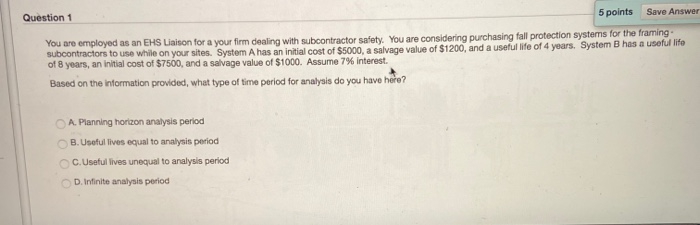

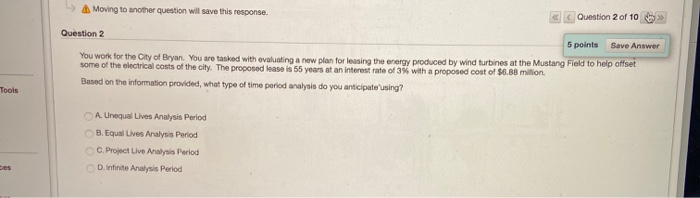

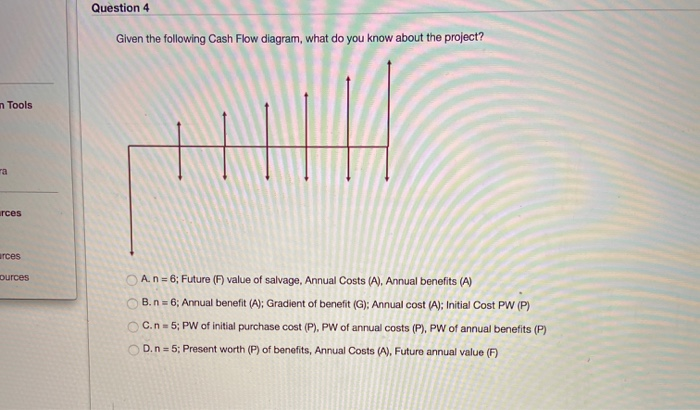

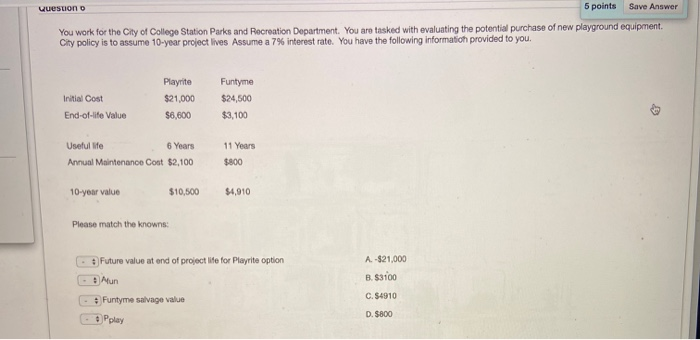

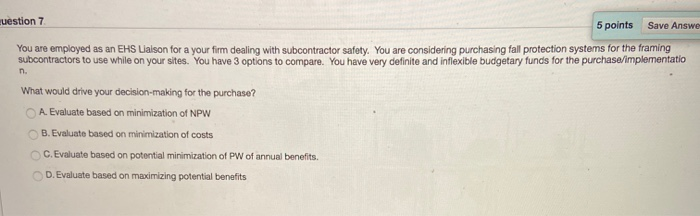

Question 1 5 points Save Answer You are employed as an EHS Liaison for a your firm dealing with subcontractor safety. You are considering purchasing fall protection systems for the framing subcontractors to use while on your sites. System A has an initial cost of $5000, a salvage value of $1200, and a useful life of 4 years. System B has a useful life of 8 years, an initial cost of $7500, and a salvage value of $1000. Assume 7% interest. Based on the information provided, what type of time period for analysis do you have here? A. Planning horizon analysis period B.Useful lives equal to analysis period C.Useful lives unequal to analysis period D. Infinite analysis period > Moving to another question will save this response. Question 2 of 10 Question 2 5 points Save Answer You work for the City of Bryan. You are tasked with evaluating a new plan for leasing the energy produced by wind turbines at the Mustang Field to help offset some of the electrical costs of the city. The proposed base is 55 years at an interest rate of with a proposed cost of $6.88 milion Based on the information provided, what type of time period analysis do you anticipate using? Tools A Unequal Lives Analysis Period B.Equal Uves Analysis Period C. Project Live Analysis Period D.Infinite Analysis Period Question 4 Given the following Cash Flow diagram, what do you know about the project? Tools Tees rces burces An= 6; Future (F) value of salvage, Annual Costs (A), Annual benefits (A) B. 6; Annual benefit (A); Gradient of benefit (G); Annual cost (A); Initial Cost PW (P) OC.n5; PW of initial purchase cost (P), PW of annual costs (P), PW of annual benefits (P) D.n=5; Present worth (P) of benefits, Annual Costs (A), Futuro annual value (F) wuesuono 5 points Save Answer You work for the City of College Station Parks and Recreation Department. You are tasked with evaluating the potential purchase of new playground equipment. City policy is to assume 10-year project lives Assume a 7% interest rate. You have the following informatich provided to you. Initial Cost End-of-life Value Playrite $21,000 $6,500 Funtyme $24,500 $3,100 Useful life 6 Years Annual Maintenance Cost $2,100 11 Years $800 10-year value $10,500 $4,910 Please match the knowns: Future value at end of project life for Playrite option A-$21,000 B. $3100 - Alun Furtyme salvage value Play C. $4910 D. $800 uestion 7 5 points Save Answe You are employed as an EHS Liaison for a your firm dealing with subcontractor safety. You are considering purchasing fall protection systems for the framing subcontractors to use while on your sites. You have 3 options to compare. You have very definite and inflexible budgetary funds for the purchase/implementatio What would drive your decision-making for the purchase? A. Evaluate based on minimization of NPW B. Evaluate based on minimization of costs C. Evaluate based on potential minimization of PW of annual benefits. D. Evaluate based on maximizing potential benefits Question 1 5 points Save Answer You are employed as an EHS Liaison for a your firm dealing with subcontractor safety. You are considering purchasing fall protection systems for the framing subcontractors to use while on your sites. System A has an initial cost of $5000, a salvage value of $1200, and a useful life of 4 years. System B has a useful life of 8 years, an initial cost of $7500, and a salvage value of $1000. Assume 7% interest. Based on the information provided, what type of time period for analysis do you have here? A. Planning horizon analysis period B.Useful lives equal to analysis period C.Useful lives unequal to analysis period D. Infinite analysis period > Moving to another question will save this response. Question 2 of 10 Question 2 5 points Save Answer You work for the City of Bryan. You are tasked with evaluating a new plan for leasing the energy produced by wind turbines at the Mustang Field to help offset some of the electrical costs of the city. The proposed base is 55 years at an interest rate of with a proposed cost of $6.88 milion Based on the information provided, what type of time period analysis do you anticipate using? Tools A Unequal Lives Analysis Period B.Equal Uves Analysis Period C. Project Live Analysis Period D.Infinite Analysis Period Question 4 Given the following Cash Flow diagram, what do you know about the project? Tools Tees rces burces An= 6; Future (F) value of salvage, Annual Costs (A), Annual benefits (A) B. 6; Annual benefit (A); Gradient of benefit (G); Annual cost (A); Initial Cost PW (P) OC.n5; PW of initial purchase cost (P), PW of annual costs (P), PW of annual benefits (P) D.n=5; Present worth (P) of benefits, Annual Costs (A), Futuro annual value (F) wuesuono 5 points Save Answer You work for the City of College Station Parks and Recreation Department. You are tasked with evaluating the potential purchase of new playground equipment. City policy is to assume 10-year project lives Assume a 7% interest rate. You have the following informatich provided to you. Initial Cost End-of-life Value Playrite $21,000 $6,500 Funtyme $24,500 $3,100 Useful life 6 Years Annual Maintenance Cost $2,100 11 Years $800 10-year value $10,500 $4,910 Please match the knowns: Future value at end of project life for Playrite option A-$21,000 B. $3100 - Alun Furtyme salvage value Play C. $4910 D. $800 uestion 7 5 points Save Answe You are employed as an EHS Liaison for a your firm dealing with subcontractor safety. You are considering purchasing fall protection systems for the framing subcontractors to use while on your sites. You have 3 options to compare. You have very definite and inflexible budgetary funds for the purchase/implementatio What would drive your decision-making for the purchase? A. Evaluate based on minimization of NPW B. Evaluate based on minimization of costs C. Evaluate based on potential minimization of PW of annual benefits. D. Evaluate based on maximizing potential benefits