Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (42) 1.1 ChemMet Ltd wants to expand their business by making a product with the by-product generated from their operations. Currently they sell

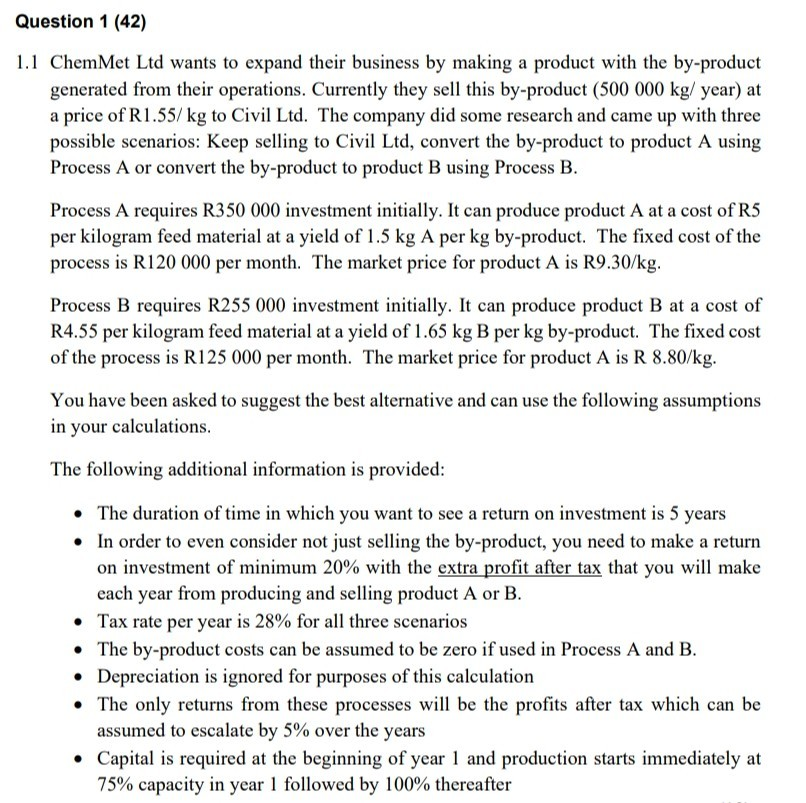

Question 1 (42) 1.1 ChemMet Ltd wants to expand their business by making a product with the by-product generated from their operations. Currently they sell this by-product (500 000 kg/ year) at a price of R1.55/ kg to Civil Ltd. The company did some research and came up with three possible scenarios: Keep selling to Civil Ltd, convert the by-product to product A using Process A or convert the by-product to product B using Process B. Process A requires R350 000 investment initially. It can produce product A at a cost of R5 per kilogram feed material at a yield of 1.5 kg A per kg by-product. The fixed cost of the process is R120 000 per month. The market price for product A is R9.30/kg. Process B requires R255 000 investment initially. It can produce product B at a cost of R4.55 per kilogram feed material at a yield of 1.65 kg B per kg by-product. The fixed cost of the process is R125 000 per month. The market price for product A is R 8.80/kg. You have been asked to suggest the best alternative and can use the following assumptions in your calculations. The following additional information is provided: The duration of time in which you want to see a return on investment is 5 years In order to even consider not just selling the by-product, you need to make a return on investment of minimum 20% with the extra profit after tax that you will make each year from producing and selling product A or B. Tax rate per year is 28% for all three scenarios The by-product costs can be assumed to be zero if used in Process A and B. Depreciation is ignored for purposes of this calculation The only returns from these processes will be the profits after tax which can be assumed to escalate by 5% over the years Capital is required at the beginning of year 1 and production starts immediately at 75% capacity in year 1 followed by 100% thereafter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started