Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (5 points) Your company signed a contract to remove soil from government-owned property. This task requires a specific bulldozer to dig and load

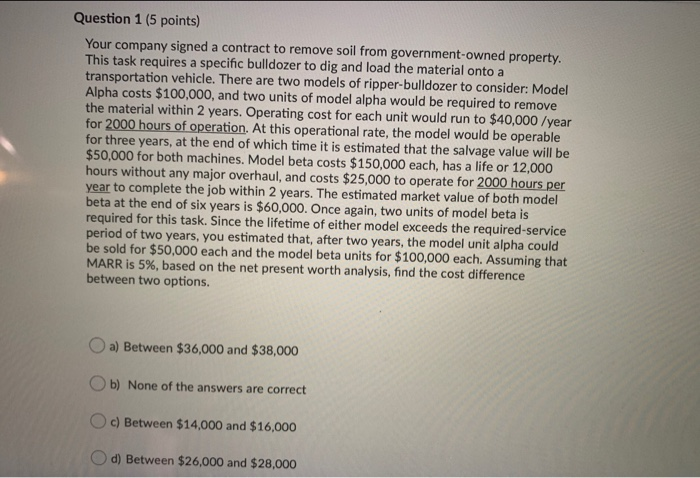

Question 1 (5 points) Your company signed a contract to remove soil from government-owned property. This task requires a specific bulldozer to dig and load the material onto a transportation vehicle. There are two models of ripper-bulldozer to consider: Model Alpha costs $100,000, and two units of model alpha would be required to remove the material within 2 years. Operating cost for each unit would run to $40,000/year for 2000 hours of operation. At this operational rate, the model would be operable for three years, at the end of which time it is estimated that the salvare value will be $50,000 for both machines. Model beta costs $150,000 each, has a life or 12,000 hours without any major overhaul, and costs $25,000 to operate for 2000 hours per year to complete the job within 2 years. The estimated market value of both model beta at the end of six years is $60,000. Once again, two units of model beta is required for this task. Since the lifetime of either model exceeds the required-service period of two years, you estimated that, after two years, the model unit alpha could be sold for $50,000 each and the model beta units for $100,000 each. Assuming that MARR IS 5%, based on the net present worth analysis, find the cost difference between two options. a) Between $36,000 and $38,000 Ob) None of the answers are correct O c) Between $14,000 and $16,000 d) Between $26,000 and $28,000

Question 1 (5 points) Your company signed a contract to remove soil from government-owned property. This task requires a specific bulldozer to dig and load the material onto a transportation vehicle. There are two models of ripper-bulldozer to consider: Model Alpha costs $100,000, and two units of model alpha would be required to remove the material within 2 years. Operating cost for each unit would run to $40,000/year for 2000 hours of operation. At this operational rate, the model would be operable for three years, at the end of which time it is estimated that the salvare value will be $50,000 for both machines. Model beta costs $150,000 each, has a life or 12,000 hours without any major overhaul, and costs $25,000 to operate for 2000 hours per year to complete the job within 2 years. The estimated market value of both model beta at the end of six years is $60,000. Once again, two units of model beta is required for this task. Since the lifetime of either model exceeds the required-service period of two years, you estimated that, after two years, the model unit alpha could be sold for $50,000 each and the model beta units for $100,000 each. Assuming that MARR IS 5%, based on the net present worth analysis, find the cost difference between two options. a) Between $36,000 and $38,000 Ob) None of the answers are correct O c) Between $14,000 and $16,000 d) Between $26,000 and $28,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started