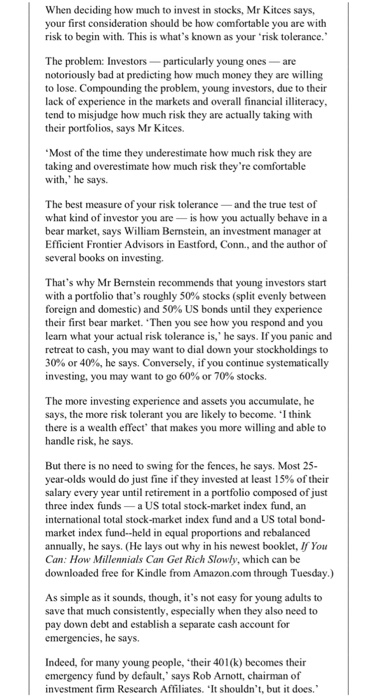

Question 1 (40 marks) Read the article 'How stocks test young investors How stocks test young investors You 1l know your true risk tolerance when equities take a dive How much should millennials invest in stocks? A lot less than you might think, according to three prominent investment experts. Conventional wisdom says the youngest investors can assume the most equity risk in pursuit of higher returns because they are furthest from retirement and have the most time to recover any losses from bear markets. Although mathematically true, 'that doesn't necessarily mean it's OK to risk losing all your money,' says Michael Kitces,ia financial adviser and co-founder of the XY Planning Network, which serves Generation X and Y investors. Rules of thumb like '100 minus your age' (meaning 25-year-olds would put 75% of their assets in stocks) and target-date funds (which are the default option in many 401(k) plans and which start out stock-heavy and shift toward conservative asset allocations closer to retirement) can leave some newbie investors dangerously overexposed to equities, he and others warn. I really worry that we may be over-risking young folks,' he says, by giving them higher doses of stocks than many of them can tolerate. The fear is that when they encounter their first bear market they'll be spooked and swear off stocks forever. When deciding how much to invest in stocks, Mr Kitces says, your first consideration should be how comfortable you are with risk to begin with. This is what's known as your risk tolerance. The problem: Investors particularly young ones-are notoriously bad at predicting how much money they are willing to lose. Compounding the problem, young investors, due to their lack of experience in the markets and overall financial illiteracy tend to misjudge how much risk they are actually taking with their portfolios, says Mr Kitces. Most of the time they underestimate how much risk they are taking and overestimate how much risk they're comfortable with,' he says The best measure of your risk tolerance-and the true test of what kind of investor you are is how you actually behave in a bear market, says William Benstein, an investment manager at Efficient Frontier Advisors in Eastford, Conn., and the author of several books on investing. That's why Mr Benstein recommends that young investors start with a portfolio that's roughly 50% stocks (split evenly between foreign and domestic) and 50% US bonds until they experience their first bear market. 'Then you see how you respond and you lean what your actual risk tolerance is,' he says. If you panic and retreat to cash, you may want to dial down your stockholdings to 30% or 40%, he says. Conversely, if you continue systematically investing, you may want to go 60% or 70% stocks. The more investing experience and assets you accumulate, he says, the more risk tolerant you are likely to become. 'I think there is a wealth effect' that makes you more willing and able to handle risk, he says. But there is no need to swing for the fences, he says. Most 25- year-olds would do just fine if they invested at least 15% of their salary every year until retirement in a portfolio composed of just three index funds a US total stock-market index fund, an international total stock-market index fund and a US total bond- market index fund-held in equal proportions and rebalanced annually, he says. (He lays out why in his newest booklet, now Can: How Millennials Can Get Rich Slowly, which can be downloaded free for Kindle from Amazon.com through Tuesday.) As simple as it sounds, though, it's not easy for young adults to save that much consistently, especially when they also need to pay down debt and establish a separate cash account for emergencies, he says Indeed, for many young people, 'their 401(k) becomes their emergency fund by default, says Rob Arnott, chairman of investment firm Research Affiliates. It shouldn't, but it does. Young adults are more vulnerable to the vagaries of the job market, more likely to get laid off when markets swoon, and more apt to cash out their 401(k)s when switching jobs, he says. He suggests young people start investing their 401(k)s in a conservative mix of one-third stocks, one-third bonds and one- third inflation hedges, such as Treasury inflation-protected securities. Only after accumulating perhaps six months" income in this 'starter portfolio' should they start raising their allocation to stocks, he says. Source: Greer, C (2014) How stocks Test Young Investors', The Wall Street Journal, 23 Nov, Answer the following questions. a According to the above article Mr Bernstein recommends that young investors start with a portfolio that's roughly 50% stocks and 50% US bonds until they experience their first bear market. Does Mr Benstein imply that the recommended portfolio is the optimal risky portfolio in the modern portfolio theory? Please use the following data to verify ETF AnnualAnnual expectedstandard returndeviation iShares Core US Aggregate Bond ETF | 10% 8% SPDR S&P 500 ETF 1 5% 13% The correlation of rates of return between the two ETFs is -0.1 and the annual risk-free retum is 3%. (10 marks) b Determine the expected returnm and standard deviation of (i) the recommended portfolio (50% stocks and 50% US bonds) and (ii) the optimal risky portfolio in (a) (10 marks) Determine and explain which portfolio you, as a young investor would choose to start your investment by assessing the Sharpe ratio for both portfolios. c (6 marks) d Mr Bemstein said that the more investing experience and assets you accumulate, the more risk tolerant you are likely to become. If you panic and retreat to cash, you may want to dial down your stockholdings to 30% or 40%. Conversely, if you continue systematically investing, you may want to go 60% or 70% stocks. In addition to what Mr Bernstein mentioned above, discuss two actions that you would take to become a more risk tolerant investor assuming you are holding a well-diversified portfolio of Bond ETF and Stock ETF. Explain whether your actions violate the Modern Portfolio Theory in terms of portfolio efficiency. (8 marks) e Rob Arnott, chairman of investment firm Research Affiliates, suggests young people start investing their 401 (k)s in a conservative mix of one-third stocks, one-third bonds and one-third inflation hedges, such as Treasury inflation-protected securities. Briefly explain whether you agree that adding inflation hedges into a mix of stock and bond can make the whole portfolio become less risky. (6 marks)