Answered step by step

Verified Expert Solution

Question

1 Approved Answer

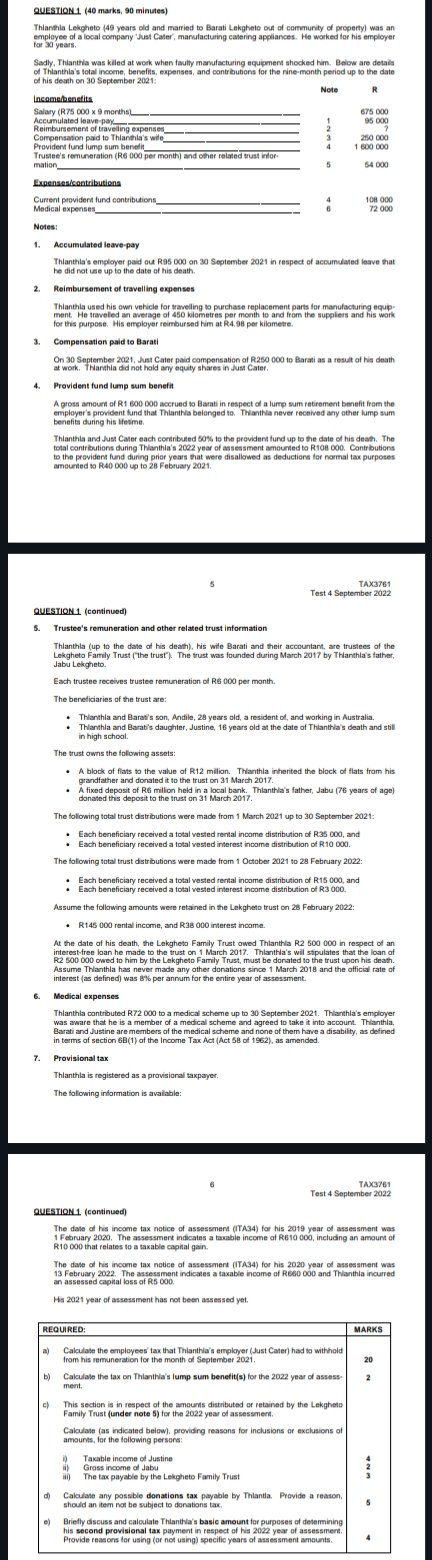

QUESTION - 1 ( 4 0 marks, 9 0 minutes ) Thiantila Lekgheto ( 4 9 years old and married to Barati Lekgheto out of

QUESTION marks, minutes

Thiantila Lekgheto years old and married to Barati Lekgheto out of community of property was an employee of for years.

Sadly. Thlantria was kiled at work when faully manufacturing equipment shocked him. Below are detaiss of Thianthia's total income, berefifs ot his death on September :

Lncomehenefits

Note

Salary R morths Accumulated leavepay Reimbursement of traveling expense Compensation paid to Thiantia's wilt

Providem fund lump sum beneln Trustee's remineration math mation mation

Expensestsontributions

Current provident furd contributio

Notes:

Notes:

Accumulated leavepay he did not use up to the date of his death.

Reimbursement of travelling expenses

Thianthia used his own vehicie for traveling to purchase replacement parts for manufacturing equipment. He traveled an average of kilometres per month to and from for tris purpose. His employer reimbursed kim at R per kilometre.

Compensation paid to Barat

On September Just Cater paid compensation of R to Barati as a result of his death at work. Tharahia did not hold any equity shares in Just Cater.

Provident fund lump sum benefit

A gross ameurt of R accrued Barati in respect of a lump sum retirement benefit from the empleyer's provident fund that Thlanthla beianged to Thianthla never received any other lump sum Thlanthla and Just Cater each contribuned to the provident furd up to the date of his death. The total contributions during Thlanthia's year of assessment amourhed to R Contr butions

TAX

TAX

QUESTIONcontinued

Trustee's remuneration and other related trust information

Thianthla up to the date of his death his wite Barati and their accountant, are trustees of the Lekgheto Family Jabu Lekgheto.

Each trustee receives trustee remuneration of R per month.

The bereficiaries of the trust are:

Thlanthla and Barat's son, Andile, years old, a resident of and working in Australis.

Thlanthila and Barat's daughter, Justine, years old at the date of Thlanttla's death and stil Thlanthla and in high school.

The trust owns the following assets:

A block of flats to the value of R milion. Thianthila irherited the block of flats from his

A fixed deposit of R milion held in a local bank. Thlanthla's father, Jabu years of age A fixed depost of R milion held in a local bank. donated this deposit to the trust on March

The folowing total trust dstributions were made from March up to September :

Each beneficiary received a total vested rental income distribution of R and

The folowing total trust distributions were made from October to February

Each beneficiary received a total vested rental income distribution of R and

Assume the following amounts were retained in the Lekgheto trust on February :

R rental income, and R interest income. interestfree loan he made to the trust on March Thlantrla's will stpulates that the loan of R owed to him by the Lekgheto Family Trust, must be donated to the trust upon his death. Assume Thlanthla has never made any other donations since March and the official rate of interest as defined was B per annum for the entire year of assesment.

Medical expenses

Thianthla contributed R to a medical scheme up to September Thlanthla's employer was aware that he is a member of a medical scheme and agreed to take it into account. Thlanthla, in terms of section of the income Tax Act Act of as amended.

Provisional tax

Thlanthla is registered as a provisional taxpaye:

The following information is avalable:

TAX

QUESTIONcontinued

Test Saptember

The date of his income tax notice of assessmemt TTA for his year of assessment was February The assessmert indicates a tambie income of R including an amourt February The assessmert indicates R that relates to a taxable capilial gain.

The date of his income tax notice of assessmert iTA for his year of assessment was February The assessmen an assessed capial lass of R

Hs year of assessment has not been assessed yet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started