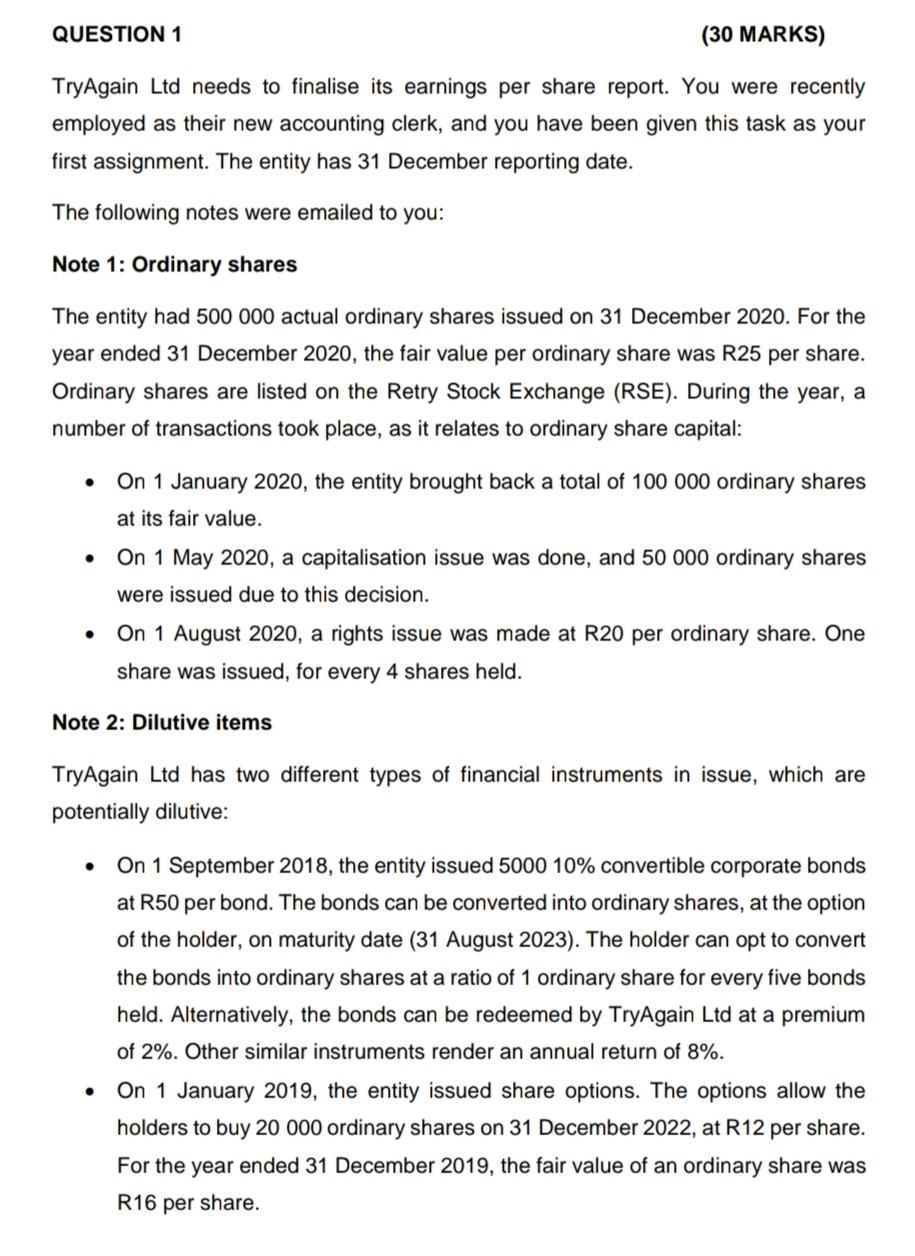

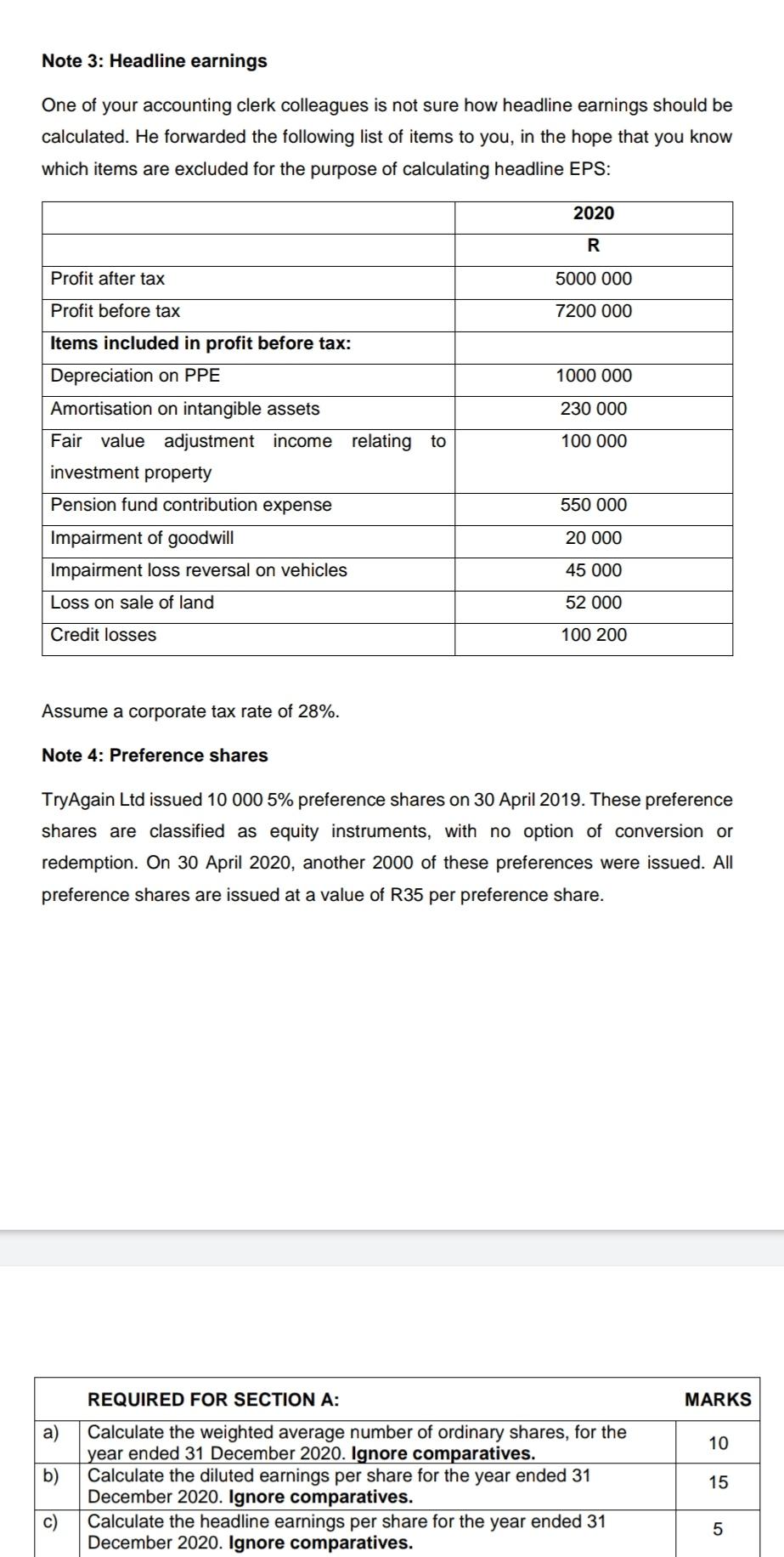

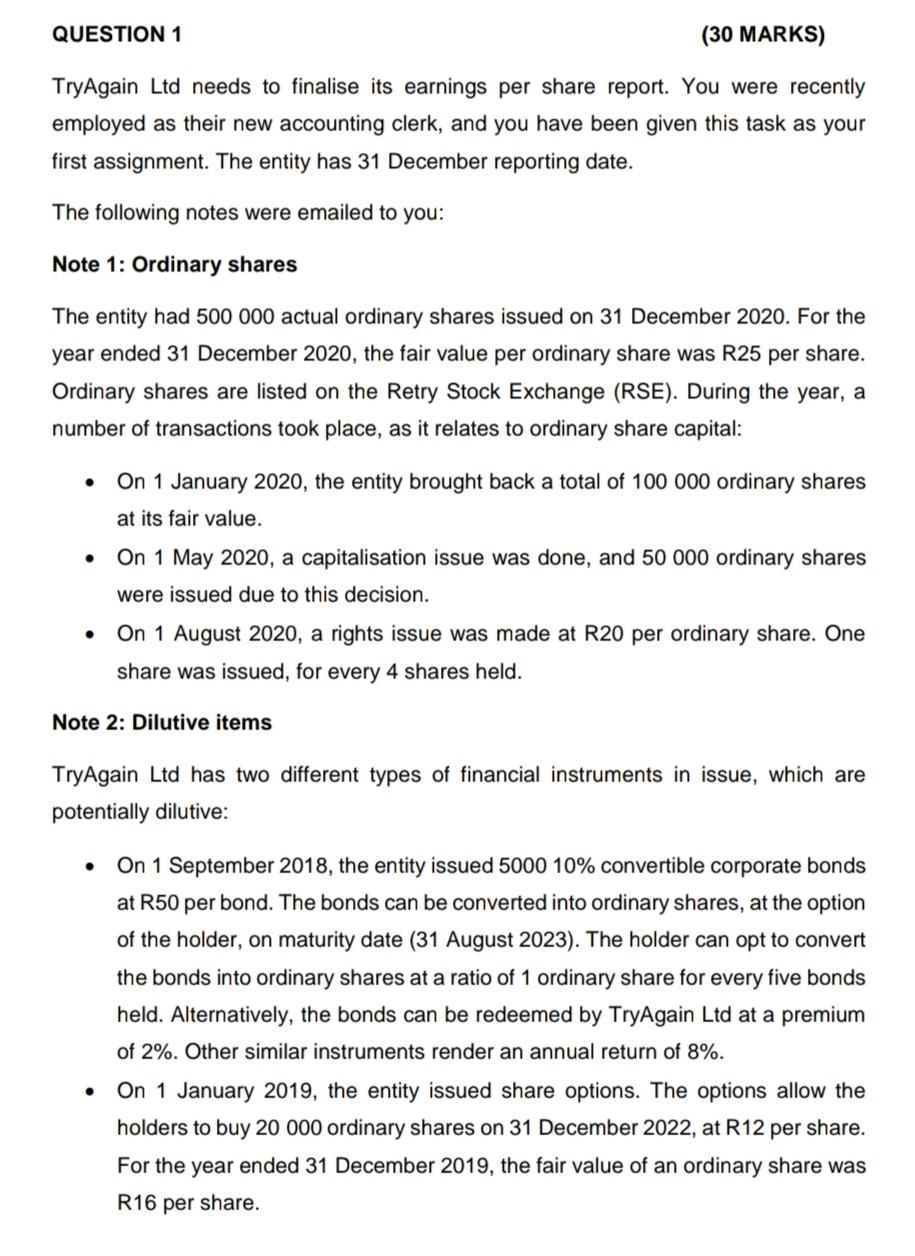

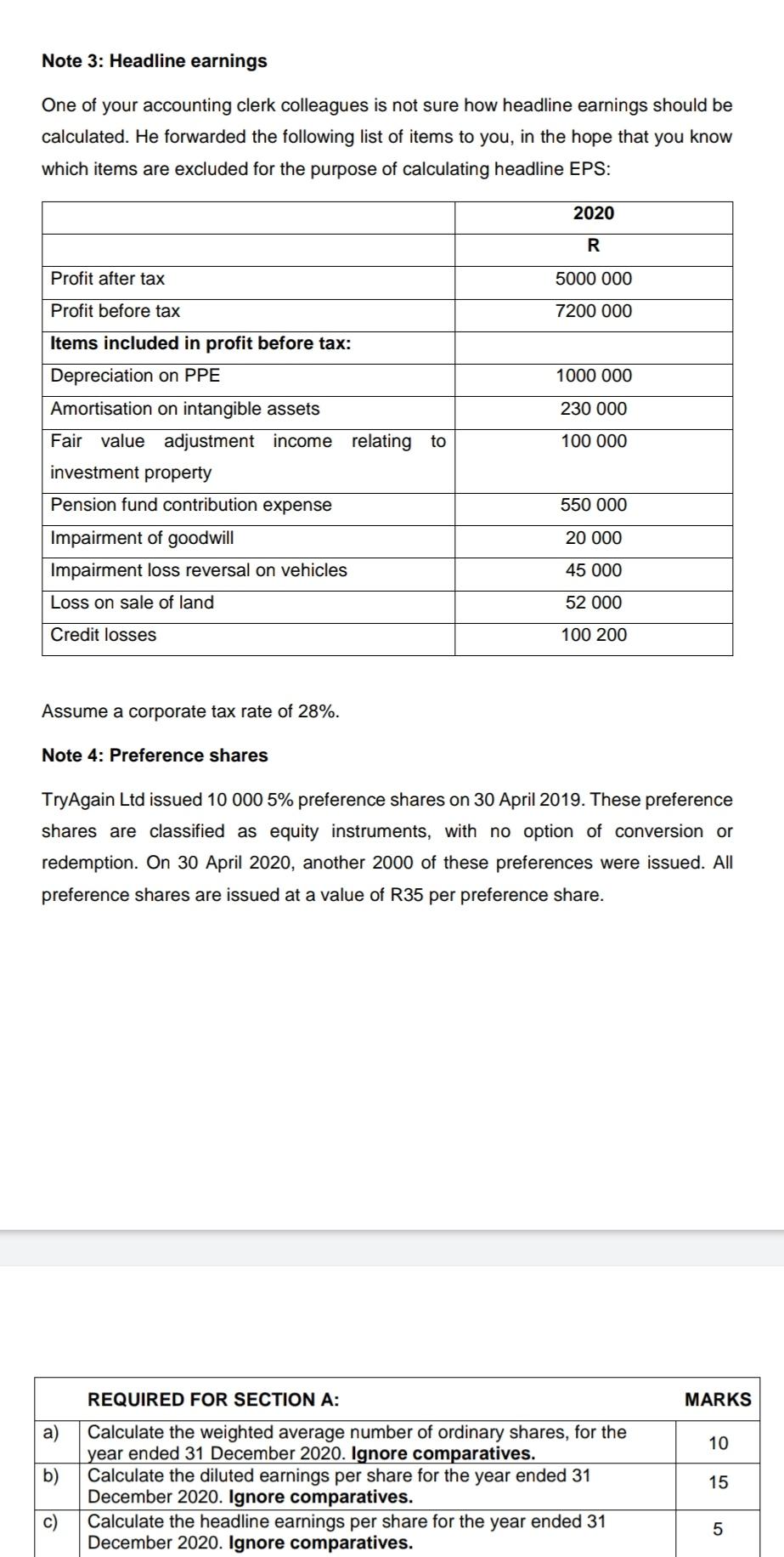

QUESTION 1 (30 MARKS) TryAgain Ltd needs to finalise its earnings per share report. You were recently employed as their new accounting clerk, and you have been given this task as your first assignment. The entity has 31 December reporting date. The following notes were emailed to you: Note 1: Ordinary shares The entity had 500 000 actual ordinary shares issued on 31 December 2020. For the year ended 31 December 2020, the fair value per ordinary share was R25 per share. Ordinary shares are listed on the Retry Stock Exchange (RSE). During the year, a number of transactions took place, as it relates to ordinary share capital: On 1 January 2020, the entity brought back a total of 100 000 ordinary shares at its fair value. On 1 May 2020, a capitalisation issue was done, and 50 000 ordinary shares were issued due to this decision. . On 1 August 2020, a rights issue was made at R20 per ordinary share. One share was issued, for every 4 shares held. Note 2: Dilutive items TryAgain Ltd has two different types of financial instruments in issue, which are potentially dilutive: . On 1 September 2018, the entity issued 5000 10% convertible corporate bonds at R50 per bond. The bonds can be converted into ordinary shares, at the option of the holder, on maturity date (31 August 2023). The holder can opt to convert the bonds into ordinary shares at a ratio of 1 ordinary share for every five bonds held. Alternatively, the bonds can be redeemed by TryAgain Ltd at a premium of 2%. Other similar instruments render an annual return of 8%. On 1 January 2019, the entity issued share options. The options allow the holders to buy 20 000 ordinary shares on 31 December 2022, at R12 per share. For the year ended 31 December 2019, the fair value of an ordinary share was R16 per share. Note 3: Headline earnings One of your accounting clerk colleagues is not sure how headline earnings should be calculated. He forwarded the following list of items to you, in the hope that you know which items are excluded for the purpose of calculating headline EPS: 2020 R Profit after tax 5000 000 Profit before tax 7200 000 Items included in profit before tax: Depreciation on PPE 1000 000 230 000 Amortisation on intangible assets Fair value adjustment income relating to 100 000 investment property Pension fund contribution expense 550 000 20 000 Impairment of goodwill Impairment loss reversal on vehicles Loss on sale of land 45 000 52 000 Credit losses 100 200 Assume a corporate tax rate of 28%. Note 4: Preference shares TryAgain Ltd issued 10 000 5% preference shares on 30 April 2019. These preference shares are classified as equity instruments, with no option of conversion or redemption. On 30 April 2020, another 2000 of these preferences were issued. All preference shares are issued at a value of R35 per preference share. REQUIRED FOR SECTION A: MARKS a) 10 b) Calculate the weighted average number of ordinary shares, for the year ended 31 December 2020. Ignore comparatives. Calculate the diluted earnings per share for the year ended 31 December 2020. Ignore comparatives. Calculate the headline earnings per share for the year ended 31 December 2020. Ignore comparatives. 15 c) 5 QUESTION 1 (30 MARKS) TryAgain Ltd needs to finalise its earnings per share report. You were recently employed as their new accounting clerk, and you have been given this task as your first assignment. The entity has 31 December reporting date. The following notes were emailed to you: Note 1: Ordinary shares The entity had 500 000 actual ordinary shares issued on 31 December 2020. For the year ended 31 December 2020, the fair value per ordinary share was R25 per share. Ordinary shares are listed on the Retry Stock Exchange (RSE). During the year, a number of transactions took place, as it relates to ordinary share capital: On 1 January 2020, the entity brought back a total of 100 000 ordinary shares at its fair value. On 1 May 2020, a capitalisation issue was done, and 50 000 ordinary shares were issued due to this decision. . On 1 August 2020, a rights issue was made at R20 per ordinary share. One share was issued, for every 4 shares held. Note 2: Dilutive items TryAgain Ltd has two different types of financial instruments in issue, which are potentially dilutive: . On 1 September 2018, the entity issued 5000 10% convertible corporate bonds at R50 per bond. The bonds can be converted into ordinary shares, at the option of the holder, on maturity date (31 August 2023). The holder can opt to convert the bonds into ordinary shares at a ratio of 1 ordinary share for every five bonds held. Alternatively, the bonds can be redeemed by TryAgain Ltd at a premium of 2%. Other similar instruments render an annual return of 8%. On 1 January 2019, the entity issued share options. The options allow the holders to buy 20 000 ordinary shares on 31 December 2022, at R12 per share. For the year ended 31 December 2019, the fair value of an ordinary share was R16 per share. Note 3: Headline earnings One of your accounting clerk colleagues is not sure how headline earnings should be calculated. He forwarded the following list of items to you, in the hope that you know which items are excluded for the purpose of calculating headline EPS: 2020 R Profit after tax 5000 000 Profit before tax 7200 000 Items included in profit before tax: Depreciation on PPE 1000 000 230 000 Amortisation on intangible assets Fair value adjustment income relating to 100 000 investment property Pension fund contribution expense 550 000 20 000 Impairment of goodwill Impairment loss reversal on vehicles Loss on sale of land 45 000 52 000 Credit losses 100 200 Assume a corporate tax rate of 28%. Note 4: Preference shares TryAgain Ltd issued 10 000 5% preference shares on 30 April 2019. These preference shares are classified as equity instruments, with no option of conversion or redemption. On 30 April 2020, another 2000 of these preferences were issued. All preference shares are issued at a value of R35 per preference share. REQUIRED FOR SECTION A: MARKS a) 10 b) Calculate the weighted average number of ordinary shares, for the year ended 31 December 2020. Ignore comparatives. Calculate the diluted earnings per share for the year ended 31 December 2020. Ignore comparatives. Calculate the headline earnings per share for the year ended 31 December 2020. Ignore comparatives. 15 c) 5