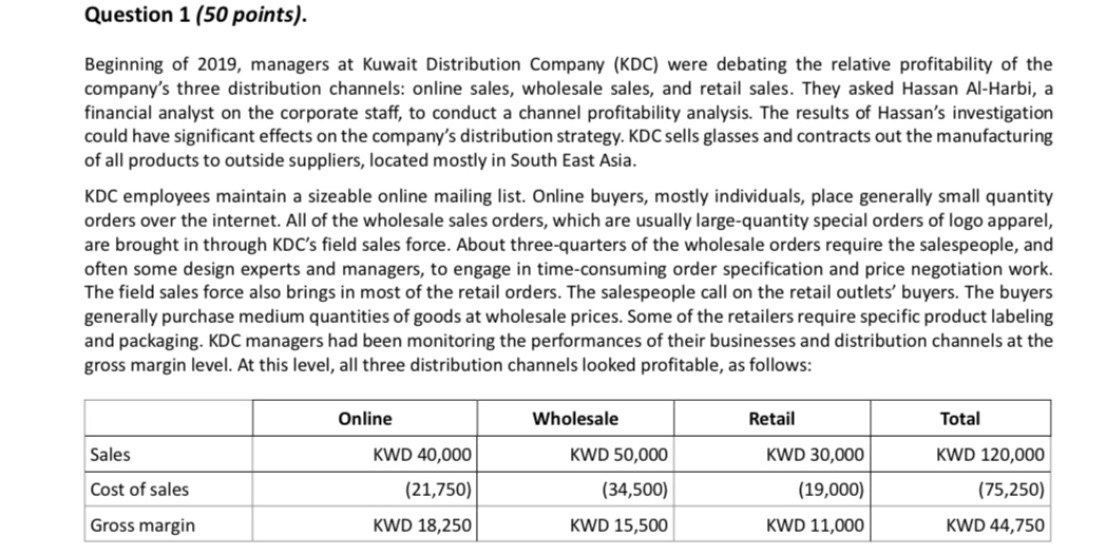

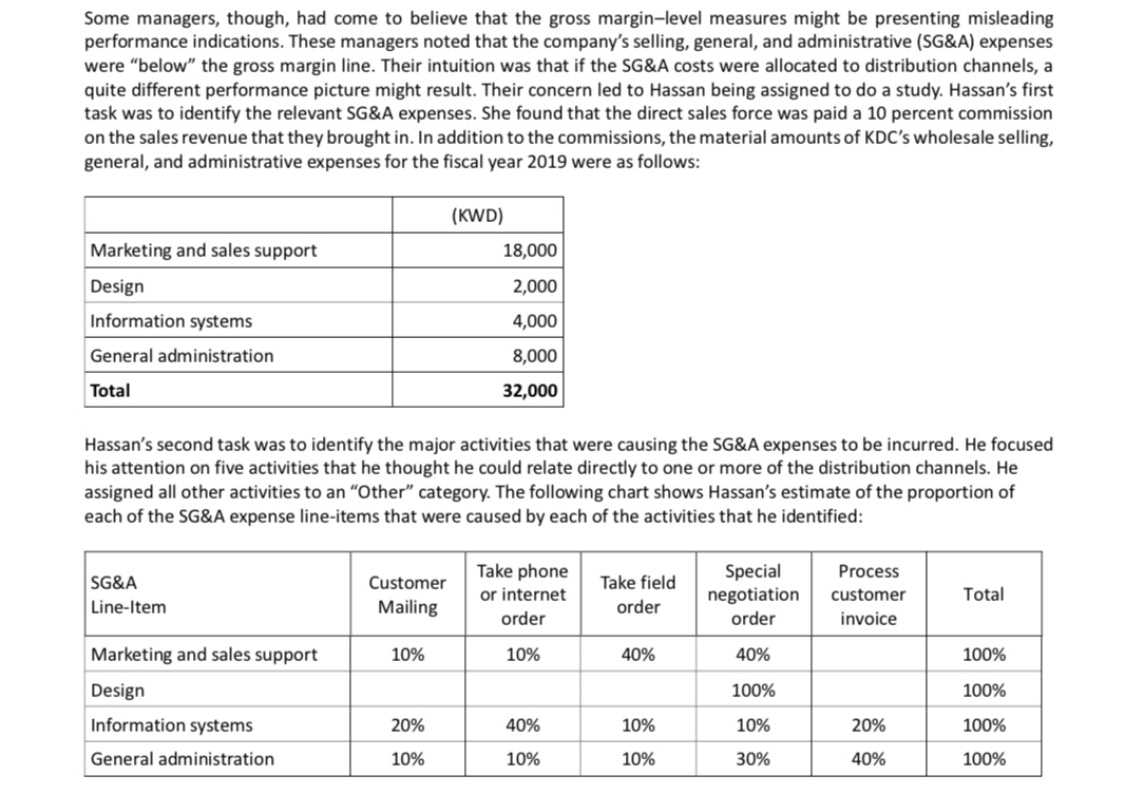

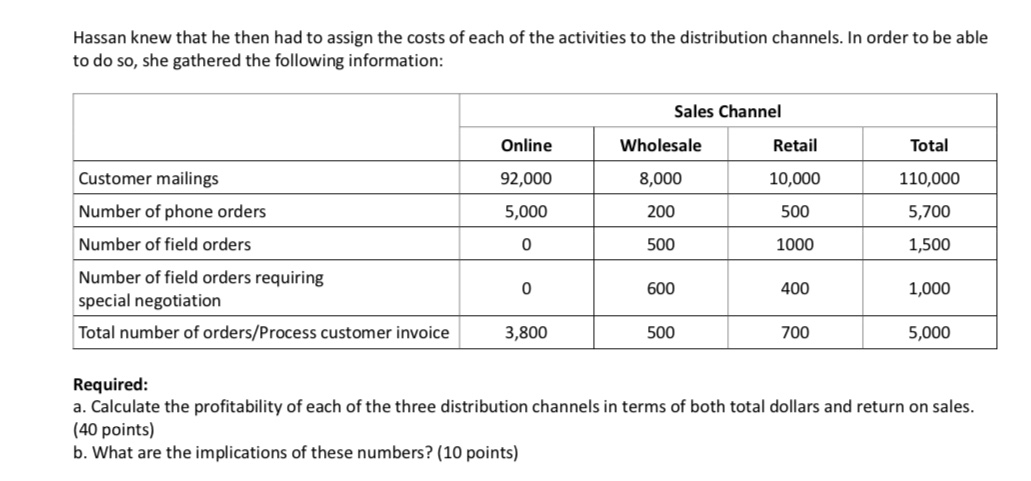

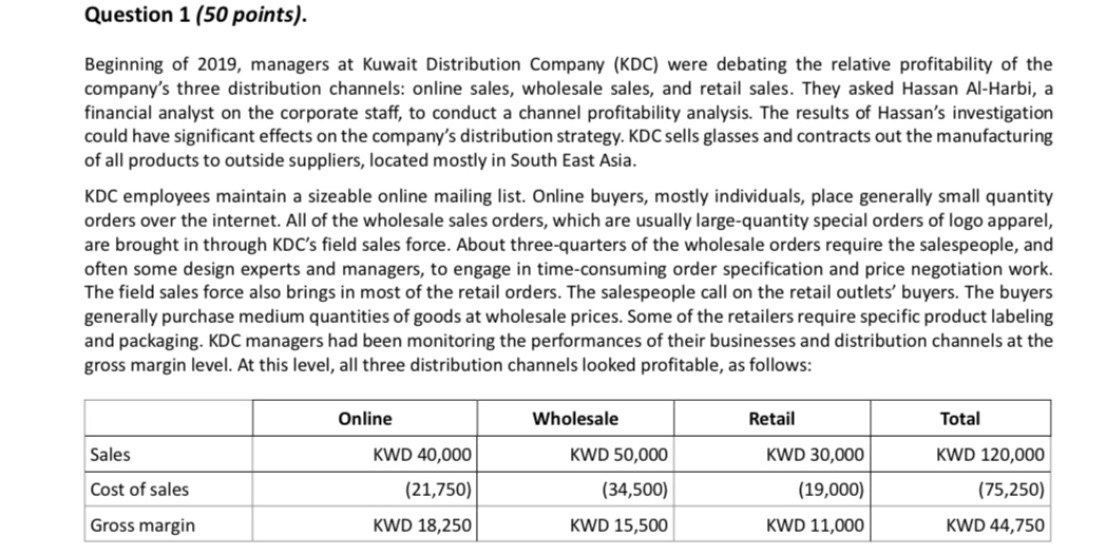

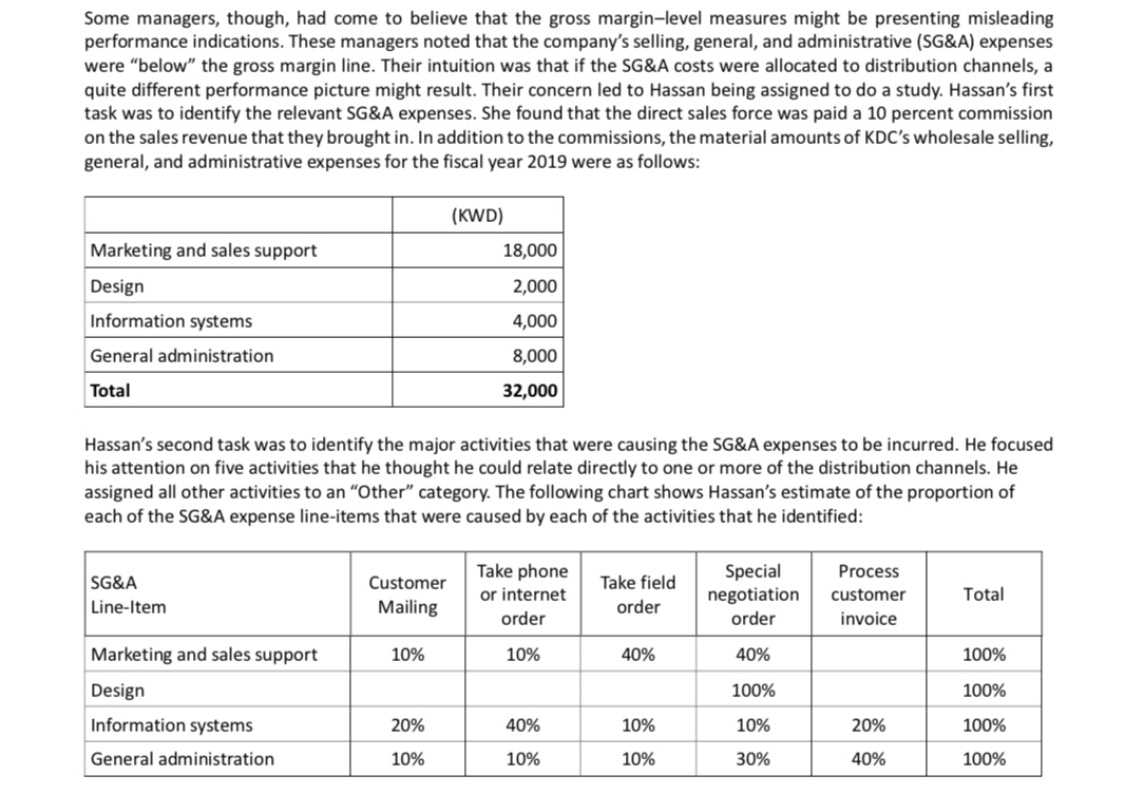

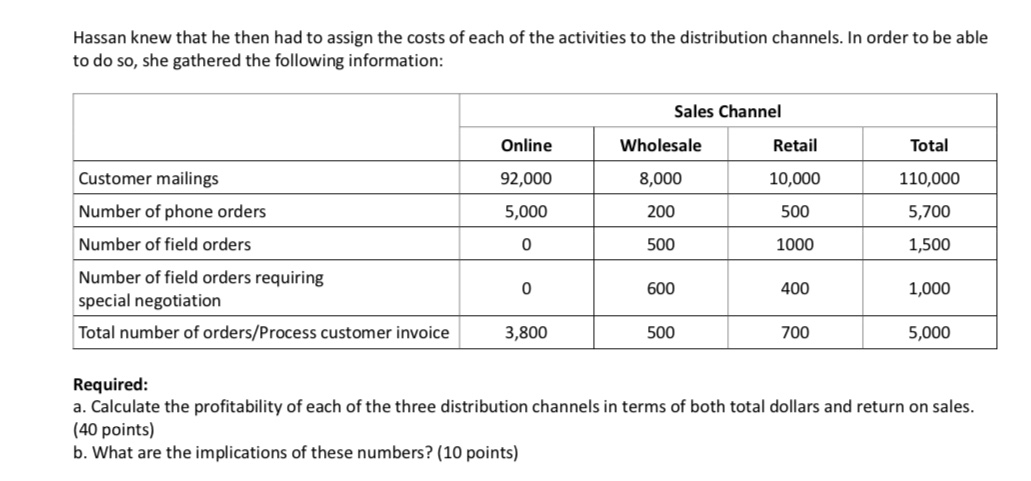

Question 1 (50 points). Beginning of 2019, managers at Kuwait Distribution Company (KDC) were debating the relative profitability of the company's three distribution channels: online sales, wholesale sales, and retail sales. They asked Hassan Al-Harbi, a financial analyst on the corporate staff, to conduct a channel profitability analysis. The results of Hassan's investigation could have significant effects on the company's distribution strategy. KDC sells glasses and contracts out the manufacturing of all products to outside suppliers, located mostly in South East Asia. KDC employees maintain a sizeable online mailing list. Online buyers, mostly individuals, place generally small quantity orders over the internet. All of the wholesale sales orders, which are usually large quantity special orders of logo apparel, are brought in through KDC's field sales force. About three-quarters of the wholesale orders require the salespeople, and often some design experts and managers, to engage in time-consuming order specification and price negotiation work. The field sales force also brings in most of the retail orders. The salespeople call on the retail outlets' buyers. The buyers generally purchase medium quantities of goods at wholesale prices. Some of the retailers require specific product labeling and packaging. KDC managers had been monitoring the performances of their businesses and distribution channels at the gross margin level. At this level, all three distribution channels looked profitable, as follows: Online Wholesale Retail Total Sales KWD 30,000 KWD 40,000 (21,750) KWD 50,000 (34,500) KWD 15,500 KWD 120,000 (75,250) Cost of sales (19,000) Gross margin KWD 18,250 KWD 11,000 KWD 44,750 Some managers, though, had come to believe that the gross margin-level measures might be presenting misleading performance indications. These managers noted that the company's selling, general, and administrative (SG&A) expenses were "below" the gross margin line. Their intuition was that if the SG&A costs were allocated to distribution channels, a quite different performance picture might result. Their concern led to Hassan being assigned to do a study. Hassan's first task was to identify the relevant SG&A expenses. She found that the direct sales force was paid a 10 percent commission on the sales revenue that they brought in. In addition to the commissions, the material amounts of KDC's wholesale selling, general, and administrative expenses for the fiscal year 2019 were as follows: (KWD) 18,000 2,000 Marketing and sales support Design Information systems General administration 4,000 8,000 Total 32,000 Hassan's second task was to identify the major activities that were causing the SG&A expenses to be incurred. He focused his attention on five activities that he thought he could relate directly to one or more of the distribution channels. He assigned all other activities to an "Other" category. The following chart shows Hassan's estimate of the proportion of each of the SG&A expense line-items that were caused by each of the activities that he identified: SG&A Line-Item Customer Mailing Take phone or internet order Take field order Special negotiation order Process customer invoice Total 10% 10% 40% 40% 100% Marketing and sales support Design 100% 100% Information systems 20% 40% 10% 10% 20% 100% General administration 10% 10% 10% 30% 40% 100% Hassan knew that he then had to assign the costs of each of the activities to the distribution channels. In order to be able to do so, she gathered the following information: Sales Channel Online Wholesale Retail Total 92,000 8,000 10,000 110,000 Customer mailings Number of phone orders 5,000 200 500 5,700 Number of field orders 0 500 1000 1,500 0 600 400 1,000 Number of field orders requiring special negotiation Total number of orders/Process customer invoice 3,800 500 700 5,000 Required: a. Calculate the profitability of each of the three distribution channels in terms of both total dollars and return on sales. (40 points) b. What are the implications of these numbers? (10 points) Question 1 (50 points). Beginning of 2019, managers at Kuwait Distribution Company (KDC) were debating the relative profitability of the company's three distribution channels: online sales, wholesale sales, and retail sales. They asked Hassan Al-Harbi, a financial analyst on the corporate staff, to conduct a channel profitability analysis. The results of Hassan's investigation could have significant effects on the company's distribution strategy. KDC sells glasses and contracts out the manufacturing of all products to outside suppliers, located mostly in South East Asia. KDC employees maintain a sizeable online mailing list. Online buyers, mostly individuals, place generally small quantity orders over the internet. All of the wholesale sales orders, which are usually large quantity special orders of logo apparel, are brought in through KDC's field sales force. About three-quarters of the wholesale orders require the salespeople, and often some design experts and managers, to engage in time-consuming order specification and price negotiation work. The field sales force also brings in most of the retail orders. The salespeople call on the retail outlets' buyers. The buyers generally purchase medium quantities of goods at wholesale prices. Some of the retailers require specific product labeling and packaging. KDC managers had been monitoring the performances of their businesses and distribution channels at the gross margin level. At this level, all three distribution channels looked profitable, as follows: Online Wholesale Retail Total Sales KWD 30,000 KWD 40,000 (21,750) KWD 50,000 (34,500) KWD 15,500 KWD 120,000 (75,250) Cost of sales (19,000) Gross margin KWD 18,250 KWD 11,000 KWD 44,750 Some managers, though, had come to believe that the gross margin-level measures might be presenting misleading performance indications. These managers noted that the company's selling, general, and administrative (SG&A) expenses were "below" the gross margin line. Their intuition was that if the SG&A costs were allocated to distribution channels, a quite different performance picture might result. Their concern led to Hassan being assigned to do a study. Hassan's first task was to identify the relevant SG&A expenses. She found that the direct sales force was paid a 10 percent commission on the sales revenue that they brought in. In addition to the commissions, the material amounts of KDC's wholesale selling, general, and administrative expenses for the fiscal year 2019 were as follows: (KWD) 18,000 2,000 Marketing and sales support Design Information systems General administration 4,000 8,000 Total 32,000 Hassan's second task was to identify the major activities that were causing the SG&A expenses to be incurred. He focused his attention on five activities that he thought he could relate directly to one or more of the distribution channels. He assigned all other activities to an "Other" category. The following chart shows Hassan's estimate of the proportion of each of the SG&A expense line-items that were caused by each of the activities that he identified: SG&A Line-Item Customer Mailing Take phone or internet order Take field order Special negotiation order Process customer invoice Total 10% 10% 40% 40% 100% Marketing and sales support Design 100% 100% Information systems 20% 40% 10% 10% 20% 100% General administration 10% 10% 10% 30% 40% 100% Hassan knew that he then had to assign the costs of each of the activities to the distribution channels. In order to be able to do so, she gathered the following information: Sales Channel Online Wholesale Retail Total 92,000 8,000 10,000 110,000 Customer mailings Number of phone orders 5,000 200 500 5,700 Number of field orders 0 500 1000 1,500 0 600 400 1,000 Number of field orders requiring special negotiation Total number of orders/Process customer invoice 3,800 500 700 5,000 Required: a. Calculate the profitability of each of the three distribution channels in terms of both total dollars and return on sales. (40 points) b. What are the implications of these numbers? (10 points)