Answered step by step

Verified Expert Solution

Question

1 Approved Answer

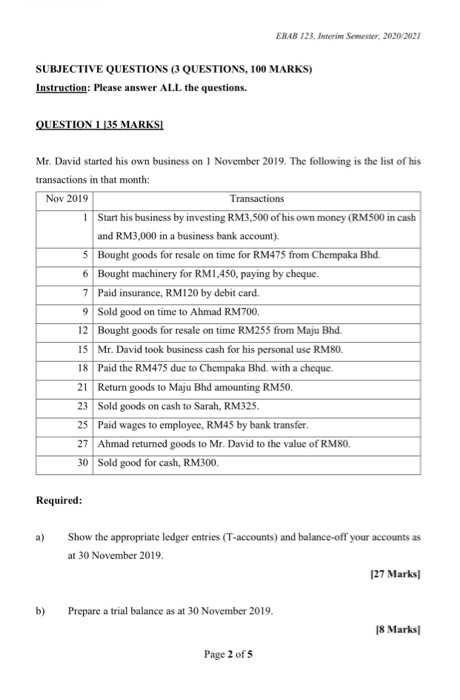

QUESTION 1 [35 MARKS] Mr. David started his own business on 1 November 2019. The following is the list of his transactions Nov 2019 5

QUESTION 1 [35 MARKS]

Mr. David started his own business on 1 November 2019. The following is the list of his

transactions Nov 2019

5 6 7 9

12

15

18

21

23

25

27

30

Required:

in that month:

EBAB 123, Interim Semester, 2020/2021

Transactions

1

Start his business by investing RM3,500 of his own money (RM500 in cash and RM3,000 in a business bank account).

Bought goods for resale on time for RM475 from Chempaka Bhd. Bought machinery for RM1,450, paying by cheque.

Paid insurance, RM120 by debit card.

Sold good on time to Ahmad RM700.

Bought goods for resale on time RM255 from Maju Bhd. Mr. David took business cash for his personal use RM80. Paid the RM475 due to Chempaka Bhd. with a cheque. Return goods to Maju Bhd amounting RM50.

Sold goods on cash to Sarah, RM325.

Paid wages to employee, RM45 by bank transfer.

Ahmad returned goods to Mr. David to the value of RM80. Sold good for cash, RM300.

a) Show the appropriate ledger entries (T-accounts) and balance-off your accounts as at 30 November 2019.

b) Prepare a trial balance as at 30 November 2019. Page 2 of 5

[27 Marks]

[8 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started