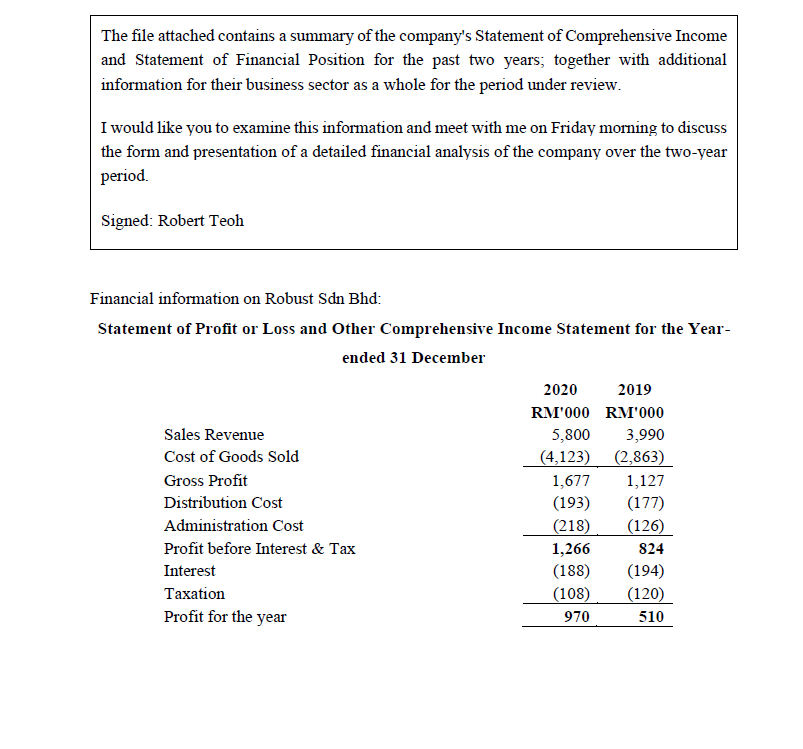

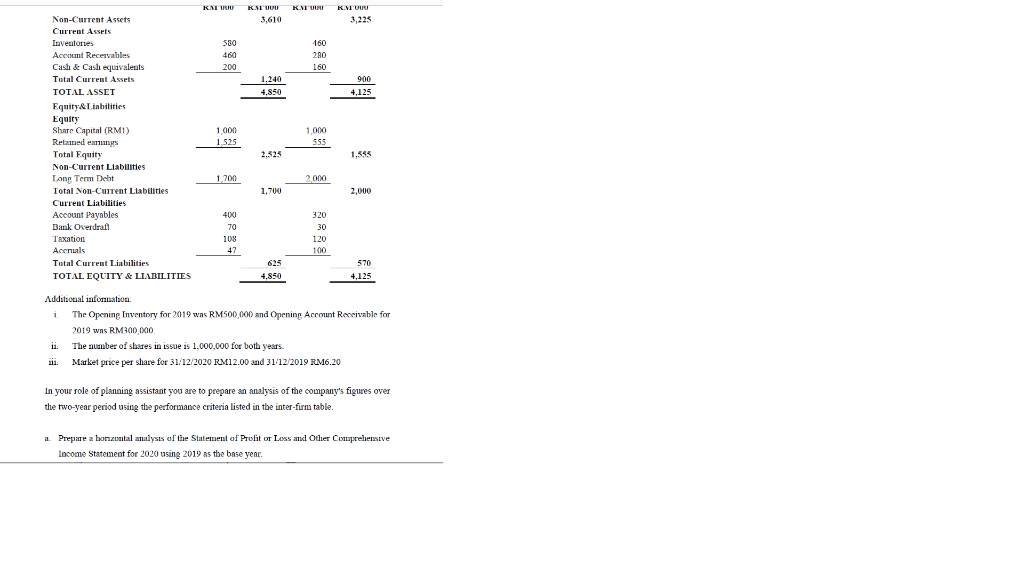

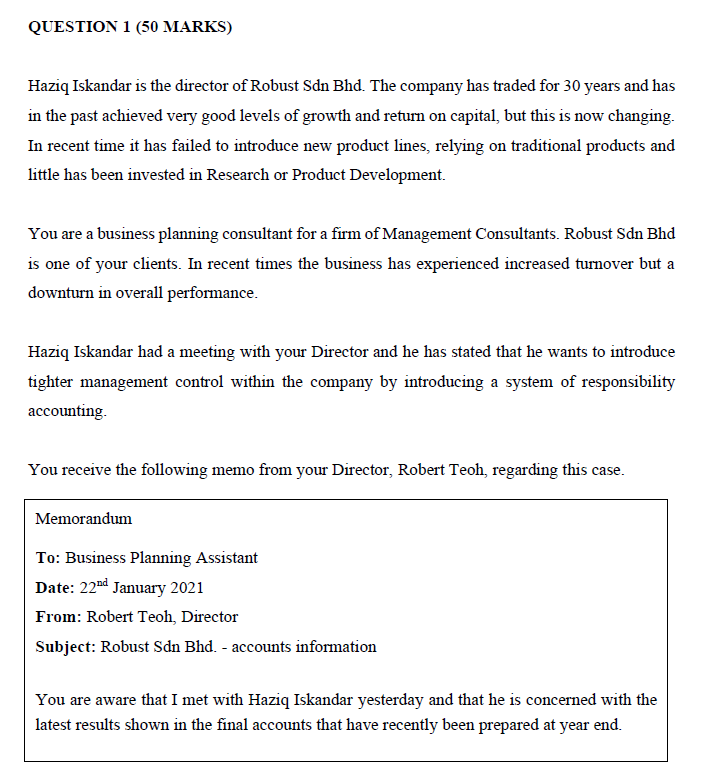

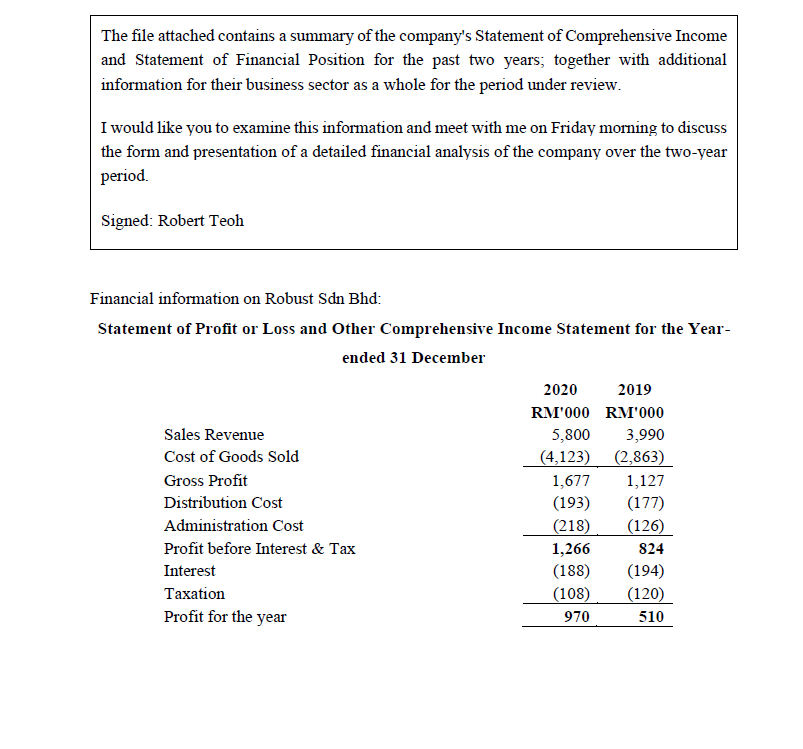

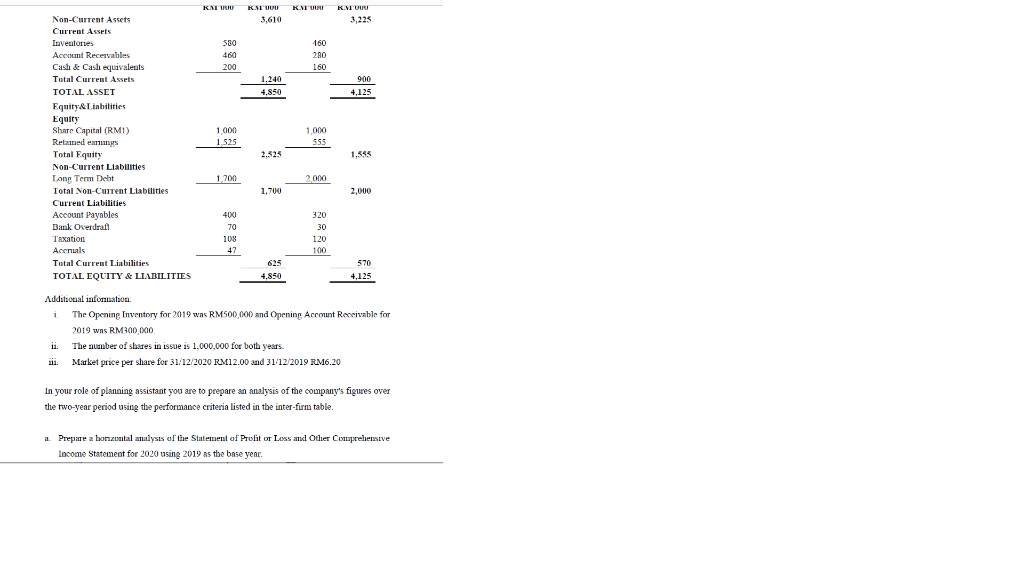

QUESTION 1 (50 MARKS) Haziq Iskandar is the director of Robust Sdn Bhd. The company has traded for 30 years and has in the past achieved very good levels of growth and return on capital, but this is now changing. In recent time it has failed to introduce new product lines, relying on traditional products and little has been invested in Research or Product Development. You are a business planning consultant for a firm of Management Consultants. Robust Sdn Bhd is one of your clients. In recent times the business has experienced increased turnover but a downturn in overall performance. Haziq Iskandar had a meeting with your Director and he has stated that he wants to introduce tighter management control within the company by introducing a system of responsibility accounting You receive the following memo from your Director, Robert Teoh, regarding this case. Memorandum To: Business Planning Assistant Date: 22nd January 2021 From: Robert Teoh, Director Subject: Robust Sdn Bhd. - accounts information You are aware that I met with Haziq Iskandar yesterday and that he is concerned with the latest results shown in the final accounts that have recently been prepared at year end. The file attached contains a summary of the company's Statement of Comprehensive Income and Statement of Financial Position for the past two years, together with additional information for their business sector as a whole for the period under review. I would like you to examine this information and meet with me on Friday morning to discuss the form and presentation of a detailed financial analysis of the company over the two-year period. Signed: Robert Teoh Financial information on Robust Sdn Bhd Statement of Profit or Loss and Other Comprehensive Income Statement for the Year- ended 31 December 2020 2019 RM'000 RM'000 Sales Revenue 5,800 3,990 Cost of Goods Sold (4,123) (2,863) Gross Profit 1,677 1,127 Distribution Cost (193) (177) Administration Cost (218) (126) Profit before Interest & Tax 1,266 824 Interest (188) (194) Taxation (108) (120) Profit for the year 970 510 KNU KNI UM KNTUU KNU 3,610 RIMU 3,225 530 460 200 160 290 160 1.240 4.850 900 4,125 1.000 1.52 1.000 555 Non-Current Assets Current Assets Inventores Account Receivables Cash & Cash equivalents Total Current Assets TOTAL ASSET Equity & Liabilities Equity Share Capital (RM) Remed en Total Equity Non-Current Liabilities Long Term Debt Total Non-Current Liabilities Current Liabilities Account Payables Bank Overdraft Taxation Accruals Total Current Liabilities TOTAL EQUITY & LIABILITIES 2.323 1.355 1.700 2000 1,700 2,000 400 70 108 47 320 30 120 100 625 570 4,125 4.850 1 Additional information The Opening Inventory for 2019 was RM500,000 and Opening Account Receivable for 2019 was RM300,000 ii. The number of shares in issue is 1,000,000 for both years. ii. Market price per share for 31/12/2020 RM12.00 and 31/12/2019 RM6.20 In your role of planning assistant you are to prepare an analysis of the company's figures over the two-year period using the performance criteria listed in the inter-firm table. al. Prepare a bonzontal analysis of the Statement of Prolit or Loss and Odier Comprehensive Income Statement for 2020 using 2019 as the base year. QUESTION 1 (50 MARKS) Haziq Iskandar is the director of Robust Sdn Bhd. The company has traded for 30 years and has in the past achieved very good levels of growth and return on capital, but this is now changing. In recent time it has failed to introduce new product lines, relying on traditional products and little has been invested in Research or Product Development. You are a business planning consultant for a firm of Management Consultants. Robust Sdn Bhd is one of your clients. In recent times the business has experienced increased turnover but a downturn in overall performance. Haziq Iskandar had a meeting with your Director and he has stated that he wants to introduce tighter management control within the company by introducing a system of responsibility accounting You receive the following memo from your Director, Robert Teoh, regarding this case. Memorandum To: Business Planning Assistant Date: 22nd January 2021 From: Robert Teoh, Director Subject: Robust Sdn Bhd. - accounts information You are aware that I met with Haziq Iskandar yesterday and that he is concerned with the latest results shown in the final accounts that have recently been prepared at year end. The file attached contains a summary of the company's Statement of Comprehensive Income and Statement of Financial Position for the past two years, together with additional information for their business sector as a whole for the period under review. I would like you to examine this information and meet with me on Friday morning to discuss the form and presentation of a detailed financial analysis of the company over the two-year period. Signed: Robert Teoh Financial information on Robust Sdn Bhd Statement of Profit or Loss and Other Comprehensive Income Statement for the Year- ended 31 December 2020 2019 RM'000 RM'000 Sales Revenue 5,800 3,990 Cost of Goods Sold (4,123) (2,863) Gross Profit 1,677 1,127 Distribution Cost (193) (177) Administration Cost (218) (126) Profit before Interest & Tax 1,266 824 Interest (188) (194) Taxation (108) (120) Profit for the year 970 510 KNU KNI UM KNTUU KNU 3,610 RIMU 3,225 530 460 200 160 290 160 1.240 4.850 900 4,125 1.000 1.52 1.000 555 Non-Current Assets Current Assets Inventores Account Receivables Cash & Cash equivalents Total Current Assets TOTAL ASSET Equity & Liabilities Equity Share Capital (RM) Remed en Total Equity Non-Current Liabilities Long Term Debt Total Non-Current Liabilities Current Liabilities Account Payables Bank Overdraft Taxation Accruals Total Current Liabilities TOTAL EQUITY & LIABILITIES 2.323 1.355 1.700 2000 1,700 2,000 400 70 108 47 320 30 120 100 625 570 4,125 4.850 1 Additional information The Opening Inventory for 2019 was RM500,000 and Opening Account Receivable for 2019 was RM300,000 ii. The number of shares in issue is 1,000,000 for both years. ii. Market price per share for 31/12/2020 RM12.00 and 31/12/2019 RM6.20 In your role of planning assistant you are to prepare an analysis of the company's figures over the two-year period using the performance criteria listed in the inter-firm table. al. Prepare a bonzontal analysis of the Statement of Prolit or Loss and Odier Comprehensive Income Statement for 2020 using 2019 as the base year