Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (4 points) Saved Facebook Corporation has 10,000 shares of common stock authorized and decides to issue 6,000 shares of common stock for cash.

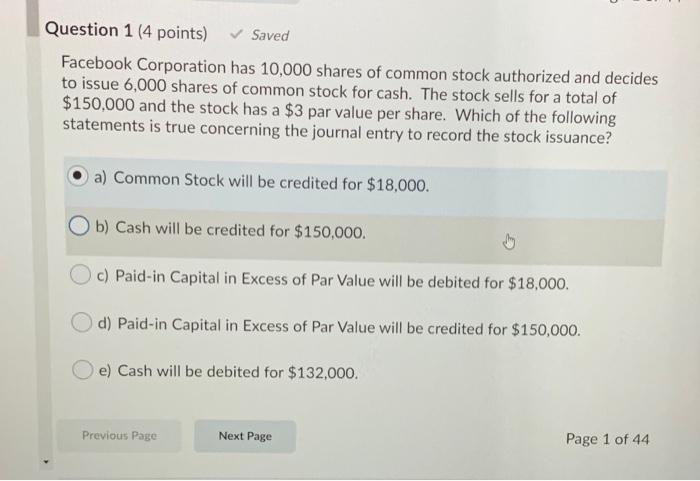

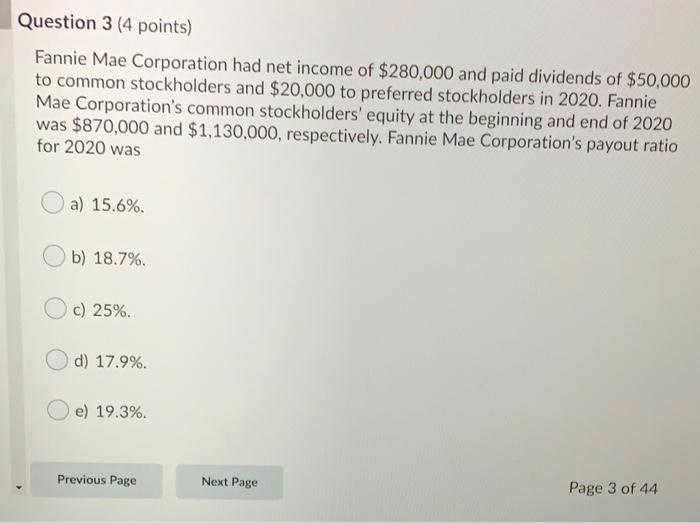

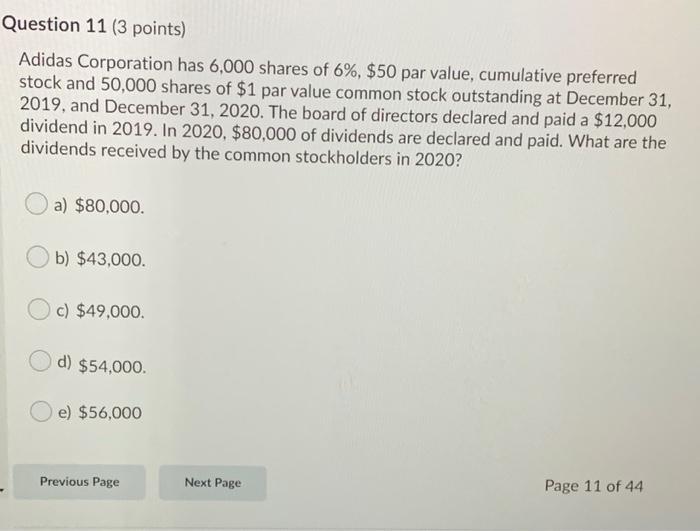

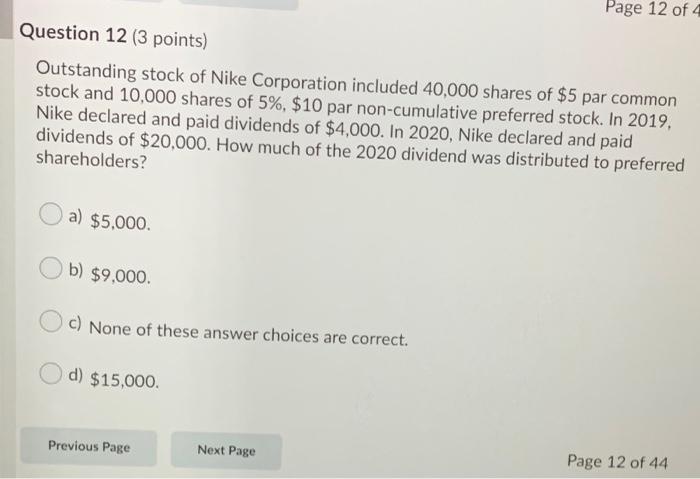

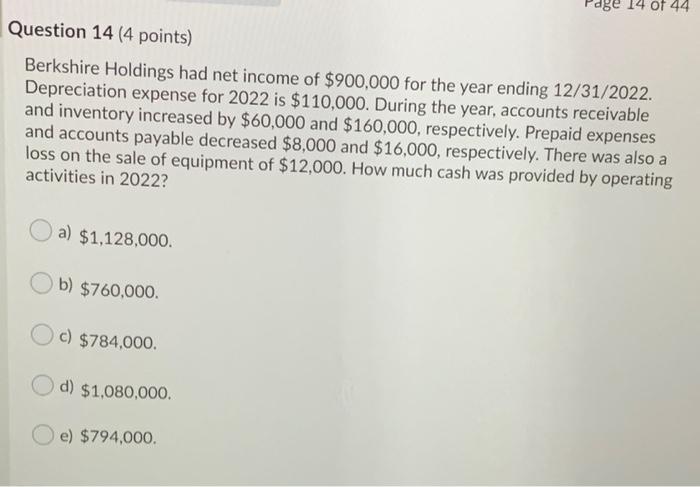

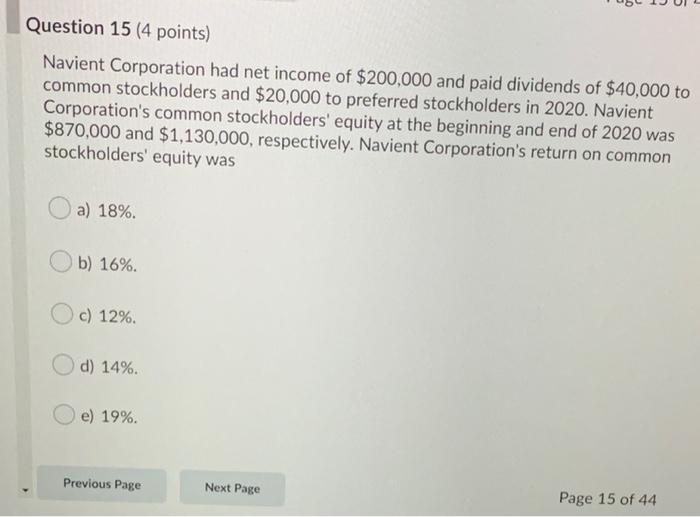

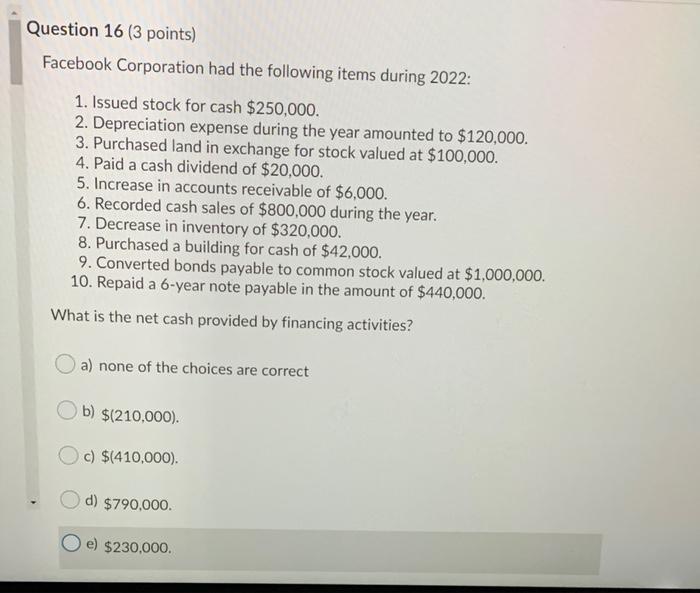

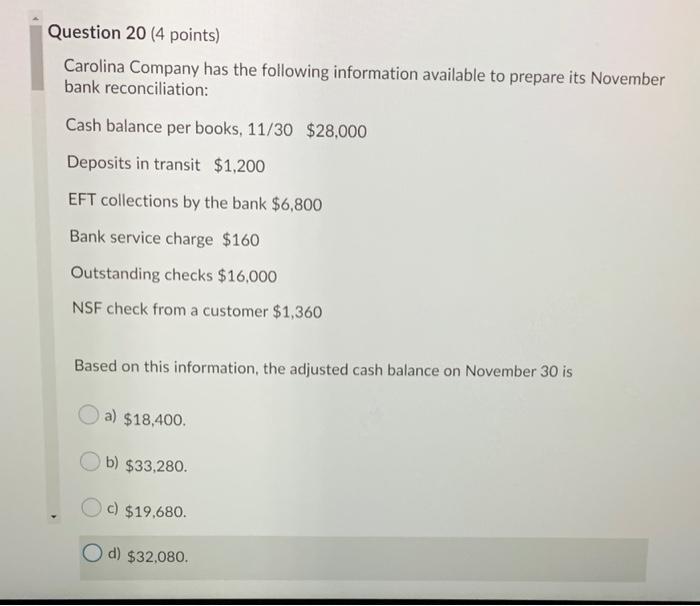

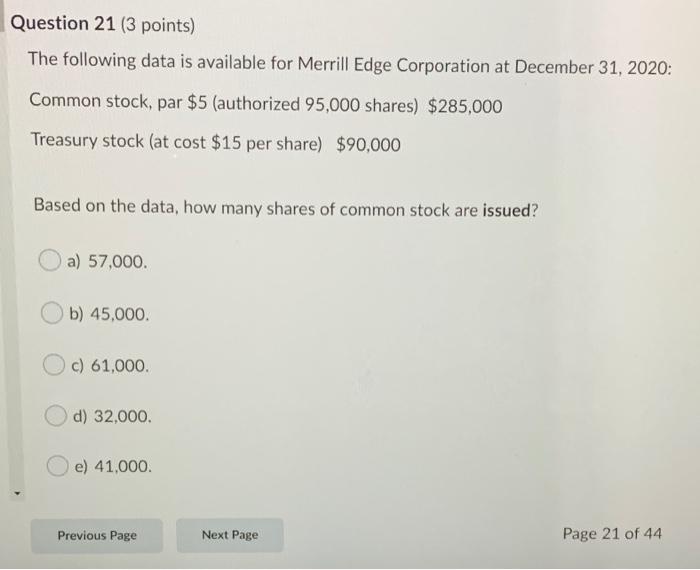

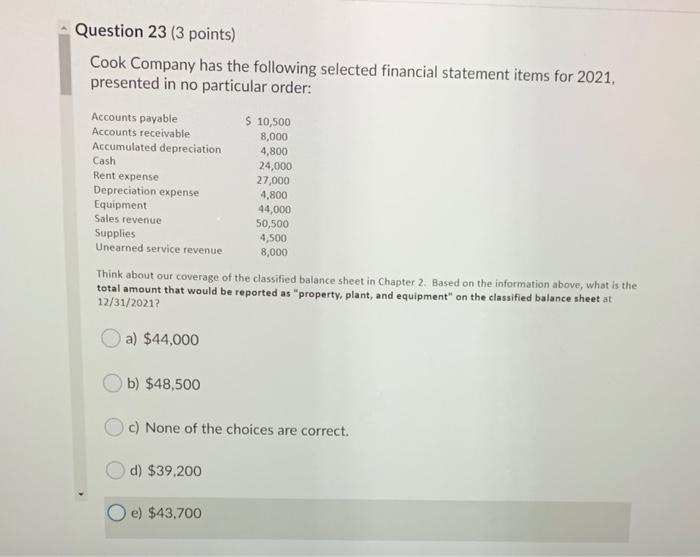

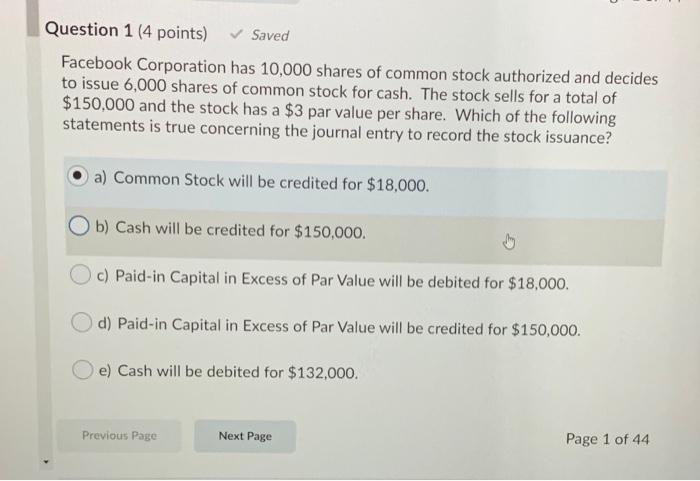

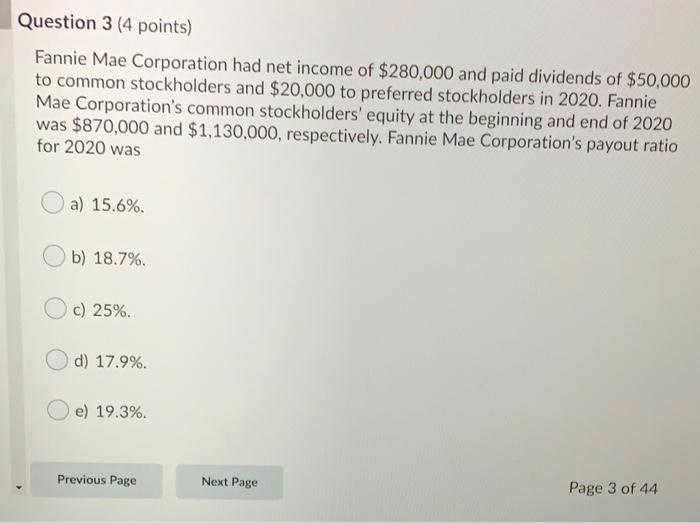

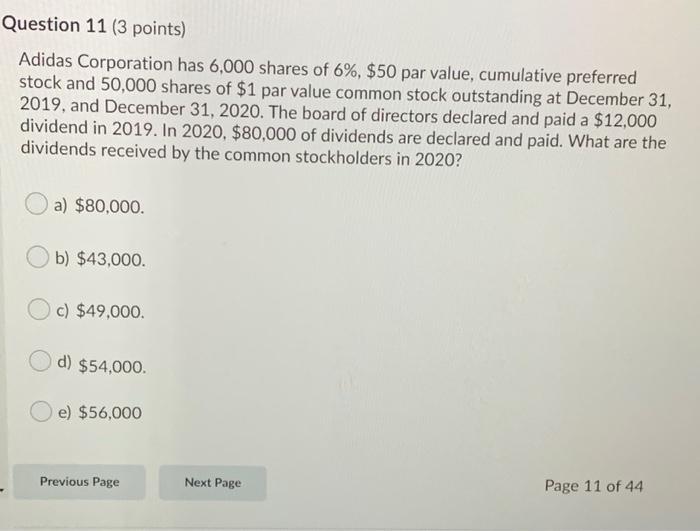

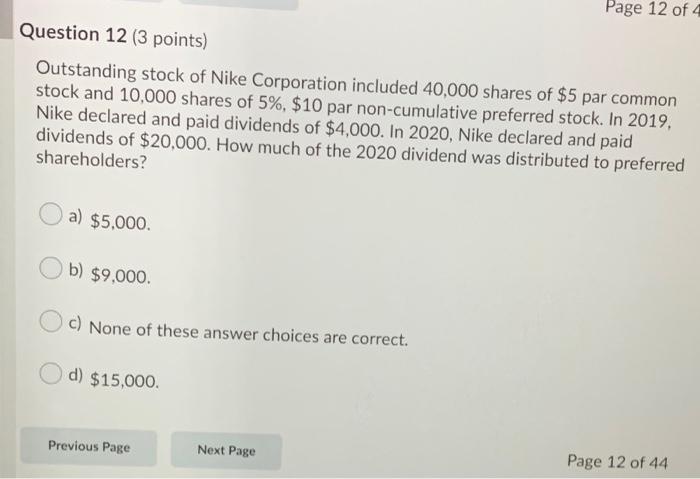

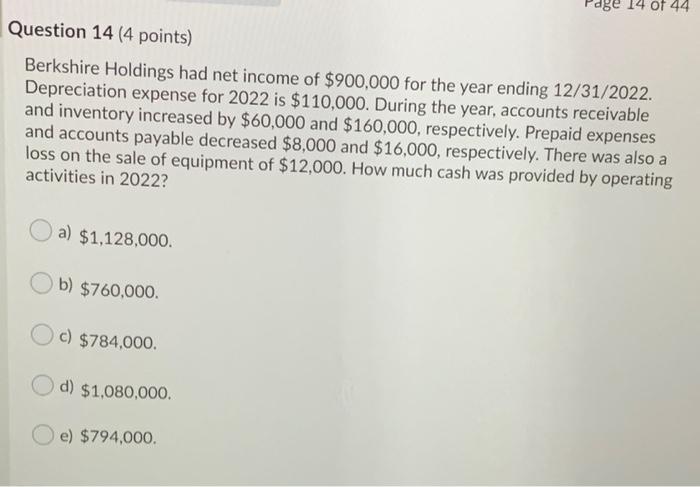

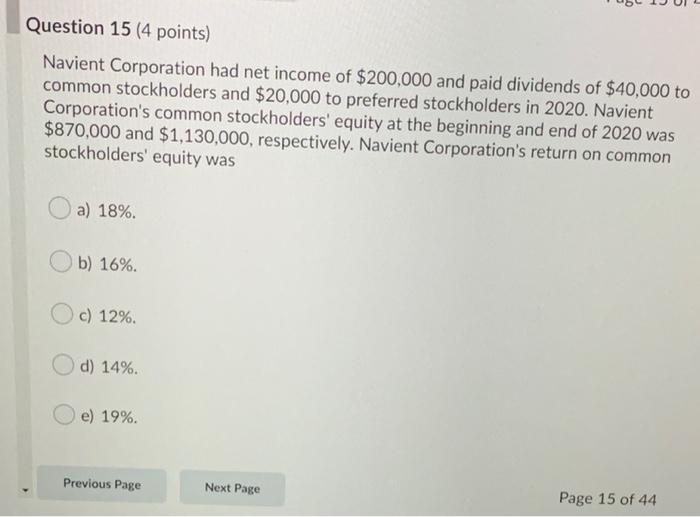

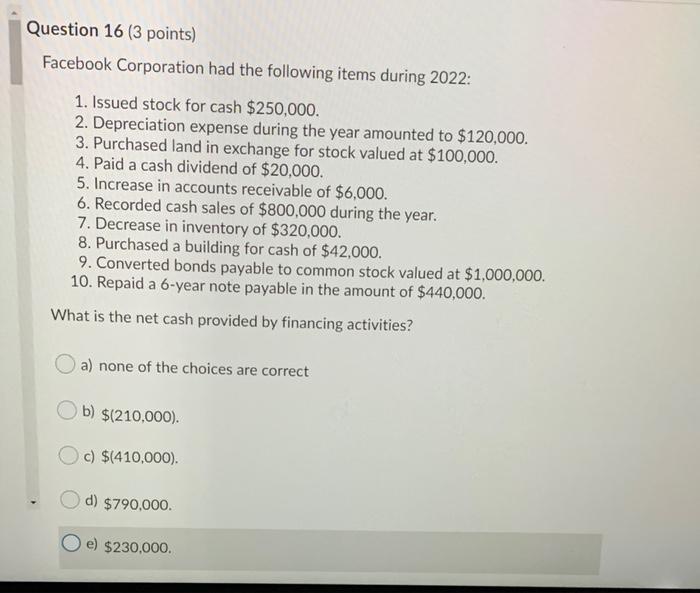

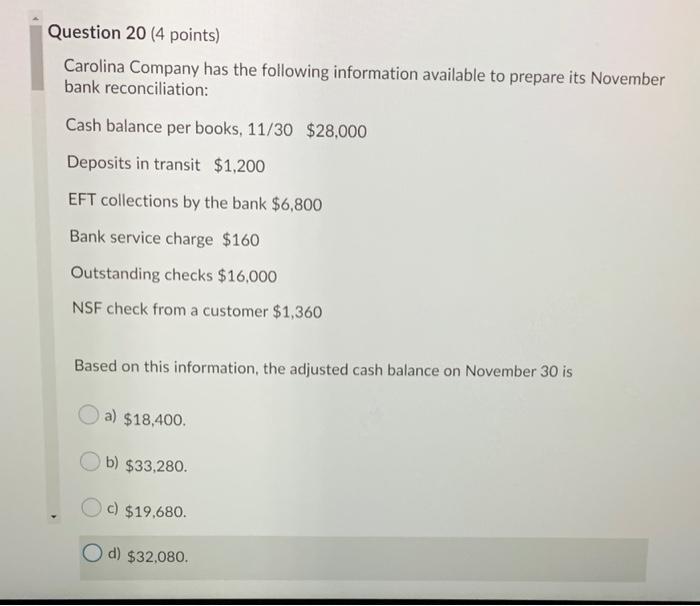

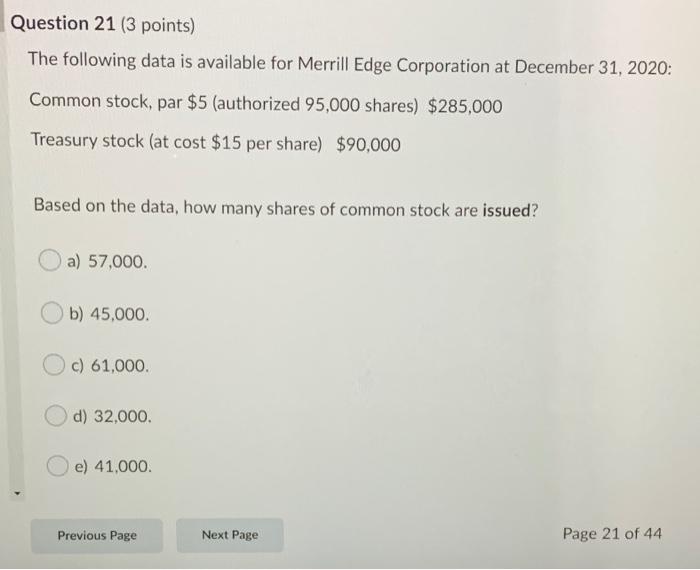

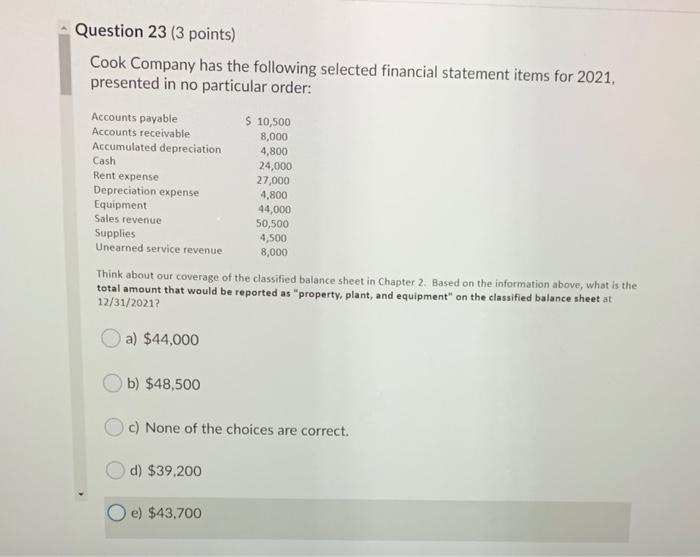

Question 1 (4 points) Saved Facebook Corporation has 10,000 shares of common stock authorized and decides to issue 6,000 shares of common stock for cash. The stock sells for a total of $150,000 and the stock has a $3 par value per share. Which of the following statements is true concerning the journal entry to record the stock issuance? a) Common Stock will be credited for $18,000. Ob) Cash will be credited for $150,000. By c) Paid-in Capital in Excess of Par Value will be debited for $18,000. d) Paid-in Capital in Excess of Par Value will be credited for $150,000. e) Cash will be debited for $132,000. Previous Page Next Page Page 1 of 44 Question 3 (4 points) Fannie Mae Corporation had net income of $280,000 and paid dividends of $50,000 to common stockholders and $20,000 to preferred stockholders in 2020. Fannie Mae Corporation's common stockholders' equity at the beginning and end of 2020 was $870,000 and $1,130,000, respectively. Fannie Mae Corporation's payout ratio for 2020 was a) 15.6%. b) 18.7%. c) 25%. d) 17.9%. e) 19.3% Previous Page Next Page Page 3 of 44 Question 11 (3 points) Adidas Corporation has 6,000 shares of 6%, $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $12,000 dividend in 2019. In 2020, $80,000 of dividends are declared and paid. What are the dividends received by the common stockholders in 2020? a) $80,000 b) $43,000. c) $49,000. d) $54,000. e) $56,000 Previous Page Next Page Page 11 of 44 Page 12 of 4 Question 12 (3 points) Outstanding stock of Nike Corporation included 40,000 shares of $5 par common stock and 10,000 shares of 5%, $10 par non-cumulative preferred stock. In 2019, Nike declared and paid dividends of $4,000. In 2020, Nike declared and paid dividends of $20,000. How much of the 2020 dividend was distributed to preferred shareholders? a) $5,000. b) $9.000. c) None of these answer choices are correct. d) $15,000. Previous Page Next Page Page 12 of 44 Page 14 of 44 Question 14 (4 points) Berkshire Holdings had net income of $900,000 for the year ending 12/31/2022. Depreciation expense for 2022 is $110,000. During the year, accounts receivable and inventory increased by $60,000 and $160,000, respectively. Prepaid expenses and accounts payable decreased $8,000 and $16,000, respectively. There was also a loss on the sale of equipment of $12,000. How much cash was provided by operating activities in 2022? a) $1,128,000 b) $760,000 c) $784,000 d) $1,080,000. e) $794,000. Question 15 (4 points) Navient Corporation had net income of $200,000 and paid dividends of $40,000 to common stockholders and $20,000 to preferred stockholders in 2020. Navient Corporation's common stockholders' equity at the beginning and end of 2020 was $870,000 and $1,130,000, respectively. Navient Corporation's return on common stockholders' equity was a) 18% b) 16% c) 12%. d) 14% e) 19%. Previous Page Next Page Page 15 of 44 Question 16 (3 points) Facebook Corporation had the following items during 2022: 1. Issued stock for cash $250,000. 2. Depreciation expense during the year amounted to $120,000. 3. Purchased land in exchange for stock valued at $100,000. 4. Paid a cash dividend of $20,000. 5. Increase in accounts receivable of $6,000. 6. Recorded cash sales of $800,000 during the year. 7. Decrease in inventory of $320,000. 8. Purchased a building for cash of $42,000. 9. Converted bonds payable to common stock valued at $1,000,000. 10. Repaid a 6-year note payable in the amount of $440,000. What is the net cash provided by financing activities? a) none of the choices are correct b) $(210,000). c) $(410,000) d) $790,000. e) $230,000. Question 20 (4 points) Carolina Company has the following information available to prepare its November bank reconciliation: Cash balance per books, 11/30 $28.000 Deposits in transit $1,200 EFT collections by the bank $6,800 Bank service charge $160 Outstanding checks $16,000 NSF check from a customer $1,360 Based on this information, the adjusted cash balance on November 30 is a) $18,400. b) $33,280. OC) $19,680. O d) $32,080. Question 21 (3 points) The following data is available for Merrill Edge Corporation at December 31, 2020: Common stock, par $5 (authorized 95,000 shares) $285,000 Treasury stock (at cost $15 per share) $90,000 Based on the data, how many shares of common stock are issued? a) 57,000. b) 45,000. c) 61,000. d) 32,000. e) 41,000. Previous Page Next Page Page 21 of 44 Question 23 (3 points) Cook Company has the following selected financial statement items for 2021. presented in no particular order: Accounts payable $ 10,500 Accounts receivable 8,000 Accumulated depreciation 4,800 Cash 24,000 Rent expense 27,000 Depreciation expense 4,800 Equipment 44,000 Sales revenue 50,500 Supplies 4,500 Unearned service revenue 8,000 Think about our coverage of the classified balance sheet in Chapter 2. Based on the information above, what is the total amount that would be reported as "property, plant, and equipment on the classified balance sheet at 12/31/2021? a) $44,000 b) $48,500 c) None of the choices are correct. d) $39.200 O e) $43.700

Question 1 (4 points) Saved Facebook Corporation has 10,000 shares of common stock authorized and decides to issue 6,000 shares of common stock for cash. The stock sells for a total of $150,000 and the stock has a $3 par value per share. Which of the following statements is true concerning the journal entry to record the stock issuance? a) Common Stock will be credited for $18,000. Ob) Cash will be credited for $150,000. By c) Paid-in Capital in Excess of Par Value will be debited for $18,000. d) Paid-in Capital in Excess of Par Value will be credited for $150,000. e) Cash will be debited for $132,000. Previous Page Next Page Page 1 of 44 Question 3 (4 points) Fannie Mae Corporation had net income of $280,000 and paid dividends of $50,000 to common stockholders and $20,000 to preferred stockholders in 2020. Fannie Mae Corporation's common stockholders' equity at the beginning and end of 2020 was $870,000 and $1,130,000, respectively. Fannie Mae Corporation's payout ratio for 2020 was a) 15.6%. b) 18.7%. c) 25%. d) 17.9%. e) 19.3% Previous Page Next Page Page 3 of 44 Question 11 (3 points) Adidas Corporation has 6,000 shares of 6%, $50 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $12,000 dividend in 2019. In 2020, $80,000 of dividends are declared and paid. What are the dividends received by the common stockholders in 2020? a) $80,000 b) $43,000. c) $49,000. d) $54,000. e) $56,000 Previous Page Next Page Page 11 of 44 Page 12 of 4 Question 12 (3 points) Outstanding stock of Nike Corporation included 40,000 shares of $5 par common stock and 10,000 shares of 5%, $10 par non-cumulative preferred stock. In 2019, Nike declared and paid dividends of $4,000. In 2020, Nike declared and paid dividends of $20,000. How much of the 2020 dividend was distributed to preferred shareholders? a) $5,000. b) $9.000. c) None of these answer choices are correct. d) $15,000. Previous Page Next Page Page 12 of 44 Page 14 of 44 Question 14 (4 points) Berkshire Holdings had net income of $900,000 for the year ending 12/31/2022. Depreciation expense for 2022 is $110,000. During the year, accounts receivable and inventory increased by $60,000 and $160,000, respectively. Prepaid expenses and accounts payable decreased $8,000 and $16,000, respectively. There was also a loss on the sale of equipment of $12,000. How much cash was provided by operating activities in 2022? a) $1,128,000 b) $760,000 c) $784,000 d) $1,080,000. e) $794,000. Question 15 (4 points) Navient Corporation had net income of $200,000 and paid dividends of $40,000 to common stockholders and $20,000 to preferred stockholders in 2020. Navient Corporation's common stockholders' equity at the beginning and end of 2020 was $870,000 and $1,130,000, respectively. Navient Corporation's return on common stockholders' equity was a) 18% b) 16% c) 12%. d) 14% e) 19%. Previous Page Next Page Page 15 of 44 Question 16 (3 points) Facebook Corporation had the following items during 2022: 1. Issued stock for cash $250,000. 2. Depreciation expense during the year amounted to $120,000. 3. Purchased land in exchange for stock valued at $100,000. 4. Paid a cash dividend of $20,000. 5. Increase in accounts receivable of $6,000. 6. Recorded cash sales of $800,000 during the year. 7. Decrease in inventory of $320,000. 8. Purchased a building for cash of $42,000. 9. Converted bonds payable to common stock valued at $1,000,000. 10. Repaid a 6-year note payable in the amount of $440,000. What is the net cash provided by financing activities? a) none of the choices are correct b) $(210,000). c) $(410,000) d) $790,000. e) $230,000. Question 20 (4 points) Carolina Company has the following information available to prepare its November bank reconciliation: Cash balance per books, 11/30 $28.000 Deposits in transit $1,200 EFT collections by the bank $6,800 Bank service charge $160 Outstanding checks $16,000 NSF check from a customer $1,360 Based on this information, the adjusted cash balance on November 30 is a) $18,400. b) $33,280. OC) $19,680. O d) $32,080. Question 21 (3 points) The following data is available for Merrill Edge Corporation at December 31, 2020: Common stock, par $5 (authorized 95,000 shares) $285,000 Treasury stock (at cost $15 per share) $90,000 Based on the data, how many shares of common stock are issued? a) 57,000. b) 45,000. c) 61,000. d) 32,000. e) 41,000. Previous Page Next Page Page 21 of 44 Question 23 (3 points) Cook Company has the following selected financial statement items for 2021. presented in no particular order: Accounts payable $ 10,500 Accounts receivable 8,000 Accumulated depreciation 4,800 Cash 24,000 Rent expense 27,000 Depreciation expense 4,800 Equipment 44,000 Sales revenue 50,500 Supplies 4,500 Unearned service revenue 8,000 Think about our coverage of the classified balance sheet in Chapter 2. Based on the information above, what is the total amount that would be reported as "property, plant, and equipment on the classified balance sheet at 12/31/2021? a) $44,000 b) $48,500 c) None of the choices are correct. d) $39.200 O e) $43.700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started