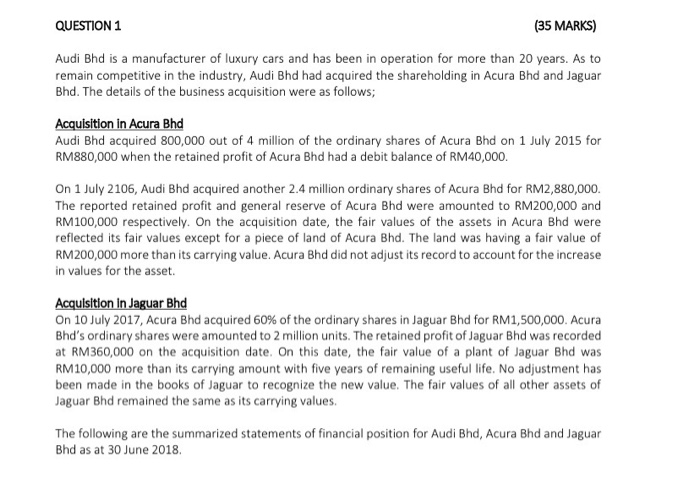

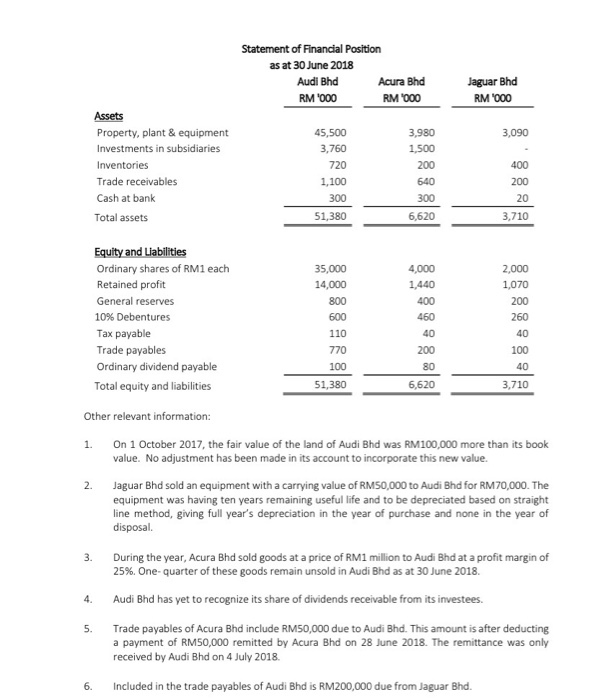

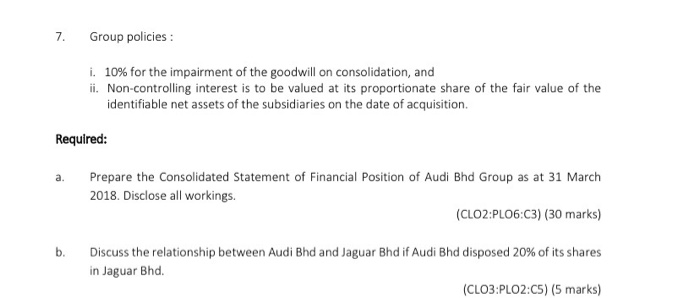

QUESTION 1 (35 MARKS) Audi Bhd is a manufacturer of luxury cars and has been in operation for more than 20 years. As to remain competitive in the industry, Audi Bhd had acquired the shareholding in Acura Bhd and Jaguar Bhd. The details of the business acquisition were as follows; Acquisition in Acura Bhd Audi Bhd acquired 800,000 out of 4 million of the ordinary shares of Acura Bhd on 1 July 2015 for RM880,000 when the retained profit of Acura Bhd had a debit balance of RM40,000. On 1 July 2106, Audi Bhd acquired another 2.4 million ordinary shares of Acura Bhd for RM2,880,000. The reported retained profit and general reserve of Acura Bhd were amounted to RM200,000 and RM100,000 respectively. On the acquisition date, the fair values of the assets in Acura Bhd were reflected its fair values except for a piece of land of Acura Bhd. The land was having a fair value of RM200,000 more than its carrying value. Acura Bhd did not adjust its record to account for the increase in values for the asset. Acquisition in Jaguar Bhd On 10 July 2017, Acura Bhd acquired 60% of the ordinary shares in Jaguar Bhd for RM1,500,000. Acura Bhd's ordinary shares were amounted to 2 million units. The retained profit of Jaguar Bhd was recorded at RM360,000 on the acquisition date. On this date, the fair value of a plant of Jaguar Bhd was RM10,000 more than its carrying amount with five years of remaining useful life. No adjustment has been made in the books of Jaguar to recognize the new value. The fair values of all other assets of Jaguar Bhd remained the same as its carrying values. The following are the summarized statements of financial position for Audi Bhd, Acura Bhd and Jaguar Bhd as at 30 June 2018, Statement of Financial Position as at 30 June 2018 Audi Bhd Acura Bhd RM 1000 RM '000 Jaguar Bhd RM 000 3,090 Assets Property, plant & equipment Investments in subsidiaries Inventories Trade receivables Cash at bank Total assets 45,500 3,760 720 1,100 3,980 1.500 200 400 300 51.380 3,710 35,000 14,000 800 4,000 1,440 400 2,000 1,070 Equity and Liabilities Ordinary shares of RM1 each Retained profit General reserves 10% Debentures Tax payable Trade payables Ordinary dividend payable Total equity and liabilities 600 460 110 100 51,380 6,620 3,710 Other relevant information: 1. On 1 October 2017, the fair value of the land of Audi Bhd was RM100,000 more than its book value. No adjustment has been made in its account to incorporate this new value. Jaguar Bhd sold an equipment with a carrying value of RM50,000 to Audi Bhd for RM70,000. The equipment was having ten years remaining useful life and to be depreciated based on straight line method, giving full year's depreciation in the year of purchase and none in the year of disposal. During the year, Acura Bhd sold goods at a price of RM1 million to Audi Bhd at a profit margin of 25%. One-quarter of these goods remain unsold in Audi Bhd as at 30 June 2018. 4. Audi Bhd has yet to recognize its share of dividends receivable from its investees. 5. Trade payables of Acura Bhd include RM50,000 due to Audi Bhd. This amount is after deducting a payment of RM50,000 remitted by Acura Bhd on 28 June 2018. The remittance was only received by Audi Bhd on 4 July 2018, 6. Included in the trade payables of Audi Bhd is RM200,000 due from Jaguar Bhd. 7. Group policies : i. 10% for the impairment of the goodwill on consolidation, and ii. Non-controlling interest is to be valued at its proportionate share of the fair value of the identifiable net assets of the subsidiaries on the date of acquisition Required: Prepare the Consolidated Statement of Financial Position of Audi Bhd Group as at 31 March 2018. Disclose all workings. (CLO2.PL06:03) (30 marks) Discuss the relationship between Audi Bhd and Jaguar Bhd if Audi Bhd disposed 20% of its shares in Jaguar Bhd. (CLO3:PLO2:C5) (5 marks) QUESTION 1 (35 MARKS) Audi Bhd is a manufacturer of luxury cars and has been in operation for more than 20 years. As to remain competitive in the industry, Audi Bhd had acquired the shareholding in Acura Bhd and Jaguar Bhd. The details of the business acquisition were as follows; Acquisition in Acura Bhd Audi Bhd acquired 800,000 out of 4 million of the ordinary shares of Acura Bhd on 1 July 2015 for RM880,000 when the retained profit of Acura Bhd had a debit balance of RM40,000. On 1 July 2106, Audi Bhd acquired another 2.4 million ordinary shares of Acura Bhd for RM2,880,000. The reported retained profit and general reserve of Acura Bhd were amounted to RM200,000 and RM100,000 respectively. On the acquisition date, the fair values of the assets in Acura Bhd were reflected its fair values except for a piece of land of Acura Bhd. The land was having a fair value of RM200,000 more than its carrying value. Acura Bhd did not adjust its record to account for the increase in values for the asset. Acquisition in Jaguar Bhd On 10 July 2017, Acura Bhd acquired 60% of the ordinary shares in Jaguar Bhd for RM1,500,000. Acura Bhd's ordinary shares were amounted to 2 million units. The retained profit of Jaguar Bhd was recorded at RM360,000 on the acquisition date. On this date, the fair value of a plant of Jaguar Bhd was RM10,000 more than its carrying amount with five years of remaining useful life. No adjustment has been made in the books of Jaguar to recognize the new value. The fair values of all other assets of Jaguar Bhd remained the same as its carrying values. The following are the summarized statements of financial position for Audi Bhd, Acura Bhd and Jaguar Bhd as at 30 June 2018, Statement of Financial Position as at 30 June 2018 Audi Bhd Acura Bhd RM 1000 RM '000 Jaguar Bhd RM 000 3,090 Assets Property, plant & equipment Investments in subsidiaries Inventories Trade receivables Cash at bank Total assets 45,500 3,760 720 1,100 3,980 1.500 200 400 300 51.380 3,710 35,000 14,000 800 4,000 1,440 400 2,000 1,070 Equity and Liabilities Ordinary shares of RM1 each Retained profit General reserves 10% Debentures Tax payable Trade payables Ordinary dividend payable Total equity and liabilities 600 460 110 100 51,380 6,620 3,710 Other relevant information: 1. On 1 October 2017, the fair value of the land of Audi Bhd was RM100,000 more than its book value. No adjustment has been made in its account to incorporate this new value. Jaguar Bhd sold an equipment with a carrying value of RM50,000 to Audi Bhd for RM70,000. The equipment was having ten years remaining useful life and to be depreciated based on straight line method, giving full year's depreciation in the year of purchase and none in the year of disposal. During the year, Acura Bhd sold goods at a price of RM1 million to Audi Bhd at a profit margin of 25%. One-quarter of these goods remain unsold in Audi Bhd as at 30 June 2018. 4. Audi Bhd has yet to recognize its share of dividends receivable from its investees. 5. Trade payables of Acura Bhd include RM50,000 due to Audi Bhd. This amount is after deducting a payment of RM50,000 remitted by Acura Bhd on 28 June 2018. The remittance was only received by Audi Bhd on 4 July 2018, 6. Included in the trade payables of Audi Bhd is RM200,000 due from Jaguar Bhd. 7. Group policies : i. 10% for the impairment of the goodwill on consolidation, and ii. Non-controlling interest is to be valued at its proportionate share of the fair value of the identifiable net assets of the subsidiaries on the date of acquisition Required: Prepare the Consolidated Statement of Financial Position of Audi Bhd Group as at 31 March 2018. Disclose all workings. (CLO2.PL06:03) (30 marks) Discuss the relationship between Audi Bhd and Jaguar Bhd if Audi Bhd disposed 20% of its shares in Jaguar Bhd. (CLO3:PLO2:C5)