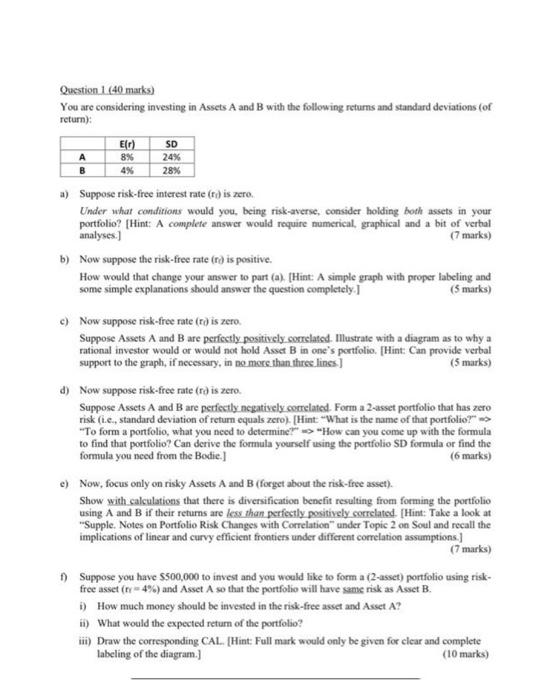

Question 1. (40 marks) You are considering investing in Assets A and B with the following returns and standard deviations (of return): a) Suppose risk-free interest rate ( (t) is zere. Under what conditions would you, being risk-averse, consider holding both assets in your portfolio? [Hint: A complete answer would require numerical, graphical and a bit of vertal analyses.] (7 marks) b) Now suppose the risk-free rate (ra) is positive. How would that change your answer to part (a). [Hint: A simple graph with proper labeling and some simple explanations should answer the question completely.] ( 5 marks) c) Now suppose risk-free rate (ri) is zero. Suppose Assets A and B are perfectly positively cocrelated. Illustrate with a diagnam as to why a rational investor would or would not hold Asset B in one's pertfolio. [Hint: Can provide verbal support to the graph, if necessary, in no more than thres lines.] d) Now suppose risk-free rate (rd is zero. (5 marks) Suppose Assets A and B are perfectly negatively correlated. Form a 2-asset portfolio that has zero risk (i.e., standard deviation of return equals zero). [Hint "What is the name of that portfolio?" "To form a portfolio, what you need to determine" " "How can you come up with the formula to find that portfolio? Can derive the formula yourself using the portfolio SD formula or find the formula you need from the Bodie.] e) Now, focus only on risky Assets A and B (forget about the risk-free asset). Show with calculations that there is diversification benefit resulting from forming the portfolio using A and B if their returns are less than perfectly positively correlated. [Hint: Take a look at "Supple. Notes on Portfolio Risk Changes with Correlation" under Topic 2 on Soul and recall the implications of linear and curvy efficient frontiers under different comelation assumptions.] (7 marks) f) Suppose you have $500,000 to invest and you would like to form a (2-asset) portfolio using riskfree asset (r=4%) and A sset A so that the portfolio will have same risk as Asset B. i) How much money should be invested in the risk-free asset and Asset A? ii) What would the expected return of the portfolio? iii) Draw the corresponding CAL. [Hint: Full mark would only be given for clear and complete labeling of the diagram.] (10 marks) Question 1. (40 marks) You are considering investing in Assets A and B with the following returns and standard deviations (of return): a) Suppose risk-free interest rate ( (t) is zere. Under what conditions would you, being risk-averse, consider holding both assets in your portfolio? [Hint: A complete answer would require numerical, graphical and a bit of vertal analyses.] (7 marks) b) Now suppose the risk-free rate (ra) is positive. How would that change your answer to part (a). [Hint: A simple graph with proper labeling and some simple explanations should answer the question completely.] ( 5 marks) c) Now suppose risk-free rate (ri) is zero. Suppose Assets A and B are perfectly positively cocrelated. Illustrate with a diagnam as to why a rational investor would or would not hold Asset B in one's pertfolio. [Hint: Can provide verbal support to the graph, if necessary, in no more than thres lines.] d) Now suppose risk-free rate (rd is zero. (5 marks) Suppose Assets A and B are perfectly negatively correlated. Form a 2-asset portfolio that has zero risk (i.e., standard deviation of return equals zero). [Hint "What is the name of that portfolio?" "To form a portfolio, what you need to determine" " "How can you come up with the formula to find that portfolio? Can derive the formula yourself using the portfolio SD formula or find the formula you need from the Bodie.] e) Now, focus only on risky Assets A and B (forget about the risk-free asset). Show with calculations that there is diversification benefit resulting from forming the portfolio using A and B if their returns are less than perfectly positively correlated. [Hint: Take a look at "Supple. Notes on Portfolio Risk Changes with Correlation" under Topic 2 on Soul and recall the implications of linear and curvy efficient frontiers under different comelation assumptions.] (7 marks) f) Suppose you have $500,000 to invest and you would like to form a (2-asset) portfolio using riskfree asset (r=4%) and A sset A so that the portfolio will have same risk as Asset B. i) How much money should be invested in the risk-free asset and Asset A? ii) What would the expected return of the portfolio? iii) Draw the corresponding CAL. [Hint: Full mark would only be given for clear and complete labeling of the diagram.] (10 marks)