, with the company recording an accounting gain on the building sale of$113,000 [($523,000 $100,000) $310,000)1 This was the only building in Class 1 and, at the beginning of 2018, the UCC for Class 1 was $290,000. There were no additions to Class 1 prior to the end of the year The Company deducted $8,500 in charitable donations during the year. The Company deducted $18,000 for business meals and entertainment during the year During the year, the Company earned $50,000 in foreign business income in its permanent establishment outside of Canada. The government in the foreign jurisdiction withheld $7,500. The company included the $42,500 amount received in its accounting income The Company has determined that for 2018, it has Canadian source active business income of $436,375. Indio is not associated with any other CCPC. The Company's Canadian sales occur in Newfoundland and Ontario. All of its wages and salaries are paid in those two provinces. The breakdown of these amounts is as follows 1. 2. 3. 4. 5. 6. 7. 8. Newfoundland Ontario Foreign Total Wages And Salaries $135,000 315,000 Sales Revenues $500,000 1,000,000 375,000 $1,875,000 $450,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started