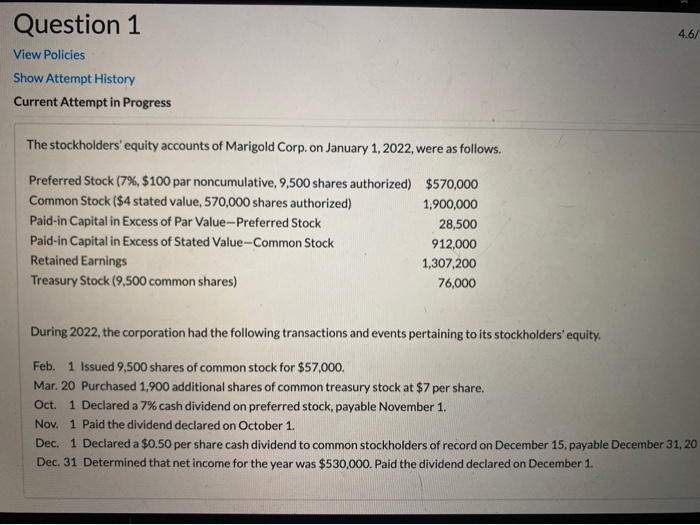

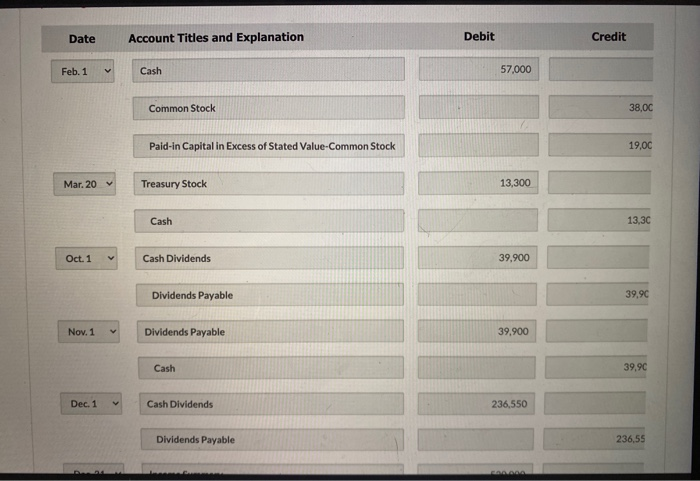

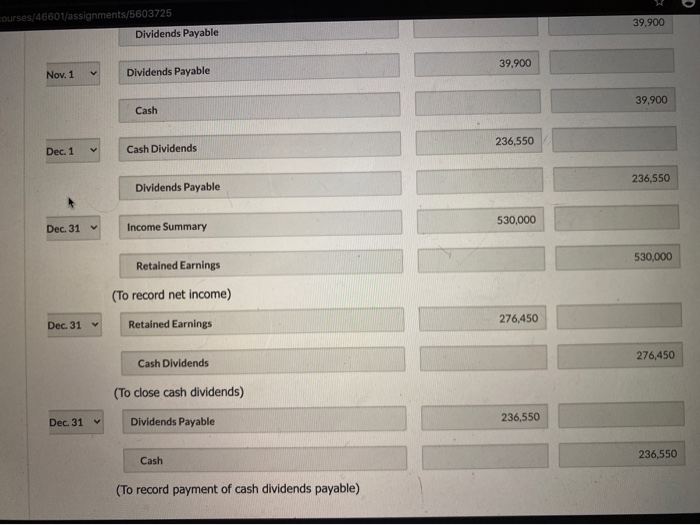

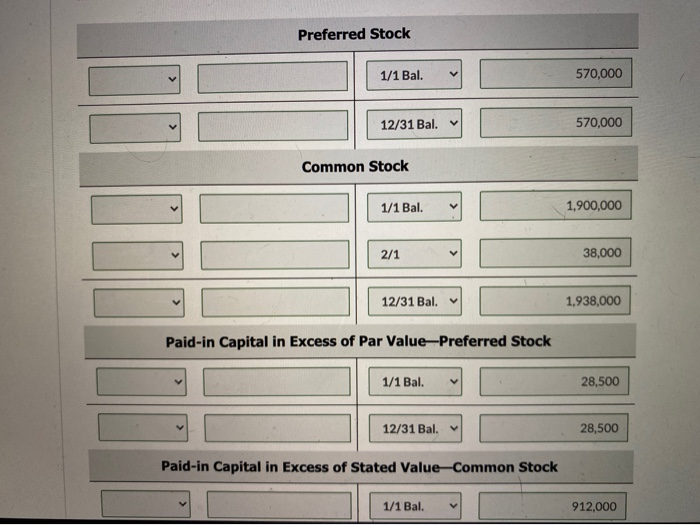

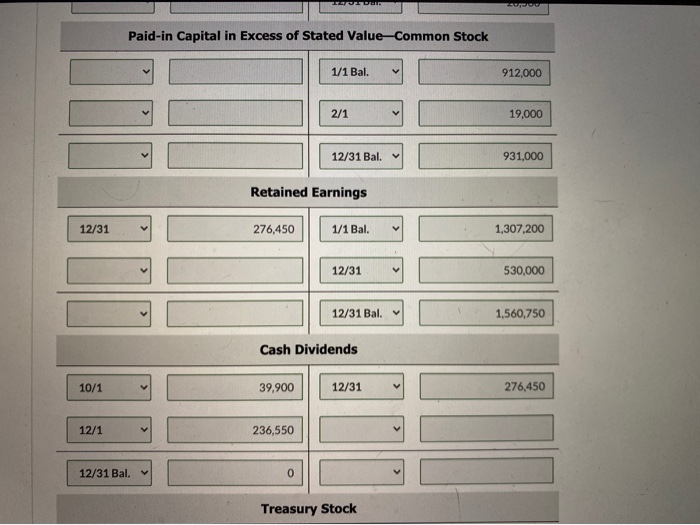

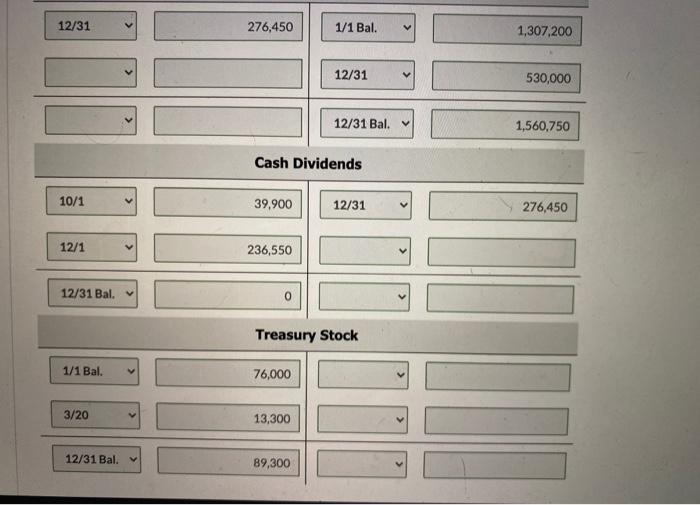

Question 1 4.6/ View Policies Show Attempt History Current Attempt in Progress The stockholders' equity accounts of Marigold Corp. on January 1, 2022, were as follows. Preferred Stock (7%, $100 par noncumulative, 9,500 shares authorized) $570,000 Common Stock ($4 stated value, 570,000 shares authorized) 1,900,000 Paid-in Capital in Excess of Par Value-Preferred Stock 28,500 Paid-in Capital in Excess of Stated Value-Common Stock 912,000 Retained Earnings 1,307,200 Treasury Stock (9,500 common shares) 76,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 9,500 shares of common stock for $57,000. Mar. 20 Purchased 1,900 additional shares of common treasury stock at $7 per share. Oct. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 20 Dec. 31 Determined that net income for the year was $530,000. Paid the dividend declared on December 1. Date Account Titles and Explanation Debit Credit Feb. 1 Cash 57,000 Common Stock 38,00 Paid-in Capital in Excess of Stated Value-Common Stock 19,00 Mar. 20 Treasury Stock 13,300 Cash 13,30 Oct. 1 > Cash Dividends 39.900 Dividends Payable 39,90 Nov. 1 Dividends Payable 39,900 Cash 39,90 Dec. 1 Cash Dividends 236,550 Dividends Payable 236,55 courses/46601/assignments/5603725 Dividends Payable 39,900 39,900 Nov. 1 Dividends Payable 39,900 Cash 236,550 Dec. 1 Cash Dividends 236,550 Dividends Payable 530,000 Dec. 31 Income Summary 530,000 Retained Earnings (To record net income) Retained Earnings 276,450 Dec. 31 276,450 Cash Dividends (To close cash dividends) 236,550 Dec. 31 Dividends Payable 236,550 Cash (To record payment of cash dividends payable) Preferred Stock 1/1 Bal. 570,000 12/31 Bal. V 570,000 Common Stock 1/1 Bal. 1,900,000 2/1 38,000 12/31 Bal. 1,938,000 Paid-in Capital in Excess of Par Value-Preferred Stock 1/1 Bal. 28,500 12/31 Bal. 28,500 Paid-in Capital in Excess of Stated Value-Common Stock 1/1 Bal. 912,000 Paid-in Capital in Excess of Stated Value-Common Stock 1/1 Bal. 912,000 2/1 19,000 12/31 Bal. 931,000 Retained Earnings 12/31 276,450 1/1 Bal. 1,307,200 12/31 530,000 12/31 Bal. 1,560,750 Cash Dividends 10/1 39,900 12/31 276,450 12/1 236,550 12/31 Bal. 0 Treasury Stock 12/31 276,450 1/1 Bal. 1,307,200 12/31 530,000 12/31 Bal. 1,560,750 Cash Dividends 10/1 39,900 12/31 276,450 12/1 236,550 12/31 Bal. 0 Treasury Stock ILLA 1/1 Bal. 76,000 3/20 13,300 12/31 Bal. 89,300 Prepare the stockholders' equity section of the balance sheet at December 31, 2022. MARIGOLD CORP. Partial Balance Sheet