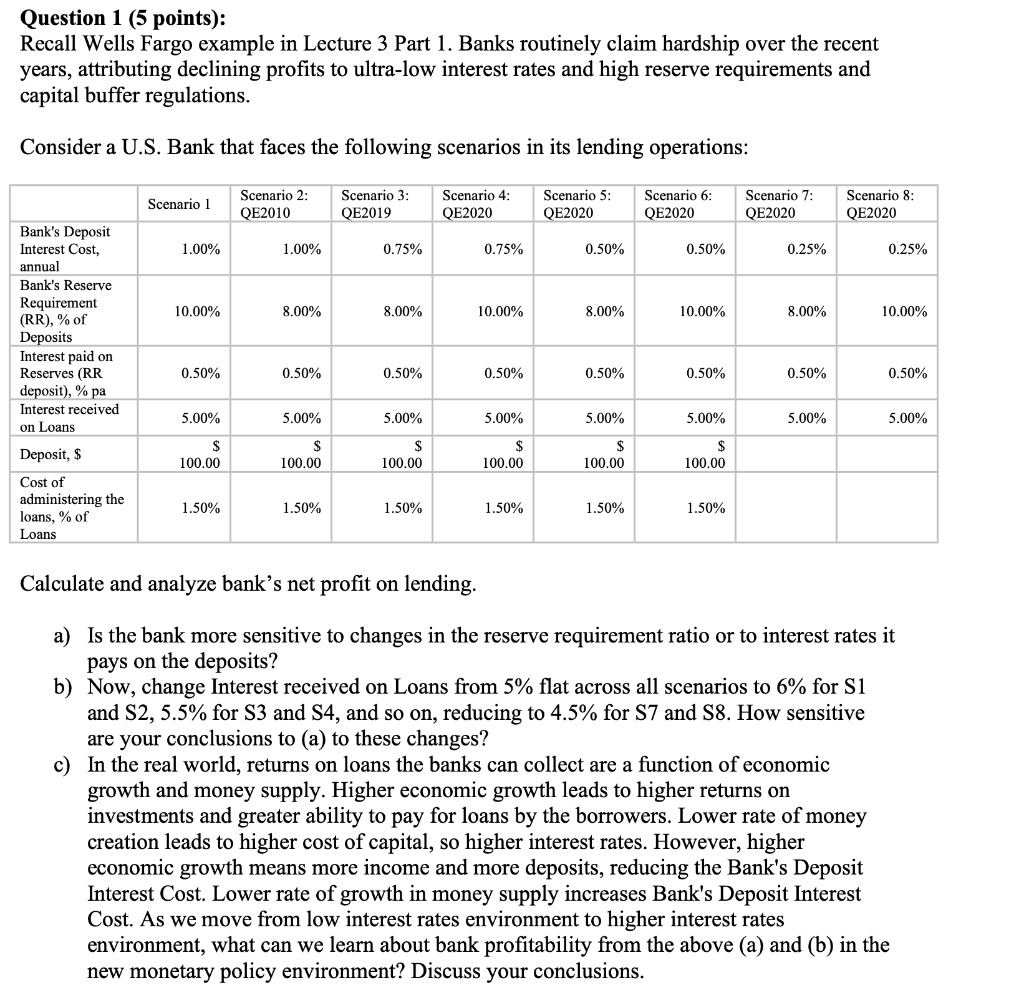

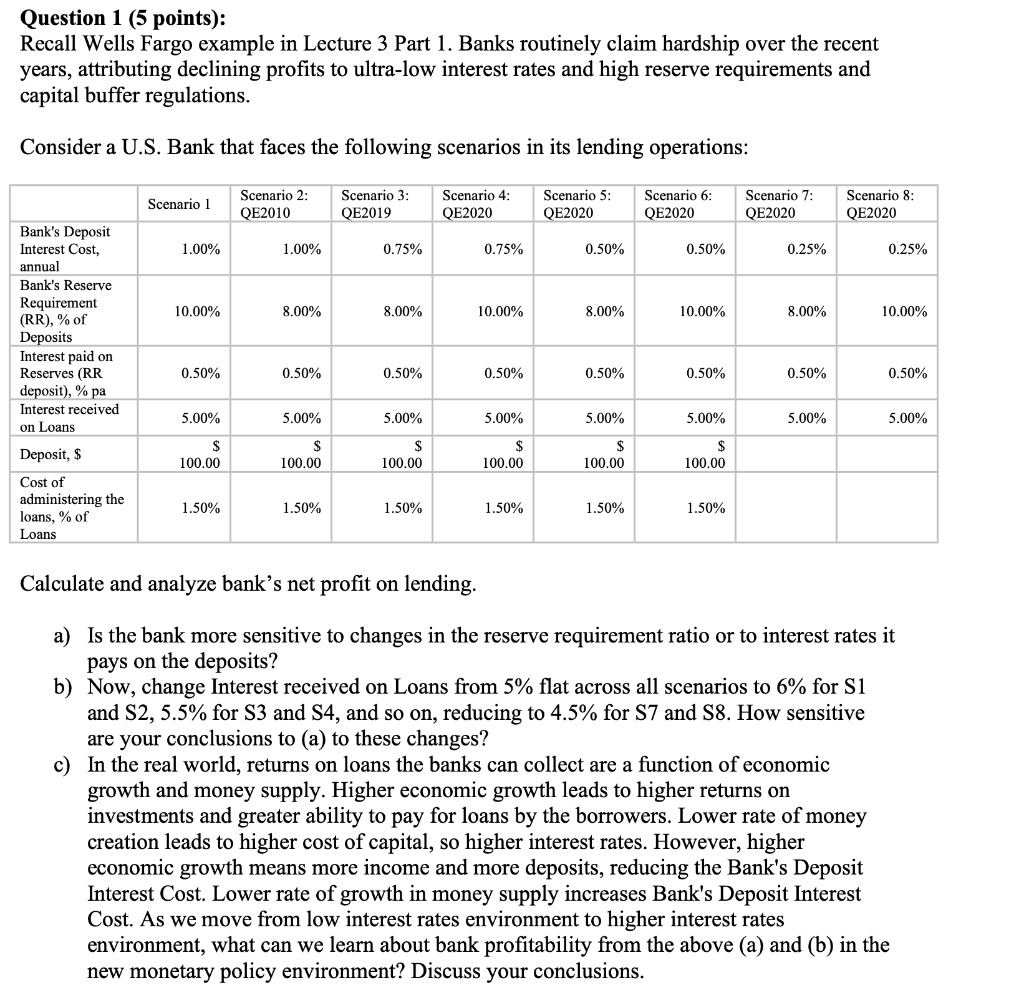

Question 1 ( 5 points): Recall Wells Fargo example in Lecture 3 Part 1. Banks routinely claim hardship over the recent years, attributing declining profits to ultra-low interest rates and high reserve requirements and capital buffer regulations. Consider a U.S. Bank that faces the following scenarios in its lending operations: Calculate and analyze bank's net profit on lending. a) Is the bank more sensitive to changes in the reserve requirement ratio or to interest rates it pays on the deposits? b) Now, change Interest received on Loans from 5\% flat across all scenarios to 6% for S1 and S2, 5.5\% for S3 and S4, and so on, reducing to 4.5% for S7 and S8. How sensitive are your conclusions to (a) to these changes? c) In the real world, returns on loans the banks can collect are a function of economic growth and money supply. Higher economic growth leads to higher returns on investments and greater ability to pay for loans by the borrowers. Lower rate of money creation leads to higher cost of capital, so higher interest rates. However, higher economic growth means more income and more deposits, reducing the Bank's Deposit Interest Cost. Lower rate of growth in money supply increases Bank's Deposit Interest Cost. As we move from low interest rates environment to higher interest rates environment, what can we learn about bank profitability from the above (a) and (b) in the new monetary policy environment? Discuss your conclusions. Question 1 ( 5 points): Recall Wells Fargo example in Lecture 3 Part 1. Banks routinely claim hardship over the recent years, attributing declining profits to ultra-low interest rates and high reserve requirements and capital buffer regulations. Consider a U.S. Bank that faces the following scenarios in its lending operations: Calculate and analyze bank's net profit on lending. a) Is the bank more sensitive to changes in the reserve requirement ratio or to interest rates it pays on the deposits? b) Now, change Interest received on Loans from 5\% flat across all scenarios to 6% for S1 and S2, 5.5\% for S3 and S4, and so on, reducing to 4.5% for S7 and S8. How sensitive are your conclusions to (a) to these changes? c) In the real world, returns on loans the banks can collect are a function of economic growth and money supply. Higher economic growth leads to higher returns on investments and greater ability to pay for loans by the borrowers. Lower rate of money creation leads to higher cost of capital, so higher interest rates. However, higher economic growth means more income and more deposits, reducing the Bank's Deposit Interest Cost. Lower rate of growth in money supply increases Bank's Deposit Interest Cost. As we move from low interest rates environment to higher interest rates environment, what can we learn about bank profitability from the above (a) and (b) in the new monetary policy environment? Discuss your conclusions