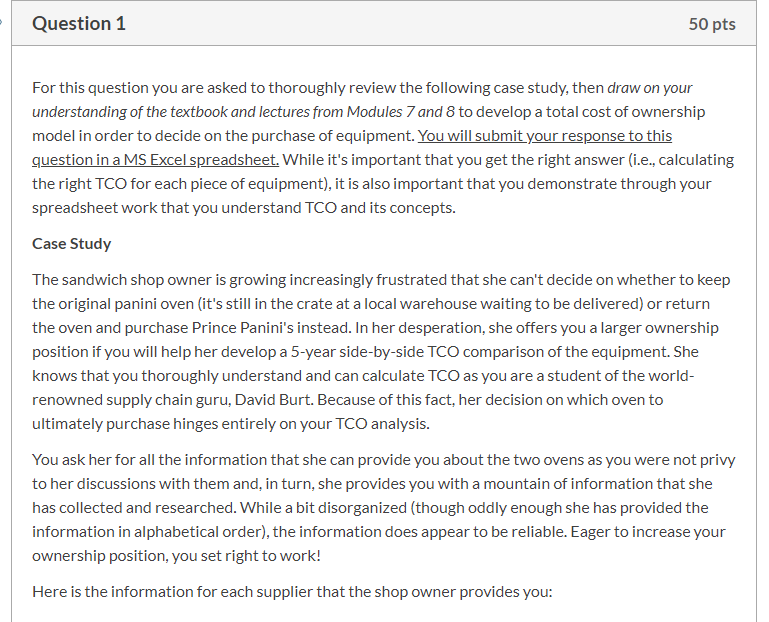

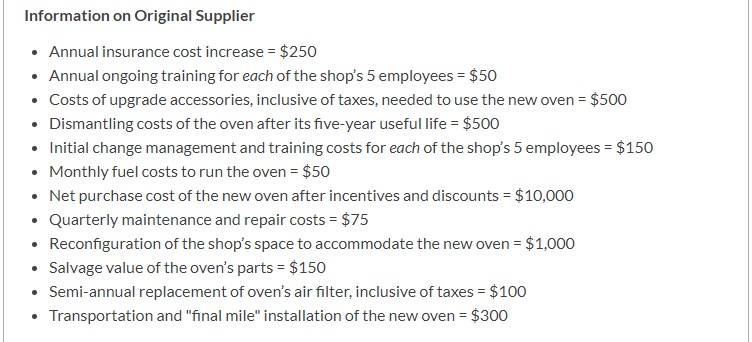

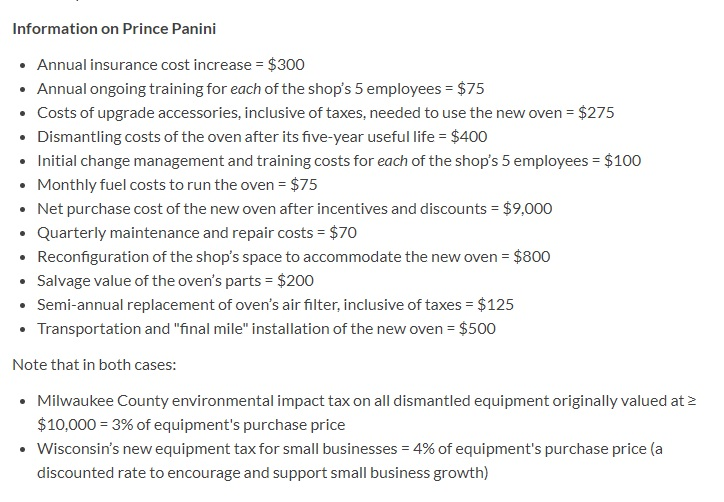

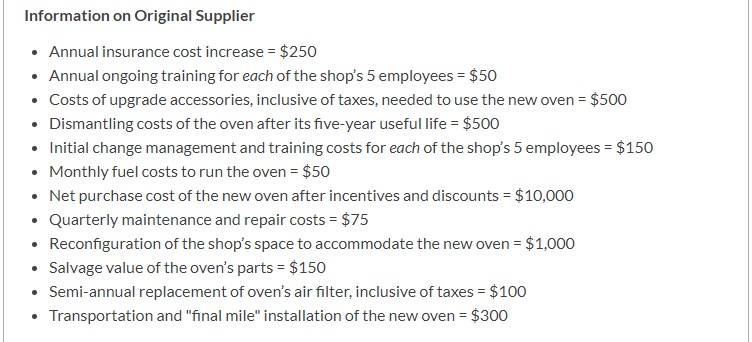

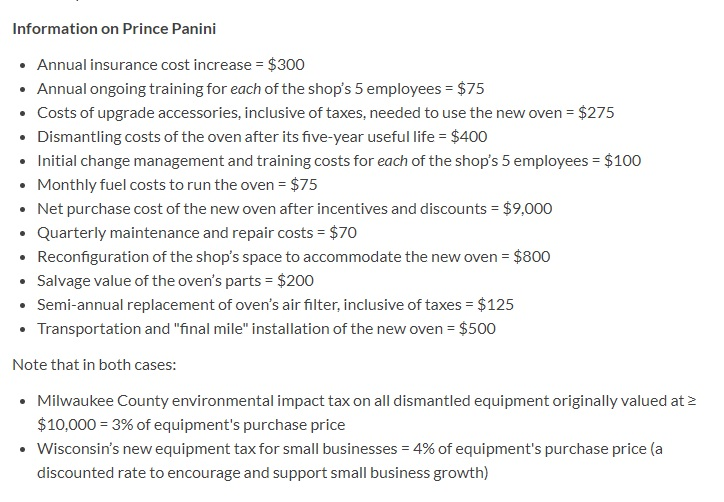

Question 1 50 pts For this question you are asked to thoroughly review the following case study, then draw on your understanding of the textbook and lectures from Modules 7 and 8 to develop a total cost of ownership model in order to decide on the purchase of equipment. You will submit your response to this question in a MS Excel spreadsheet. While it's important that you get the right answer (i.e., calculating the right TCO for each piece of equipment), it is also important that you demonstrate through your spreadsheet work that you understand TCO and its concepts. Case Study The sandwich shop owner is growing increasingly frustrated that she can't decide on whether to keep the original panini oven (it's still in the crate at a local warehouse waiting to be delivered) or return the oven and purchase Prince Panini's instead. In her desperation, she offers you a larger ownership position if you will help her develop a 5-year side-by-side TCO comparison of the equipment. She knows that you thoroughly understand and can calculate TCO as you are a student of the world- renowned supply chain guru, David Burt. Because of this fact, her decision on which oven to ultimately purchase hinges entirely on your TCO analysis. You ask her for all the information that she can provide you about the two ovens as you were not privy to her discussions with them and, in turn, she provides you with a mountain of information that she has collected and researched. While a bit disorganized (though oddly enough she has provided the information in alphabetical order), the information does appear to be reliable. Eager to increase your ownership position, you set right to work! Here is the information for each supplier that the shop owner provides you: Information on Original Supplier Annual insurance cost increase = $250 Annual ongoing training for each of the shop's 5 employees = $50 Costs of upgrade accessories, inclusive of taxes, needed to use the new oven = $500 Dismantling costs of the oven after its five-year useful life = $500 Initial change management and training costs for each of the shop's 5 employees = $150 Monthly fuel costs to run the oven = $50 Net purchase cost of the new oven after incentives and discounts = $10,000 Quarterly maintenance and repair costs = $75 Reconfiguration of the shop's space to accommodate the new oven = $1,000 Salvage value of the oven's parts = $150 Semi-annual replacement of oven's air filter, inclusive of taxes = $100 Transportation and "final mile" installation of the new oven = $300 Information on Prince Panini Annual insurance cost increase = $300 Annual ongoing training for each of the shop's 5 employees = $75 Costs of upgrade accessories, inclusive of taxes, needed to use the new oven = $275 Dismantling costs of the oven after its five-year useful life = $400 Initial change management and training costs for each of the shop's 5 employees = $100 Monthly fuel costs to run the oven = $75 Net purchase cost of the new oven after incentives and discounts = $9,000 Quarterly maintenance and repair costs = $70 Reconfiguration of the shop's space to accommodate the new oven = $800 Salvage value of the oven's parts = $200 Semi-annual replacement of oven's air filter, inclusive of taxes = $125 Transportation and "final mile" installation of the new oven = $500 . Note that in both cases: Milwaukee County environmental impact tax on all dismantled equipment originally valued at 2 $10,000 = 3% of equipment's purchase price Wisconsin's new equipment tax for small businesses = 4% of equipment's purchase price (a discounted rate to encourage and support small business growth) Question 1 50 pts For this question you are asked to thoroughly review the following case study, then draw on your understanding of the textbook and lectures from Modules 7 and 8 to develop a total cost of ownership model in order to decide on the purchase of equipment. You will submit your response to this question in a MS Excel spreadsheet. While it's important that you get the right answer (i.e., calculating the right TCO for each piece of equipment), it is also important that you demonstrate through your spreadsheet work that you understand TCO and its concepts. Case Study The sandwich shop owner is growing increasingly frustrated that she can't decide on whether to keep the original panini oven (it's still in the crate at a local warehouse waiting to be delivered) or return the oven and purchase Prince Panini's instead. In her desperation, she offers you a larger ownership position if you will help her develop a 5-year side-by-side TCO comparison of the equipment. She knows that you thoroughly understand and can calculate TCO as you are a student of the world- renowned supply chain guru, David Burt. Because of this fact, her decision on which oven to ultimately purchase hinges entirely on your TCO analysis. You ask her for all the information that she can provide you about the two ovens as you were not privy to her discussions with them and, in turn, she provides you with a mountain of information that she has collected and researched. While a bit disorganized (though oddly enough she has provided the information in alphabetical order), the information does appear to be reliable. Eager to increase your ownership position, you set right to work! Here is the information for each supplier that the shop owner provides you: Information on Original Supplier Annual insurance cost increase = $250 Annual ongoing training for each of the shop's 5 employees = $50 Costs of upgrade accessories, inclusive of taxes, needed to use the new oven = $500 Dismantling costs of the oven after its five-year useful life = $500 Initial change management and training costs for each of the shop's 5 employees = $150 Monthly fuel costs to run the oven = $50 Net purchase cost of the new oven after incentives and discounts = $10,000 Quarterly maintenance and repair costs = $75 Reconfiguration of the shop's space to accommodate the new oven = $1,000 Salvage value of the oven's parts = $150 Semi-annual replacement of oven's air filter, inclusive of taxes = $100 Transportation and "final mile" installation of the new oven = $300 Information on Prince Panini Annual insurance cost increase = $300 Annual ongoing training for each of the shop's 5 employees = $75 Costs of upgrade accessories, inclusive of taxes, needed to use the new oven = $275 Dismantling costs of the oven after its five-year useful life = $400 Initial change management and training costs for each of the shop's 5 employees = $100 Monthly fuel costs to run the oven = $75 Net purchase cost of the new oven after incentives and discounts = $9,000 Quarterly maintenance and repair costs = $70 Reconfiguration of the shop's space to accommodate the new oven = $800 Salvage value of the oven's parts = $200 Semi-annual replacement of oven's air filter, inclusive of taxes = $125 Transportation and "final mile" installation of the new oven = $500 . Note that in both cases: Milwaukee County environmental impact tax on all dismantled equipment originally valued at 2 $10,000 = 3% of equipment's purchase price Wisconsin's new equipment tax for small businesses = 4% of equipment's purchase price (a discounted rate to encourage and support small business growth)