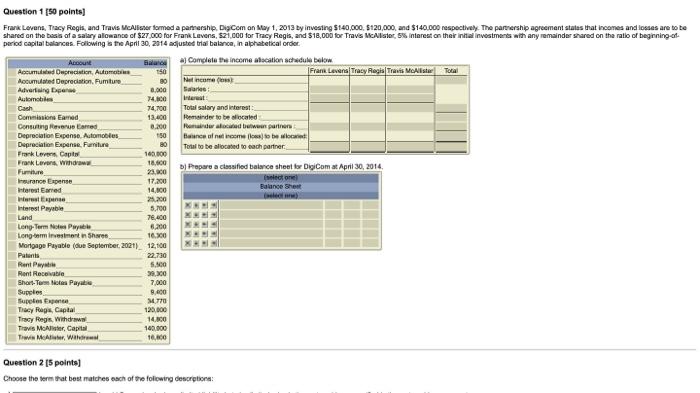

Question 1 (50 points Frank Levens, Tracy Regis and Travis McAllister formed a partnership Digicom on May 1, 2013 by investing $140,000 $120,000 and $140.000 respectively. The partnership agreement states that incomes and losses are to be shared on the basis of a salary allowance of $27.000 for Frank Levens. 521.000 for Tracy Regis, and $18,000 for Travis McAllister, 5% interest on their initial investments with any remainder shared on the ratio of beginning of period capital balances. Following is the Aprili 30, 2014 adjusted trial balanca, in aphabetical ordet ACCOUNT sa Complete the income location schedule below Accumulated Depreciation Automobi 150 Fran Leven Tracy Regis Travis Melist Total Acumulated Depreciation. Pumitur 80 Nel nome Adverting po 0.000 States Automobile 74.00 interest Cash 74.700 Total salary and interest Commissione Eamed 13.400 Reminder to be located Constingene med 8.200 Rodwaled bliwwen partner Depreciation Expense. Automobles 150 tance of womes to be Depreciation Expense, Furniture 80 Total to be allocated to each partner Frank Love Cape 100.000 Frank Lovers Who 18.600 Furniture B) Prepare a classified balance sheet for Digicomat April 30, 2014 23.900 Insurance Expense 17.200 elector Interest Earred 14. O Balance Sheet 2200 Interest Payable 5,700 Land 78,000 Long-Term Payable 6.200 Long-term investment in Shoes 16.00 X Mortgage Payable (lue September 2021) 12.100 XX Patents 22.730 Rent wat 5.400 Rent Receivable 39.00 Short Tees Payale 7.000 Supplies 8.400 Supplies Expo M70 They Raps, Capital 120.000 Tracy Rege. Withdraw 100 Travis McAlister, Capital 190.000 Twin M. Wir 16.00 Question 25 points) Choose the term that test matches each of the following description: Question 1 (50 points Frank Levens, Tracy Regis and Travis McAllister formed a partnership Digicom on May 1, 2013 by investing $140,000 $120,000 and $140.000 respectively. The partnership agreement states that incomes and losses are to be shared on the basis of a salary allowance of $27.000 for Frank Levens. 521.000 for Tracy Regis, and $18,000 for Travis McAllister, 5% interest on their initial investments with any remainder shared on the ratio of beginning of period capital balances. Following is the Aprili 30, 2014 adjusted trial balanca, in aphabetical ordet ACCOUNT sa Complete the income location schedule below Accumulated Depreciation Automobi 150 Fran Leven Tracy Regis Travis Melist Total Acumulated Depreciation. Pumitur 80 Nel nome Adverting po 0.000 States Automobile 74.00 interest Cash 74.700 Total salary and interest Commissione Eamed 13.400 Reminder to be located Constingene med 8.200 Rodwaled bliwwen partner Depreciation Expense. Automobles 150 tance of womes to be Depreciation Expense, Furniture 80 Total to be allocated to each partner Frank Love Cape 100.000 Frank Lovers Who 18.600 Furniture B) Prepare a classified balance sheet for Digicomat April 30, 2014 23.900 Insurance Expense 17.200 elector Interest Earred 14. O Balance Sheet 2200 Interest Payable 5,700 Land 78,000 Long-Term Payable 6.200 Long-term investment in Shoes 16.00 X Mortgage Payable (lue September 2021) 12.100 XX Patents 22.730 Rent wat 5.400 Rent Receivable 39.00 Short Tees Payale 7.000 Supplies 8.400 Supplies Expo M70 They Raps, Capital 120.000 Tracy Rege. Withdraw 100 Travis McAlister, Capital 190.000 Twin M. Wir 16.00 Question 25 points) Choose the term that test matches each of the following description