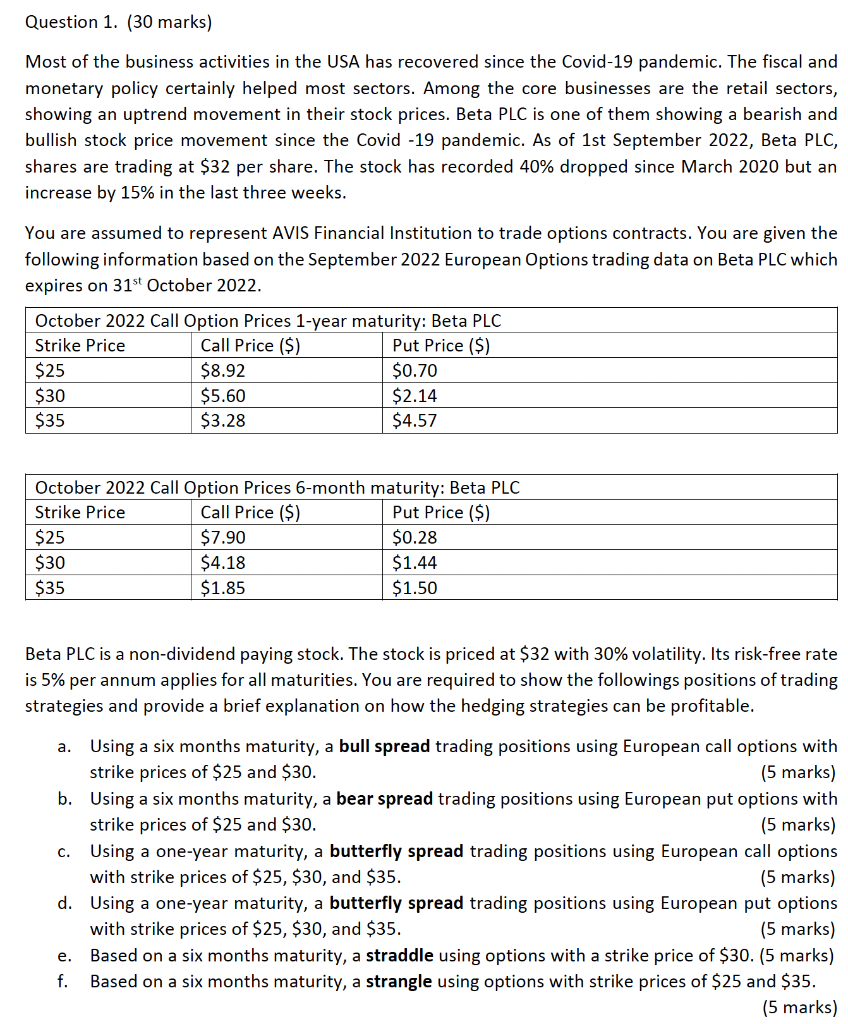

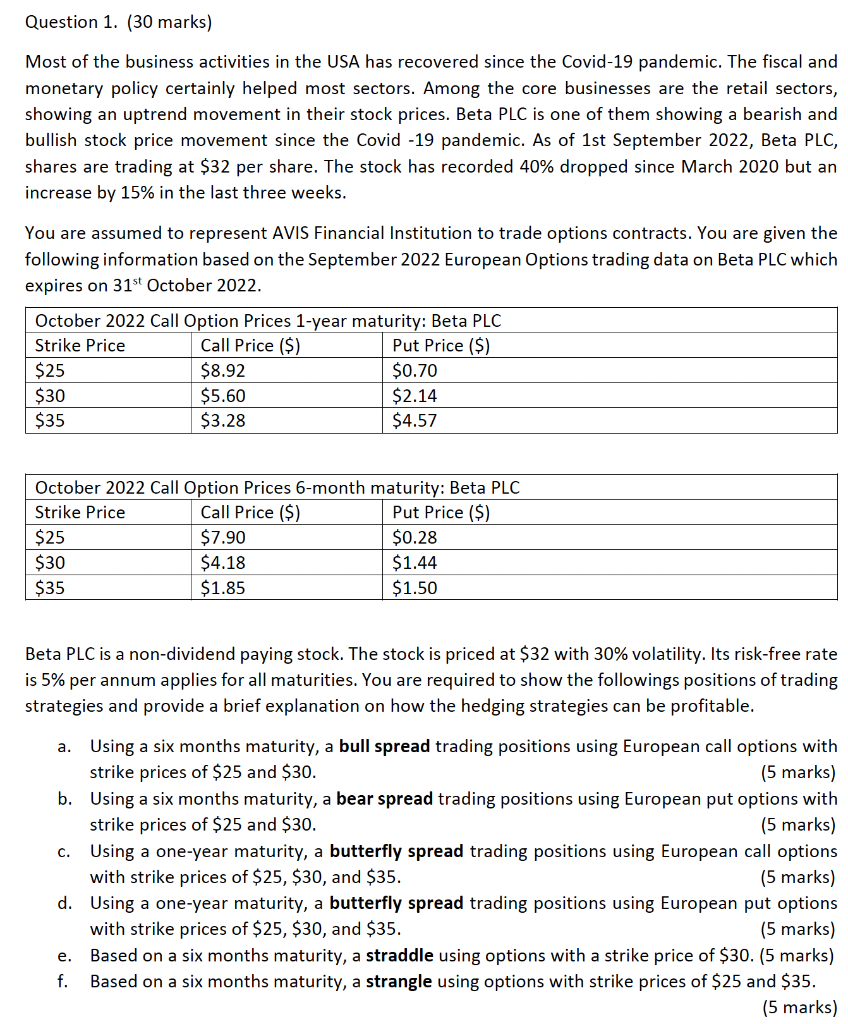

Question 1. ( 30 marks) Most of the business activities in the USA has recovered since the Covid-19 pandemic. The fiscal and monetary policy certainly helped most sectors. Among the core businesses are the retail sectors, showing an uptrend movement in their stock prices. Beta PLC is one of them showing a bearish and bullish stock price movement since the Covid -19 pandemic. As of 1st September 2022, Beta PLC, shares are trading at $32 per share. The stock has recorded 40% dropped since March 2020 but an increase by 15% in the last three weeks. You are assumed to represent AVIS Financial Institution to trade options contracts. You are given the following information based on the September 2022 European Options trading data on Beta PLC which expires on 31st October 2022. Beta PLC is a non-dividend paying stock. The stock is priced at $32 with 30% volatility. Its risk-free rate is 5% per annum applies for all maturities. You are required to show the followings positions of trading strategies and provide a brief explanation on how the hedging strategies can be profitable. a. Using a six months maturity, a bull spread trading positions using European call options with strike prices of $25 and $30. (5 marks) b. Using a six months maturity, a bear spread trading positions using European put options with strike prices of $25 and $30. (5 marks) c. Using a one-year maturity, a butterfly spread trading positions using European call options with strike prices of $25,$30, and $35. (5 marks) d. Using a one-year maturity, a butterfly spread trading positions using European put options with strike prices of $25,$30, and $35. (5 marks) e. Based on a six months maturity, a straddle using options with a strike price of \$30. (5 marks) f. Based on a six months maturity, a strangle using options with strike prices of $25 and \$35. (5 marks) Question 1. ( 30 marks) Most of the business activities in the USA has recovered since the Covid-19 pandemic. The fiscal and monetary policy certainly helped most sectors. Among the core businesses are the retail sectors, showing an uptrend movement in their stock prices. Beta PLC is one of them showing a bearish and bullish stock price movement since the Covid -19 pandemic. As of 1st September 2022, Beta PLC, shares are trading at $32 per share. The stock has recorded 40% dropped since March 2020 but an increase by 15% in the last three weeks. You are assumed to represent AVIS Financial Institution to trade options contracts. You are given the following information based on the September 2022 European Options trading data on Beta PLC which expires on 31st October 2022. Beta PLC is a non-dividend paying stock. The stock is priced at $32 with 30% volatility. Its risk-free rate is 5% per annum applies for all maturities. You are required to show the followings positions of trading strategies and provide a brief explanation on how the hedging strategies can be profitable. a. Using a six months maturity, a bull spread trading positions using European call options with strike prices of $25 and $30. (5 marks) b. Using a six months maturity, a bear spread trading positions using European put options with strike prices of $25 and $30. (5 marks) c. Using a one-year maturity, a butterfly spread trading positions using European call options with strike prices of $25,$30, and $35. (5 marks) d. Using a one-year maturity, a butterfly spread trading positions using European put options with strike prices of $25,$30, and $35. (5 marks) e. Based on a six months maturity, a straddle using options with a strike price of \$30. (5 marks) f. Based on a six months maturity, a strangle using options with strike prices of $25 and \$35