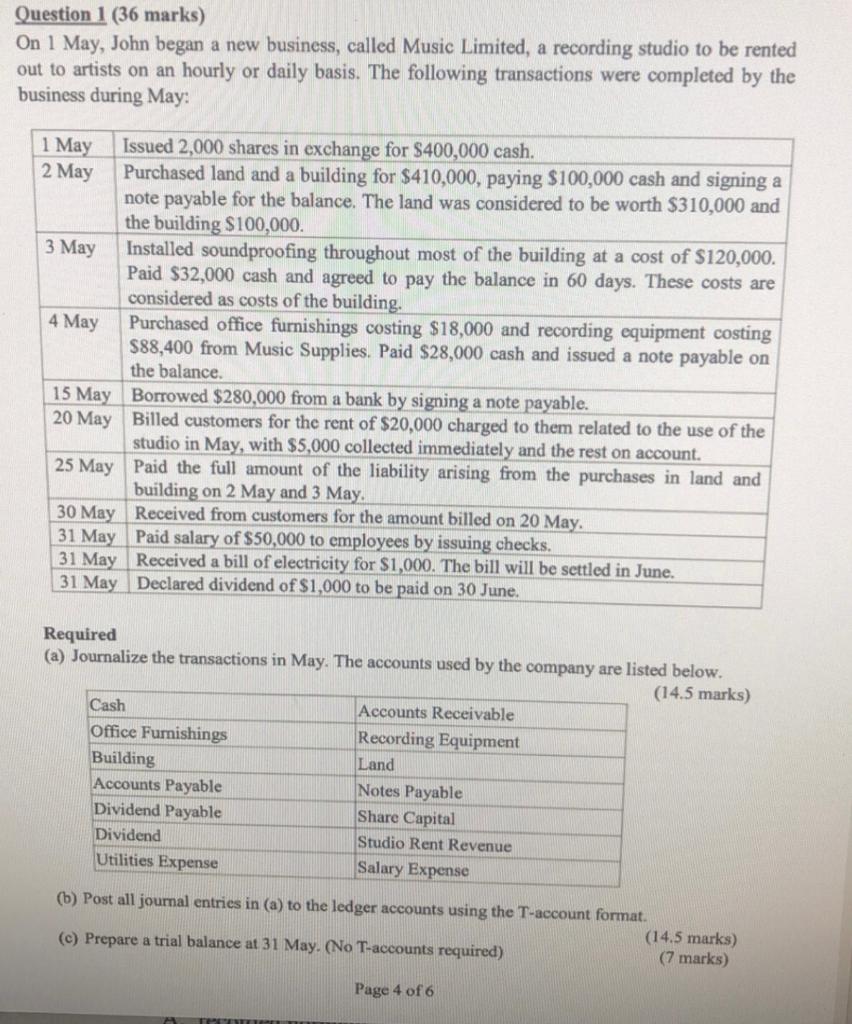

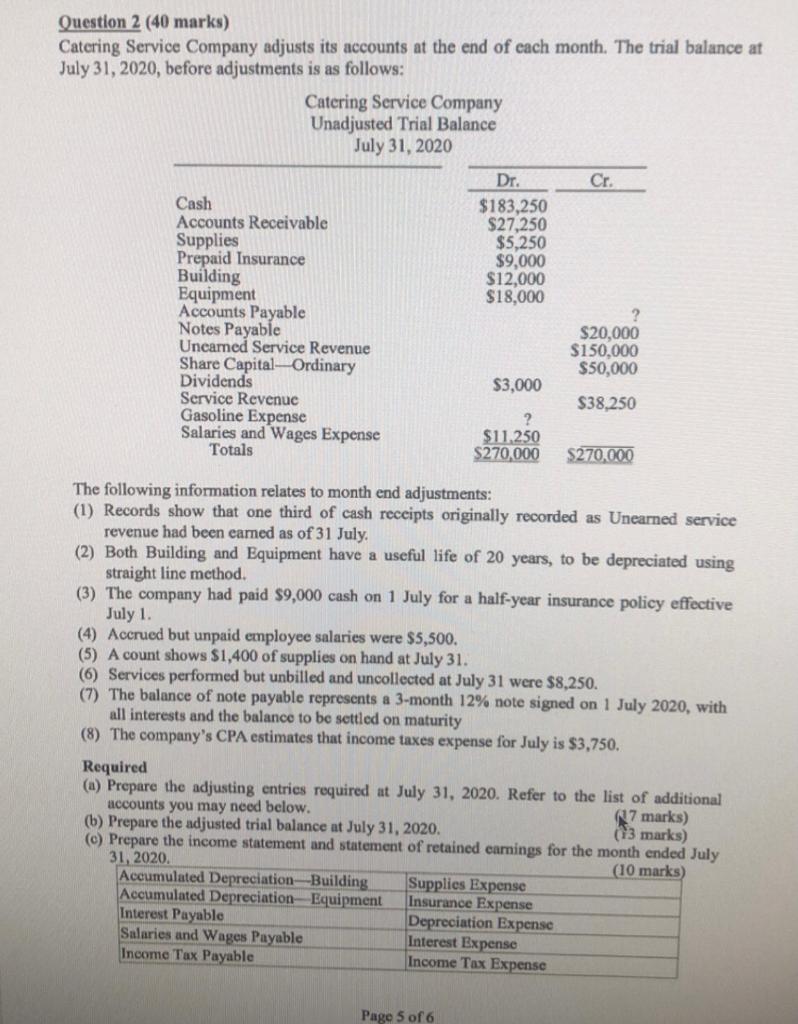

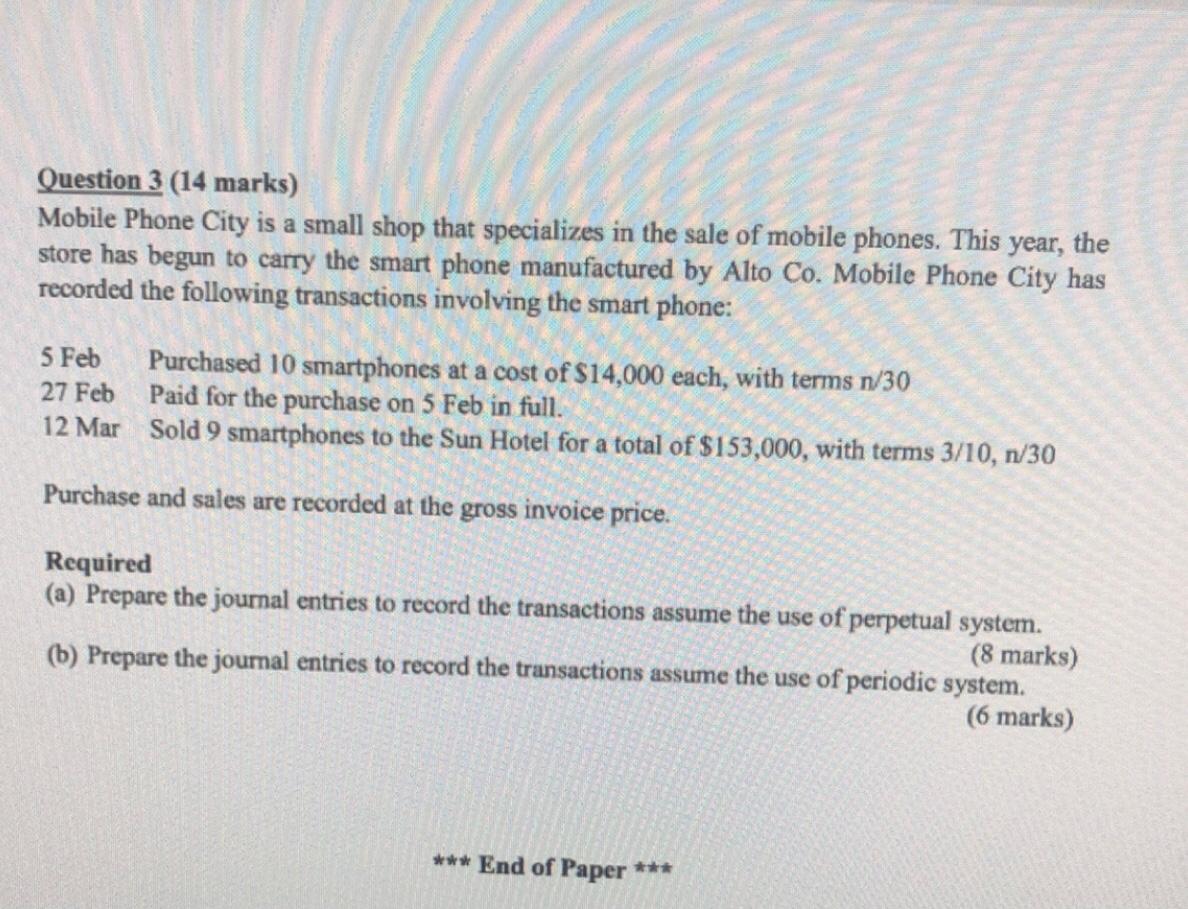

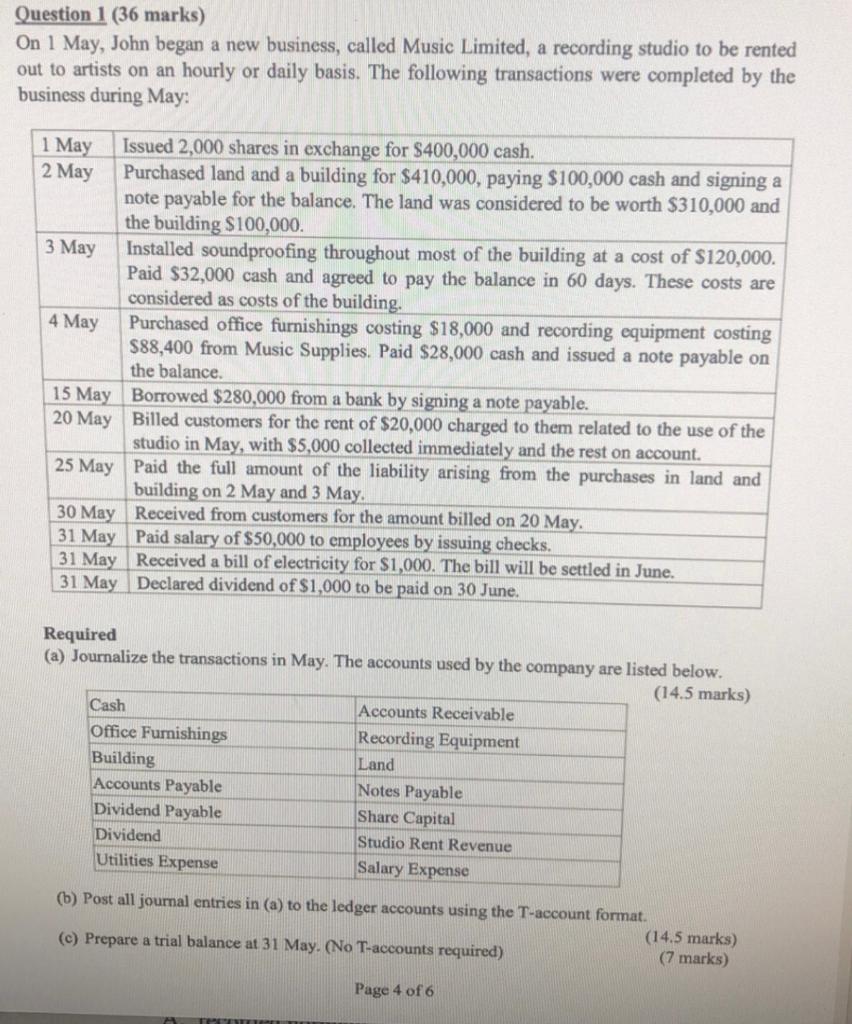

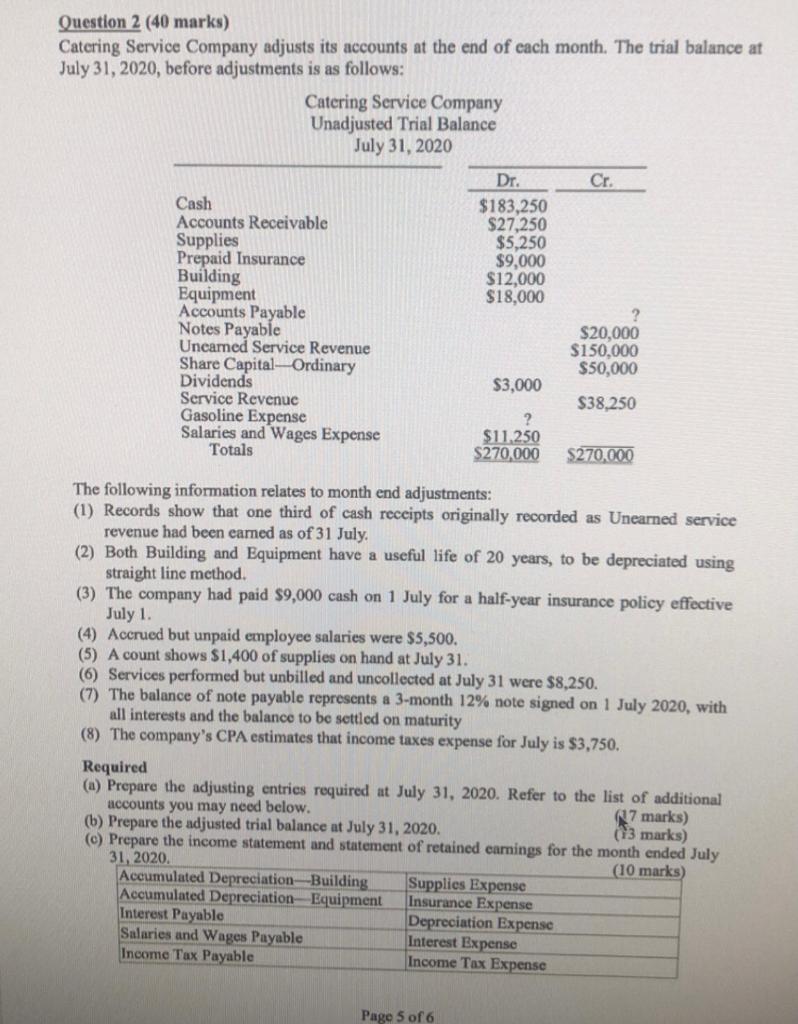

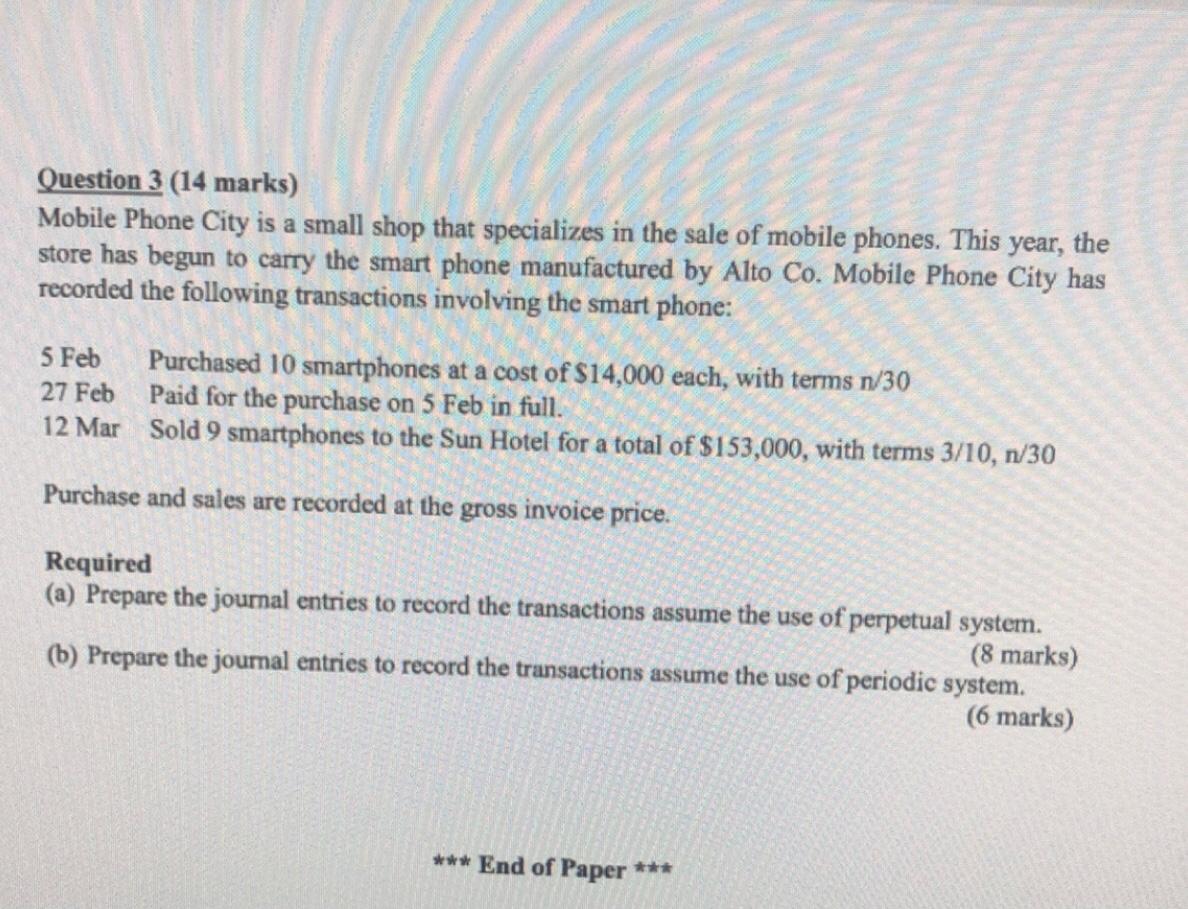

Question 1 (36 marks) On 1 May, John began a new business, called Music Limited, a recording studio to be rented out to artists on an hourly or daily basis. The following transactions were completed by the business during May: 1 May Issued 2,000 shares in exchange for $400,000 cash. 2 May Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000. 3 May Installed soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. These costs are considered as costs of the building. 4 May Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Paid $28,000 cash and issued a note payable on the balance. 15 May Borrowed $280,000 from a bank by signing a note payable. 20 May Billed customers for the rent of $20,000 charged to them related to the use of the studio in May, with $5,000 collected immediately and the rest on account. 25 May Paid the full amount of the liability arising from the purchases in land and building on 2 May and 3 May. 30 May Received from customers for the amount billed on 20 May. 31 May Paid salary of $50,000 to employees by issuing checks. 31 May Received a bill of electricity for $1,000. The bill will be settled in June. 31 May Declared dividend of $1,000 to be paid on 30 June. Required (a) Journalize the transactions in May. The accounts used by the company are listed below. (14.5 marks) Cash Accounts Receivable Office Furnishings Recording Equipment Building Land Accounts Payable Notes Payable Dividend Payable Share Capital Dividend Studio Rent Revenue Utilities Expense Salary Expense (b) Post all journal entries in (a) to the ledger accounts using the T-account format. (14.5 marks) (c) Prepare a trial balance at 31 May. (No T-accounts required) (7 marks) Page 4 of 6 Question 2 (40 marks) Catering Service Company adjusts its accounts at the end of each month. The trial balance at July 31, 2020, before adjustments is as follows: Catering Service Company Unadjusted Trial Balance July 31, 2020 Cr. Dr. $183,250 $27,250 $5,250 $9,000 $12,000 $18,000 Cash Accounts Receivable Supplies Prepaid Insurance Building Equipment Accounts Payable Notes Payable Uncamed Service Revenue Share Capital Ordinary Dividends Service Revenue Gasoline Expense Salaries and Wages Expense Totals $20,000 $150,000 $50,000 $3,000 $38,250 2 $11.250 $270,000 $270,000 The following information relates to month end adjustments: (1) Records show that one third of cash receipts originally recorded as Unearned service revenue had been earned as of 31 July (2) Both Building and Equipment have a useful life of 20 years, to be depreciated using straight line method. (3) The company had paid $9,000 cash on 1 July for a half-year insurance policy effective July 1. (4) Accrued but unpaid employee salaries were $5,500. (5) A count shows $1,400 of supplies on hand at July 31. (6) Services performed but unbilled and uncollected at July 31 were $8,250. (7) The balance of note payable represents a 3-month 12% note signed on 1 July 2020, with all interests and the balance to be settled on maturity (8) The company's CPA estimates that income taxes expense for July is $3,750. Required (a) Prepare the adjusting entries required at July 31, 2020. Refer to the list of additional accounts you may need below. 7 marks) (6) Prepare the adjusted trial balance at July 31, 2020. (13 marks) (c) Prepare the income statement and statement of retained earnings for the month ended July 31, 2020. (10 marks) Accumulated Depreciation Building Supplies Expense Accumulated Depreciation Equipment Insurance Expense Interest Payable Depreciation Expense Salaries and Wages Payable Interest Expense Income Tax Payable Income Tax Expense Page 5 of 6 Question 3 (14 marks) Mobile Phone City is a small shop that specializes in the sale of mobile phones. This year, the store has begun to carry the smart phone manufactured by Alto Co. Mobile Phone City has recorded the following transactions involving the smart phone: 5 Feb Purchased 10 smartphones at a cost of $14,000 each, with terms n/30 27 Feb Paid for the purchase on 5 Feb in full. 12 Mar Sold 9 smartphones to the Sun Hotel for a total of $153,000, with terms 3/10, n/30 Purchase and sales are recorded at the gross invoice price. Required (a) Prepare the journal entries to record the transactions assume the use of perpetual system. (8 marks) (6) Prepare the journal entries to record the transactions assume the use of periodic system. (6 marks) *** End of Paper