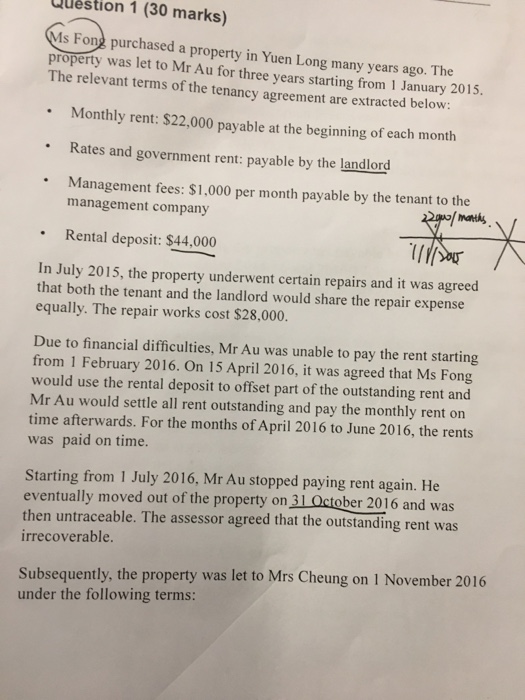

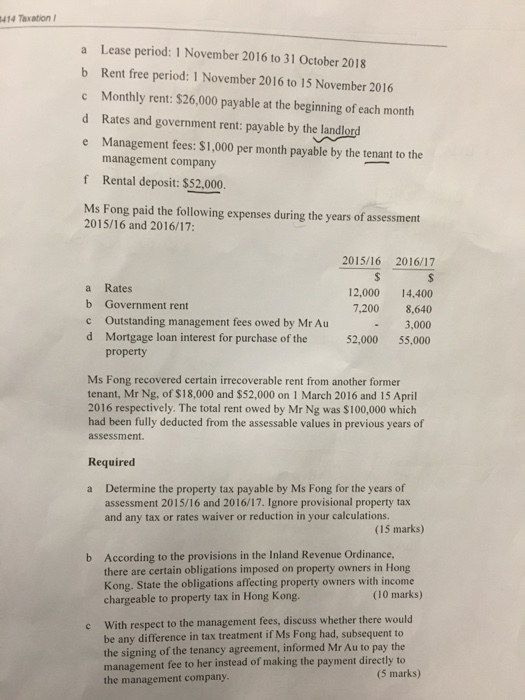

Question 1 (30 marks) Ms Fong purchased a property in Yuen Long many years ago. The The relevant terms of the tenancy agreement are extracted below . Monthly rent: $22,000 payable at the beginning of each month . Rates and government rent: payable by the landlord was let to Mr Au for three years starting from 1 January 2015. Management fees: $1,000 per month payable by the tenant to the management company Rental deposit: $44,000 In July 2015, the property underwent certain repairs and it was agreed that both the tenant and the landlord would share the repair expense equally. The repair works cost $28.000, Due to financial difficulties, Mr Au was unable to pay the rent starting from 1 February 2016. On 15 April 2016, it was agreed that Ms Fong would use the rental deposit to offset part of the outstanding rent and Mr Au would settle all rent outstanding and pay the monthly rent on time afterwards. For the months of April 2016 to June 2016, the rents was paid on time. Starting from 1 July 2016, Mr Au stopped paying rent again. He eventually moved out of the property on 31 October 2016 and w then untraceable. The assessor agreed that the outstanding rent was irrecoverable. Subsequently, the property was let to Mrs Cheung on 1 November 2016 under the following terms: Question 1 (30 marks) Ms Fong purchased a property in Yuen Long many years ago. The The relevant terms of the tenancy agreement are extracted below . Monthly rent: $22,000 payable at the beginning of each month . Rates and government rent: payable by the landlord was let to Mr Au for three years starting from 1 January 2015. Management fees: $1,000 per month payable by the tenant to the management company Rental deposit: $44,000 In July 2015, the property underwent certain repairs and it was agreed that both the tenant and the landlord would share the repair expense equally. The repair works cost $28.000, Due to financial difficulties, Mr Au was unable to pay the rent starting from 1 February 2016. On 15 April 2016, it was agreed that Ms Fong would use the rental deposit to offset part of the outstanding rent and Mr Au would settle all rent outstanding and pay the monthly rent on time afterwards. For the months of April 2016 to June 2016, the rents was paid on time. Starting from 1 July 2016, Mr Au stopped paying rent again. He eventually moved out of the property on 31 October 2016 and w then untraceable. The assessor agreed that the outstanding rent was irrecoverable. Subsequently, the property was let to Mrs Cheung on 1 November 2016 under the following terms