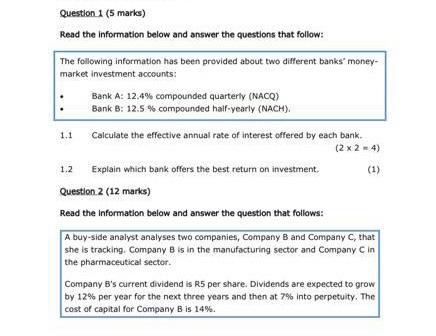

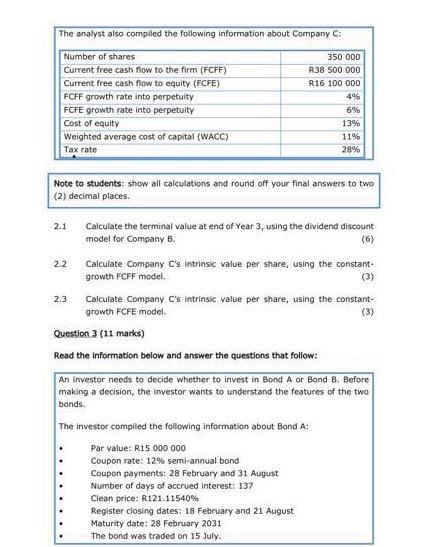

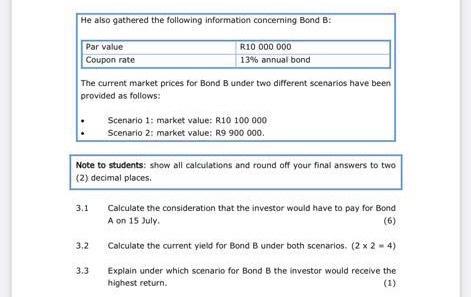

Question 1 (5 marks) Read the information below and answer the questions that follow: The following information has been provided about two different banks' money- market investment accounts: Bank A: 12.4% compounded quarterly (NACQ) Bank B: 12.5% compounded half-yearly (NACH), 1.1 Calculate the effective annual rate of interest offered by each bank. (2 x 2-4) (1) 1.2 Explain which bank offers the best return on investment Question 2 (12 marks) Read the information below and answer the question that follows: A buy-side analyst analyses two companies, Company B and Company C, that she is tracking. Company B is in the manufacturing sector and Company Cin the pharmaceutical sector. Company B's current dividend is R5 per share. Dividends are expected to grow by 12% per year for the next three years and then at 7% into perpetuity. The cost of capital for Company Bis 14%. The analyst also compiled the following information about Company C: Number of shares Current free cash flow to the firm (FCFF) Current free cash flow to equity (FCFE) FCFF growth rate into perpetuity FCFE growth rate into perpetuity Cost of equity Weighted average cost of capital (WACC) Tax rate 350 000 R38 500 000 R16 100 000 4% 6% 13% 11% 28% Note to students: show all calculations and round off your final answers to two (2) decimal places. 2.1 Calculate the terminal value at end of Year 3, using the dividend discount model for Company B. (6) 2.2 Calculate Company C's intrinsic value per share, using the constant- growth FCFF model, (3) 2.3 Calculate Company C's intrinsic value per share, using the constant- growth FCFE modet. (3) Question 3 (11 marks) Read the information below and answer the questions that follow: An investor needs to decide whether to invest in Bond A or Bond B. Before making a decision, the investor wants to understand the features of the two bonds. The investor compiled the following information about Band A: Par value: R15 000 000 Coupon rate: 12% semi-annual bond Coupon payments: 28 February and 31 August Number of days of accrued interest: 137 Clean price: R121.11540% Register closing dates: 18 February and 21 August Maturity date: 28 February 2031 The bond was traded on 15 July He also gathered the following information concerning Bond B: Par value Coupon rate R10 000 000 13% annual bond The current market prices for Bond B under two different scenarios have been provided as follows: Scenario 1: market value: R10 100 000 Scenario 2: market value: R9 900 000. Note to students: show all calculations and round off your final answers to two (2) decimal places. 3.1 Calculate the consideration that the investor would have to pay for Bond A on 15 July (6) 3.2 Calculate the current yield for Bond B under both scenarios (2 x 2 - 4) 3.3 Explain under which scenario for Bond B the investor would receive the highest return. (1)