Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 4 pts What is the accumulated value of deposits of $1120.00 made at the end of every six months for 6 years if

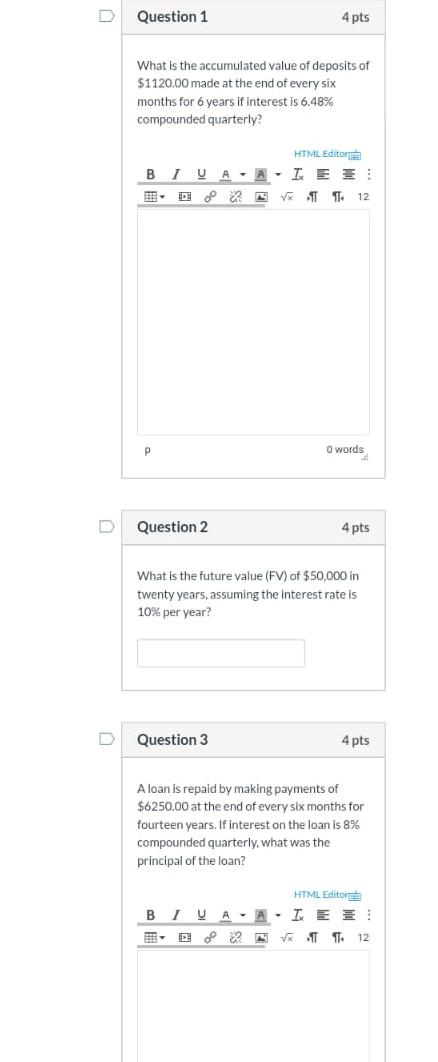

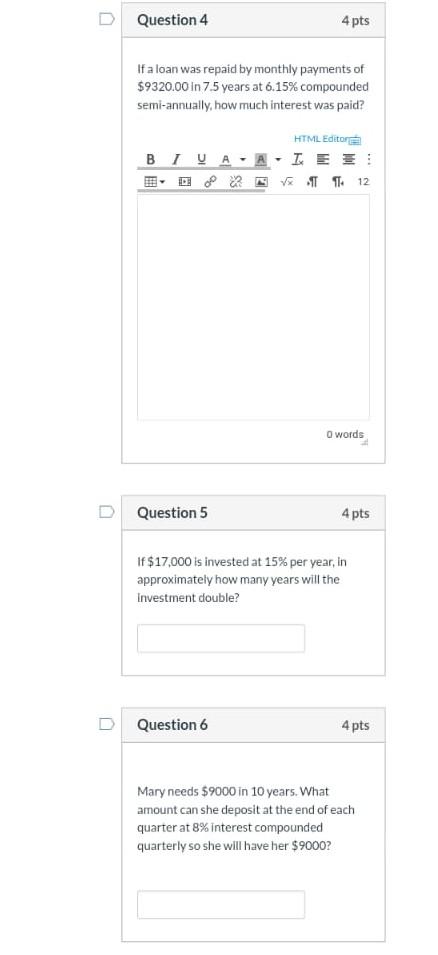

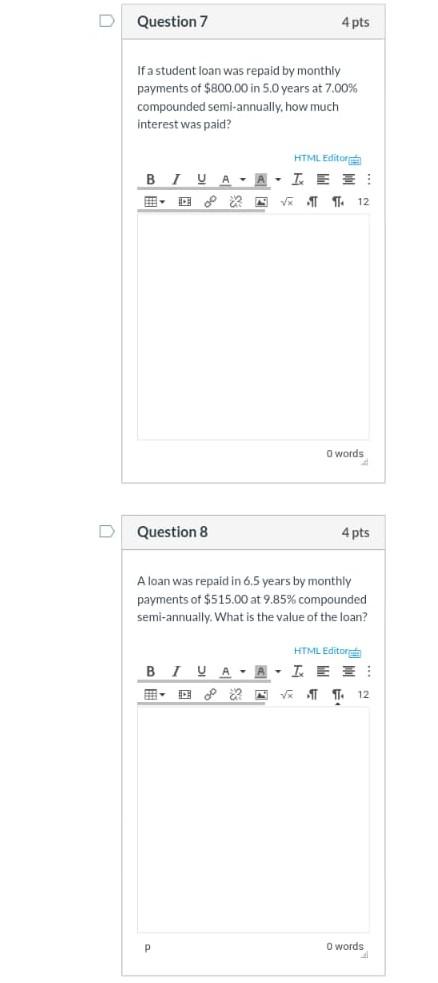

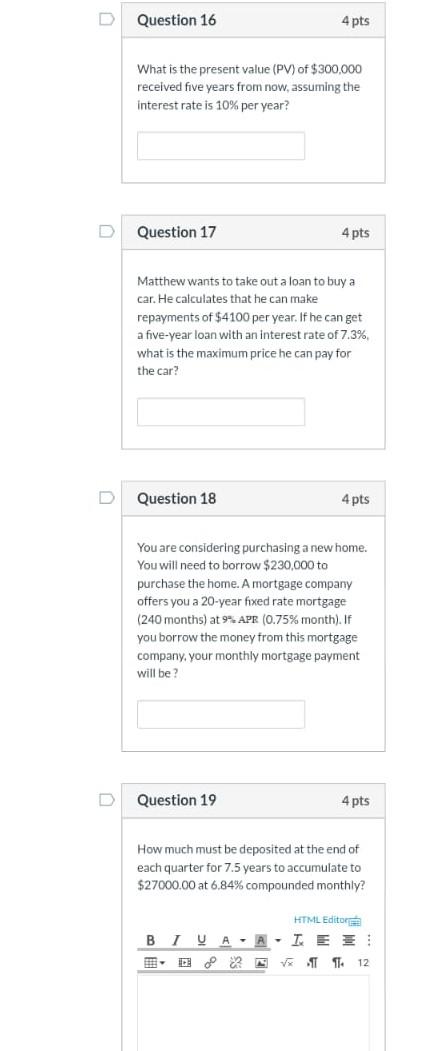

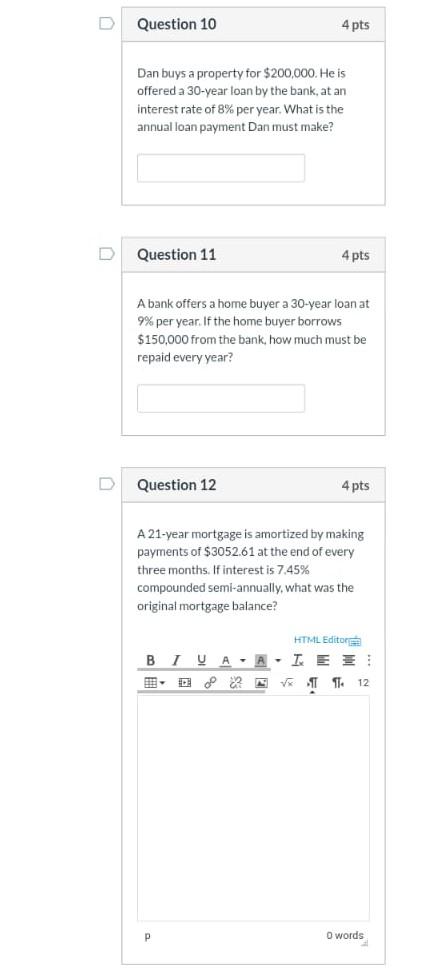

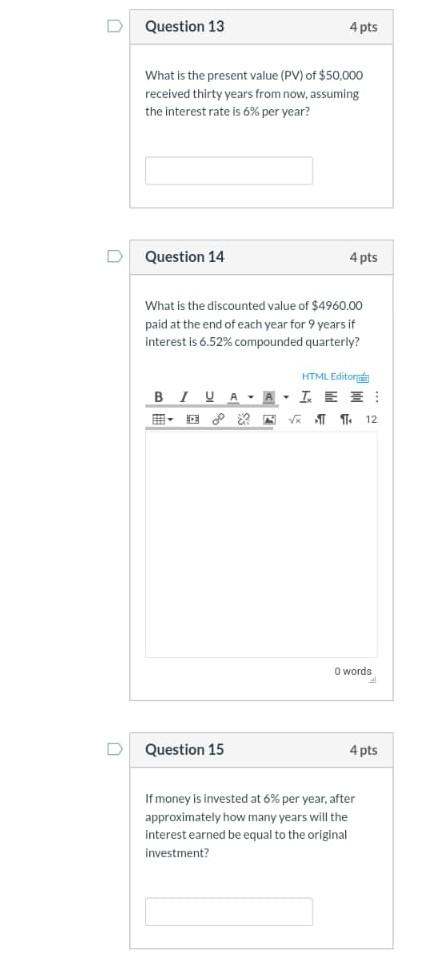

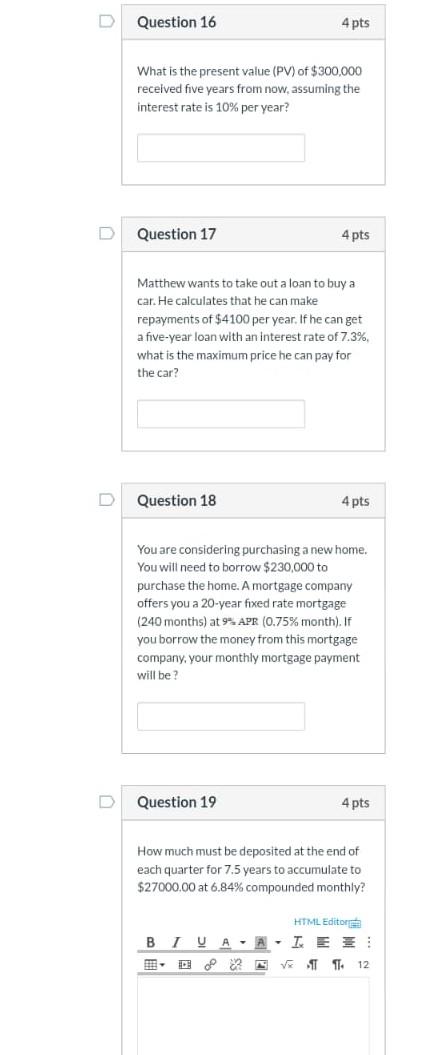

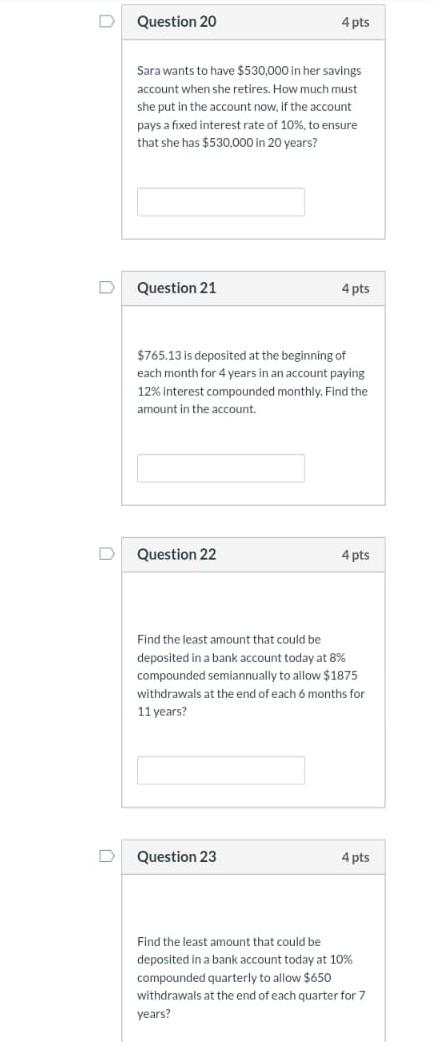

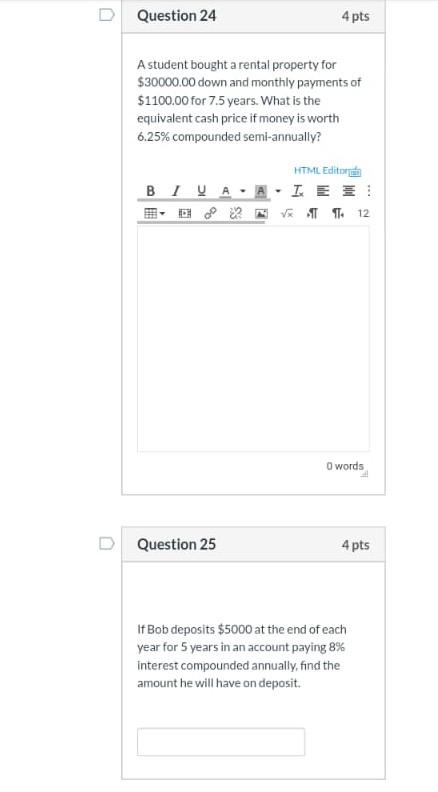

Question 1 4 pts What is the accumulated value of deposits of $1120.00 made at the end of every six months for 6 years if Interest is 6.48% compounded quarterly? HTML Editore BIVA -A- TE : T 11 12 O words D Question 2 4 pts What is the future value (FV) of $50,000 in twenty years, assuming the interest rate is 10% per year? Question 3 4 pts A loan is repaid by making payments of $6250.00 at the end of every six months for fourteen years. If interest on the loan is 8% compounded quarterly, what was the principal of the loan? HTML Editore BIV AA- IES: TTT 12 D Question 4 4 pts If a loan was repaid by monthly payments of $9320.00 in 7.5 years at 6.15% compounded semi-annually, how much interest was paid? HTML Editore BIYA so ES . 12 Owords Question 5 4 pts If $17,000 is invested at 15% per year, in approximately how many years will the Investment double? D Question 6 4 pts Mary needs $9000 in 10 years. What amount can she deposit at the end of each quarter at 8% interest compounded quarterly so she will have her $9000? D Question 7 4 pts If a student loan was repaid by monthly payments of $800.00 in 5.0 years at 7.00% compounded semi-annually. how much interest was paid? HTML Editor BIVA-A-IE VT14 12 o words Question 8 4 pts Aloan was repaid in 6.5 years by monthly payments of $515.00 at 9.85% compounded semi-annually. What is the value of the loan? HTML Editor BIVA -A- IEE V T 154 12 O words D Question 16 4 pts What is the present value (PV) of $300,000 received five years from now, assuming the interest rate is 10% per year? Question 17 4 pts Matthew wants to take out a loan to buy a car. He calculates that he can make repayments of $4100 per year. If he can get a five-year loan with an interest rate of 7.3% what is the maximum price he can pay for the car? D Question 18 4 pts You are considering purchasing a new home. You will need to borrow $230,000 to purchase the home. A mortgage company offers you a 20-year fixed rate mortgage (240 months) at 9. APR (0.75% month). If you borrow the money from this mortgage company, your monthly mortgage payment will be? D Question 19 4 pts How much must be deposited at the end of each quarter for 7.5 years to accumulate to $27000.00 at 6.84% compounded monthly? HTML Editor BIVA.ALE : VT 114 12 Question 10 4 pts Dan buys a property for $200,000. He is offered a 30-year loan by the bank, at an interest rate of 8% per year. What is the annual loan payment Dan must make? Question 11 4 pts A bank offers a home buyer a 30-year loan at 9% per year. If the home buyer borrows $150,000 from the bank, how much must be repaid every year? Question 12 4 pts A 21-year mortgage is amortized by making payments of $3052.61 at the end of every three months. If interest is 7.45% compounded semi-annually, what was the original mortgage balance? HTML Editore BIUA. A. IE: V 11 12 O words Question 13 4 pts What is the present value (PV) of $50,000 received thirty years from now, assuming the interest rate is 6% per year? U Question 14 4 pts What is the discounted value of $4960.00 paid at the end of each year for 9 years if Interest is 6.52% compounded quarterly? HTML Editor BIVAAIKE VTT 1. 12 O words Question 15 4 pts If money is invested at 6% per year, after approximately how many years will the interest earned be equal to the original investment? Question 16 4 pts What is the present value (PV) of $300,000 received five years from now, assuming the interest rate is 10% per year? Question 17 4 pts Matthew wants to take out a loan to buy a car. He calculates that he can make repayments of $4100 per year. If he can get a five-year loan with an interest rate of 7.3%, what is the maximum price he can pay for the car? Question 18 4 pts You are considering purchasing a new home. You will need to borrow $230,000 to purchase the home. A mortgage company offers you a 20-year fixed rate mortgage (240 months) at 9. APR (0.75% month). If you borrow the money from this mortgage company, your monthly mortgage payment will be? D Question 19 4 pts How much must be deposited at the end of each quarter for 7.5 years to accumulate to $27000.00 at 6.84% compounded monthly? HTML Editore BIUA-A-IE V T 1412 D Question 20 4 pts Sara wants to have $530,000 in her savings account when she retires. How much must she put in the account now, if the account pays a fixed interest rate of 10%, to ensure that she has $530,000 in 20 years? Question 21 4 pts $765.13 is deposited at the beginning of each month for 4 years in an account paying 12% Interest compounded monthly. Find the amount in the account. D Question 22 4 pts Find the least amount that could be deposited in a bank account today at 8% compounded semiannually to allow $1875 withdrawals at the end of each 6 months for 11 years? Question 23 4 pts Find the least amount that could be deposited in a bank account today at 10% compounded quarterly to allow $650 withdrawals at the end of each quarter for 7 years? D Question 24 4 pts A student bought a rental property for $30000.00 down and monthly payments of $1100.00 for 7.5 years. What is the equivalent cash price if money is worth 6.25% compounded semi-annually? HTML Editore BI VAAI. EZ 5 % 4 | 12 $ O words Question 25 4 pts If Bob deposits $5000 at the end of each year for 5 years in an account paying 8% Interest compounded annually, find the amount he will have on deposit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started