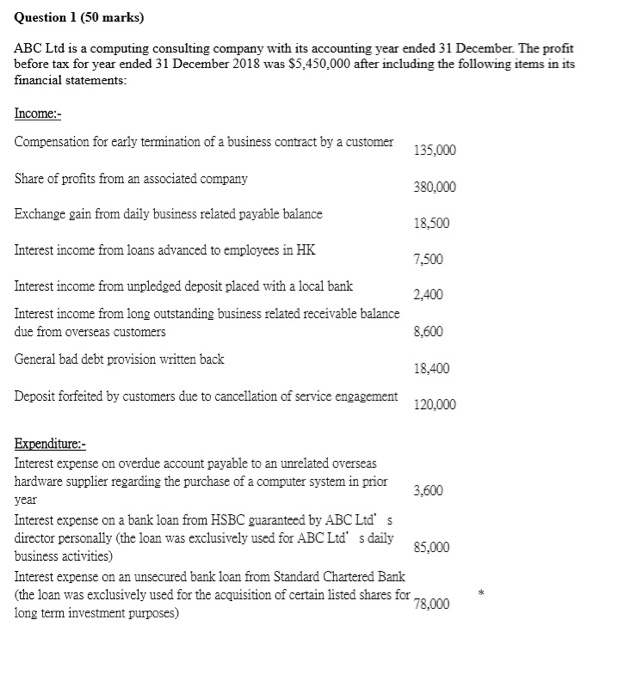

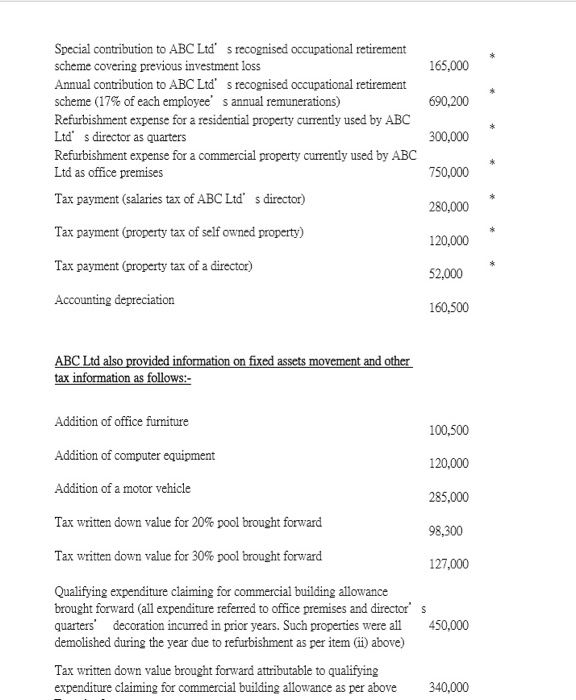

Question 1 (50 marks) ABC Ltd is a computing consulting company with its accounting year ended 31 December. The profit before tax for year ended 31 December 2018 was $5,450,000 after including the following items in its financial statements: Income:- Compensation for early termination of a business contract by a customer 135,000 Share of profits from an associated company 380,000 Exchange gain from daily business related payable balance 18,500 Interest income from loans advanced to employees in HK 7,500 2,400 Interest income from unpledged deposit placed with a local bank Interest income from long outstanding business related receivable balance due from overseas customers General bad debt provision written back 8,600 18,400 Deposit forfeited by customers due to cancellation of service engagement 120,000 Expenditure:- Interest expense on overdue account payable to an unrelated overseas hardware supplier regarding the purchase of a computer system in prior 3,600 year Interest expense on a bank loan from HSBC guaranteed by ABC Ltd's director personally (the loan was exclusively used for ABC Ltd' s daily con business activities) Interest expense on an unsecured bank loan from Standard Chartered Bank (the loan was exclusively used for the acquisition of certain listed shares for en long term investment purposes) a. Calculation the depreciation allowances for deduction of ABC Ltd for 2018/19 under Part 6 of Inland Revenue Ordinance. (15 marks) Question 1 (50 marks) ABC Ltd is a computing consulting company with its accounting year ended 31 December. The profit before tax for year ended 31 December 2018 was $5,450,000 after including the following items in its financial statements: Income:- Compensation for early termination of a business contract by a customer 135,000 Share of profits from an associated company 380,000 Exchange gain from daily business related payable balance 18,500 Interest income from loans advanced to employees in HK 7,500 2,400 Interest income from unpledged deposit placed with a local bank Interest income from long outstanding business related receivable balance due from overseas customers General bad debt provision written back 8,600 18,400 Deposit forfeited by customers due to cancellation of service engagement 120,000 Expenditure:- Interest expense on overdue account payable to an unrelated overseas hardware supplier regarding the purchase of a computer system in prior 3,600 year Interest expense on a bank loan from HSBC guaranteed by ABC Ltd's director personally (the loan was exclusively used for ABC Ltd' s daily con business activities) Interest expense on an unsecured bank loan from Standard Chartered Bank (the loan was exclusively used for the acquisition of certain listed shares for en long term investment purposes) a. Calculation the depreciation allowances for deduction of ABC Ltd for 2018/19 under Part 6 of Inland Revenue Ordinance. (15 marks)