Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 ( 5 marks ) . Maria is a very successful farmer. She rented a land from the owner and she paid SR 4

Question marks

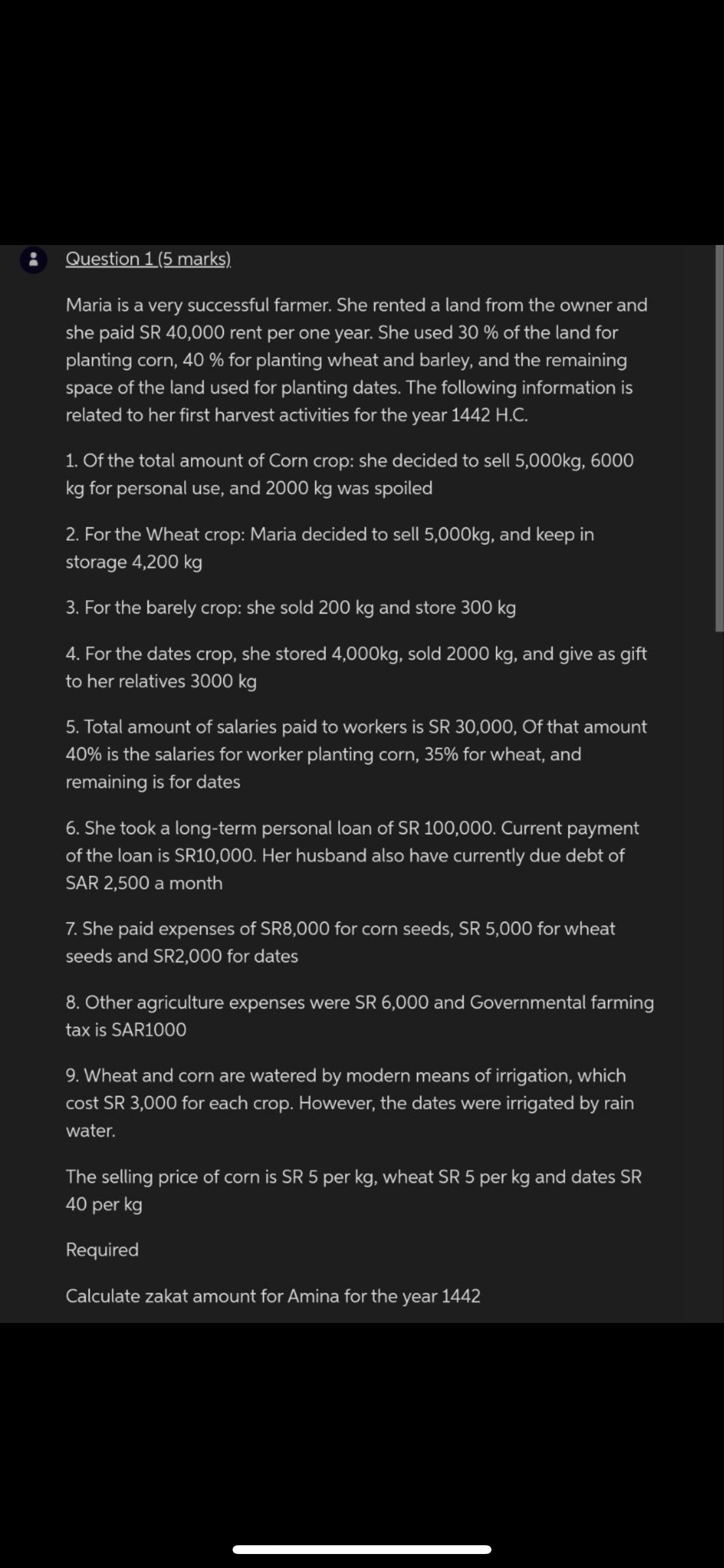

Maria is a very successful farmer. She rented a land from the owner and she paid SR rent per one year. She used of the land for planting corn, for planting wheat and barley, and the remaining space of the land used for planting dates. The following information is related to her first harvest activities for the year HC

Of the total amount of Corn crop: she decided to sell for personal use, and was spoiled

For the Wheat crop: Maria decided to sell and keep in storage

For the barely crop: she sold and store

For the dates crop, she stored sold and give as gift to her relatives

Total amount of salaries paid to workers is SR Of that amount is the salaries for worker planting corn, for wheat, and remaining is for dates

She took a longterm personal loan of SR Current payment of the loan is SR Her husband also have currently due debt of SAR a month

She paid expenses of SR for corn seeds, SR for wheat seeds and SR for dates

Other agriculture expenses were SR and Governmental farming tax is SAR

Wheat and corn are watered by modern means of irrigation, which cost SR for each crop. However, the dates were irrigated by rain water.

The selling price of corn is SR per wheat SR per and dates SR per kg

Required

Calculate zakat amount for Amina for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started