Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 4 A Market - neutral portfolio is designed to provide significant alpha but no beta ( B = 0 ) . You want

Question

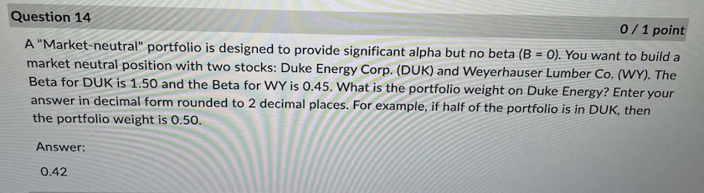

A "Marketneutral" portfolio is designed to provide significant alpha but no beta You want to build a

market neutral position with two stocks: Duke Energy Corp. DUK and Weyerhauser Lumber CoWY The

Beta for DUK is and the Beta for WY is What is the portfolio weight on Duke Energy? Enter your

answer in decimal form rounded to decimal places. For example, if half of the portfolio is in DUK, then

the portfolio weight is

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started