Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (40 marks) Tiffany Goodman, a marketing representative with RC Pharmaceuticals Inc. (a Canadian public company), requests your assistance in determining her employment income

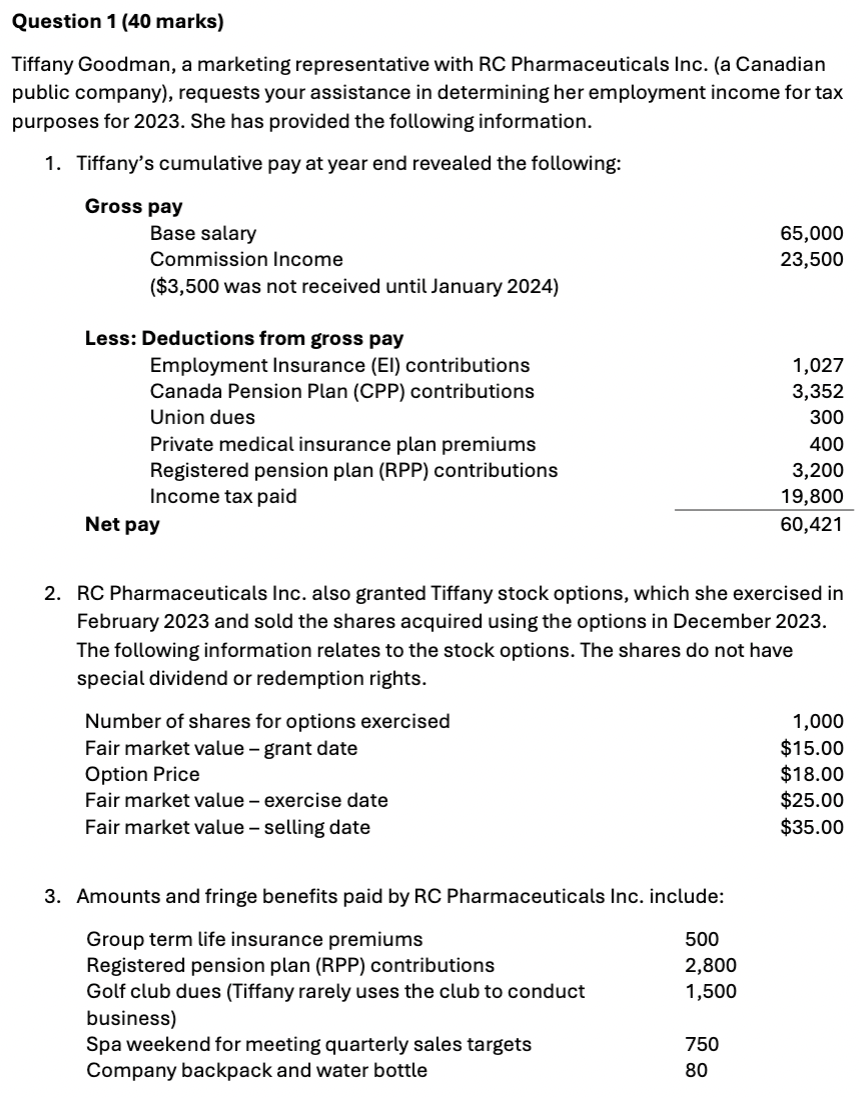

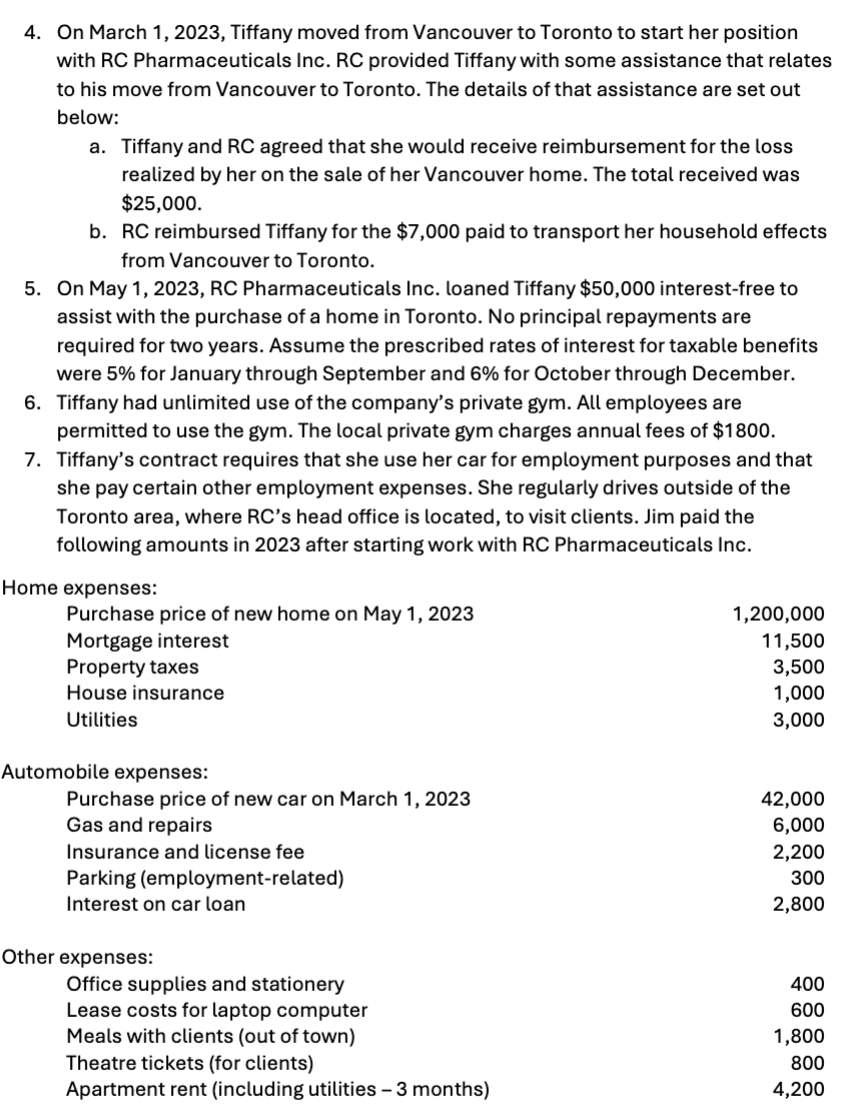

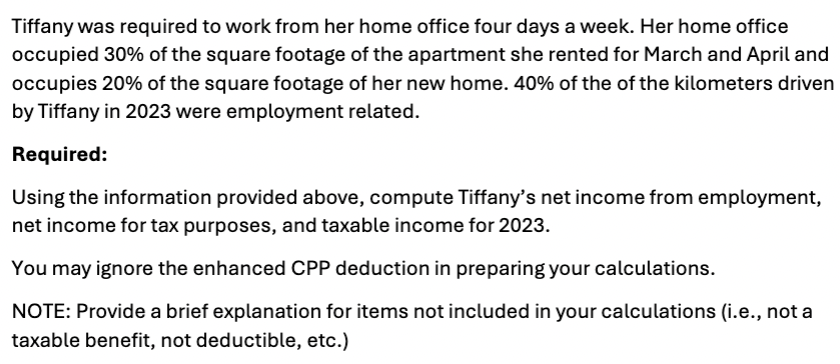

Question 1 (40 marks) Tiffany Goodman, a marketing representative with RC Pharmaceuticals Inc. (a Canadian public company), requests your assistance in determining her employment income for tax purposes for 2023. She has provided the following information. 1. Tiffany's cumulative pay at year end revealed the following: 2. RC Pharmaceuticals Inc. also granted Tiffany stock options, which she exercised in February 2023 and sold the shares acquired using the options in December 2023. The following information relates to the stock options. The shares do not have special dividend or redemption rights. 3. Amounts and fringe benefits paid by RC Pharmaceuticals Inc. include: 4. On March 1, 2023, Tiffany moved from Vancouver to Toronto to start her position with RC Pharmaceuticals Inc. RC provided Tiffany with some assistance that relates to his move from Vancouver to Toronto. The details of that assistance are set out below: a. Tiffany and RC agreed that she would receive reimbursement for the loss realized by her on the sale of her Vancouver home. The total received was $25,000. b. RC reimbursed Tiffany for the $7,000 paid to transport her household effects from Vancouver to Toronto. 5. On May 1,2023,RC Pharmaceuticals Inc. loaned Tiffany $50,000 interest-free to assist with the purchase of a home in Toronto. No principal repayments are required for two years. Assume the prescribed rates of interest for taxable benefits were 5% for January through September and 6\% for October through December. Tiffany was required to work from her home office four days a week. Her home office occupied 30% of the square footage of the apartment she rented for March and April and occupies 20% of the square footage of her new home. 40% of the of the kilometers driven by Tiffany in 2023 were employment related. Required: Using the information provided above, compute Tiffany's net income from employment, net income for tax purposes, and taxable income for 2023. You may ignore the enhanced CPP deduction in preparing your calculations. NOTE: Provide a brief explanation for items not included in your calculations (i.e., not a taxable benefit, not deductible, etc.)

Question 1 (40 marks) Tiffany Goodman, a marketing representative with RC Pharmaceuticals Inc. (a Canadian public company), requests your assistance in determining her employment income for tax purposes for 2023. She has provided the following information. 1. Tiffany's cumulative pay at year end revealed the following: 2. RC Pharmaceuticals Inc. also granted Tiffany stock options, which she exercised in February 2023 and sold the shares acquired using the options in December 2023. The following information relates to the stock options. The shares do not have special dividend or redemption rights. 3. Amounts and fringe benefits paid by RC Pharmaceuticals Inc. include: 4. On March 1, 2023, Tiffany moved from Vancouver to Toronto to start her position with RC Pharmaceuticals Inc. RC provided Tiffany with some assistance that relates to his move from Vancouver to Toronto. The details of that assistance are set out below: a. Tiffany and RC agreed that she would receive reimbursement for the loss realized by her on the sale of her Vancouver home. The total received was $25,000. b. RC reimbursed Tiffany for the $7,000 paid to transport her household effects from Vancouver to Toronto. 5. On May 1,2023,RC Pharmaceuticals Inc. loaned Tiffany $50,000 interest-free to assist with the purchase of a home in Toronto. No principal repayments are required for two years. Assume the prescribed rates of interest for taxable benefits were 5% for January through September and 6\% for October through December. Tiffany was required to work from her home office four days a week. Her home office occupied 30% of the square footage of the apartment she rented for March and April and occupies 20% of the square footage of her new home. 40% of the of the kilometers driven by Tiffany in 2023 were employment related. Required: Using the information provided above, compute Tiffany's net income from employment, net income for tax purposes, and taxable income for 2023. You may ignore the enhanced CPP deduction in preparing your calculations. NOTE: Provide a brief explanation for items not included in your calculations (i.e., not a taxable benefit, not deductible, etc.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started