Answered step by step

Verified Expert Solution

Question

1 Approved Answer

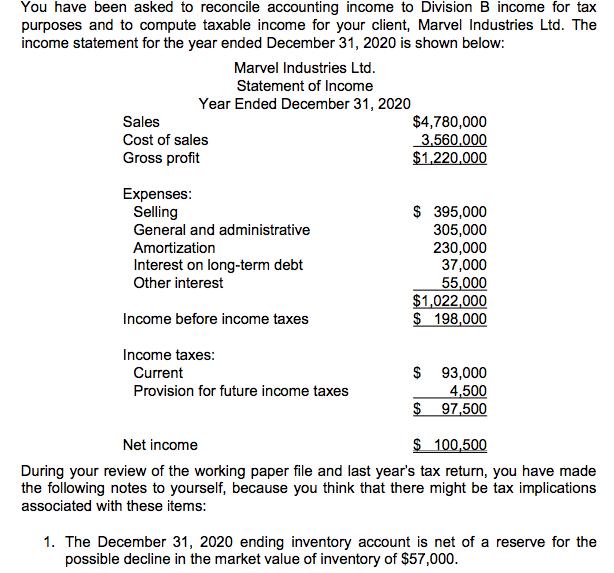

You have been asked to reconcile accounting income to Division B income for tax purposes and to compute taxable income for your client, Marvel

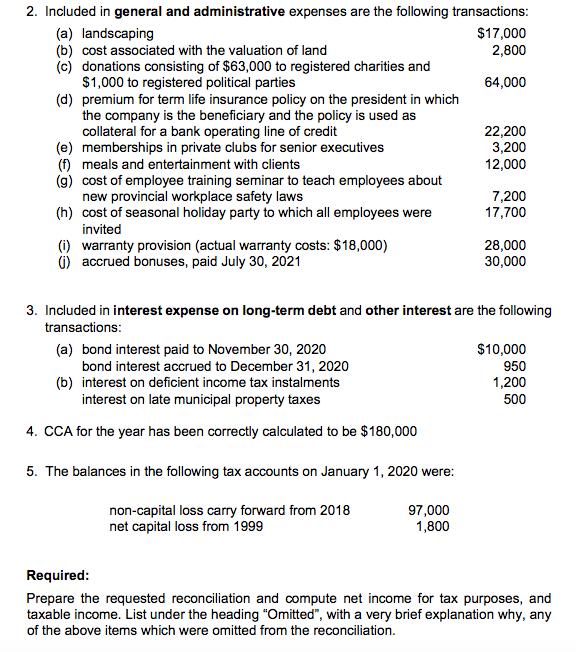

You have been asked to reconcile accounting income to Division B income for tax purposes and to compute taxable income for your client, Marvel Industries Ltd. The income statement for the year ended December 31, 2020 is shown below: Marvel Industries Ltd. Statement of Income Year Ended December 31, 2020 $4,780,000 3.560,000 $1,220,000 Sales Cost of sales Gross profit Expenses: Selling $ 395,000 305,000 230,000 37,000 55,000 $1,022,000 $ 198,000 General and administrative Amortization Interest on long-term debt Other interest Income before income taxes Income taxes: Current $ 93,000 4,500 $ Provision for future income taxes 97,500 Net income $ 100,500 During your review of the working paper file and last year's tax return, you have made the following notes to yourself, because you think that there might be tax implications associated with these items: 1. The December 31, 2020 ending inventory account is net of a reserve for the possible decline in the market value of inventory of $57,000. 2. Included in general and administrative expenses are the following transactions: (a) landscaping (b) cost associated with the valuation of land (c) donations consisting of $63,000 to registered charities and $1,000 to registered political parties (d) premium for term life insurance policy on the president in which the company is the beneficiary and the policy is used as collateral for a bank operating line of credit (e) memberships in private clubs for senior executives (f) meals and entertainment with clients (g) cost of employee training seminar to teach employees about new provincial workplace safety laws (h) cost of seasonal holiday party to which all employees were $17,000 2,800 64,000 22,200 3,200 12,000 7,200 17,700 invited (i) warranty provision (actual warranty costs: $18,000) 0) accrued bonuses, paid July 30, 2021 28,000 30,000 3. Included in interest expense on long-term debt and other interest are the following transactions: $10,000 950 (a) bond interest paid to November 30, 2020 bond interest accrued to December 31, 2020 (b) interest on deficient income tax instalments interest on late municipal property taxes 1,200 500 4. CCA for the year has been correctly calculated to be $180,000 5. The balances in the following tax accounts on January 1, 2020 were: non-capital loss carry forward from 2018 net capital loss from 1999 97,000 1,800 Required: Prepare the requested reconciliation and compute net income for tax purposes, and taxable income. List under the heading "Omitted", with a very brief explanation why, any of the above items which were omitted from the reconciliation.

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

211400 93000 4500 308900 30000 17700 Net Income Income TaxesCurrent Provision for future i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started