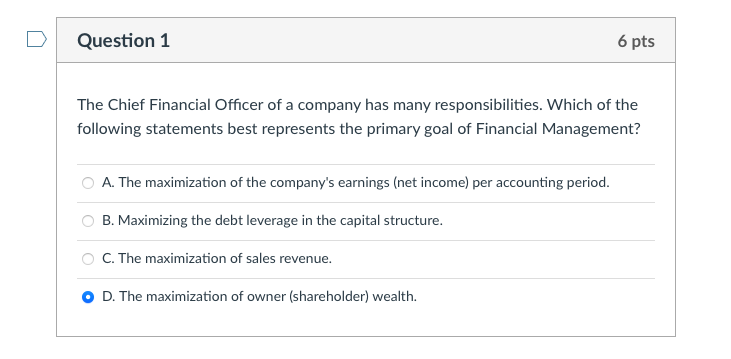

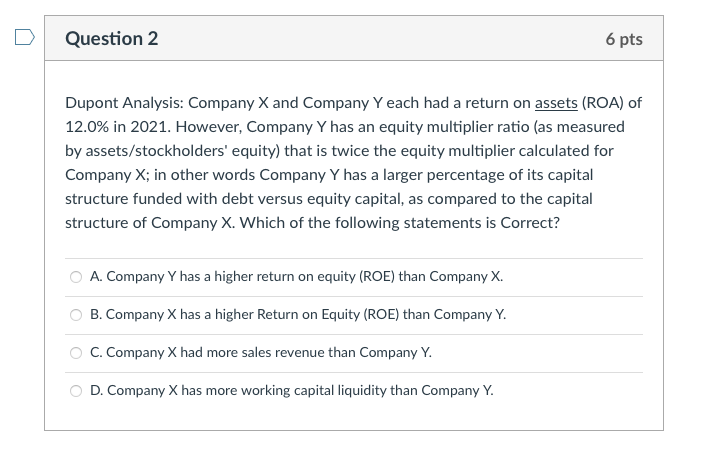

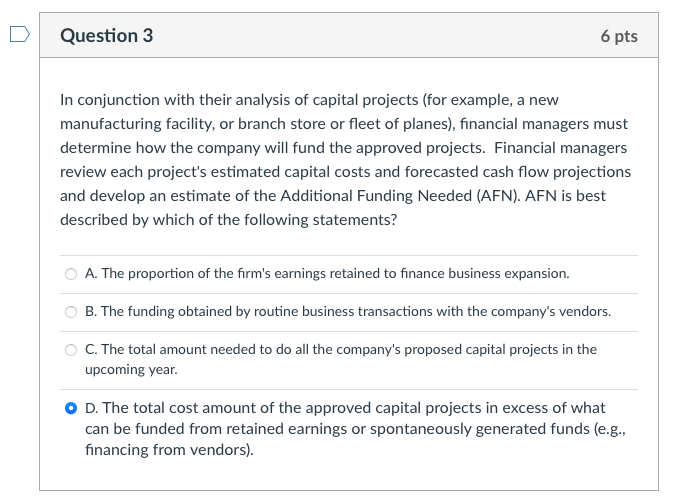

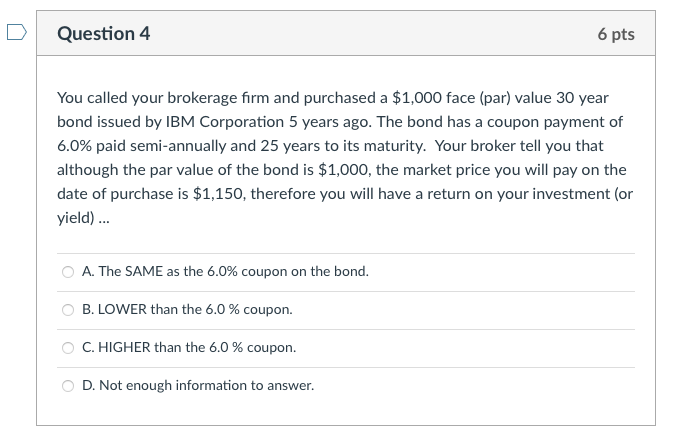

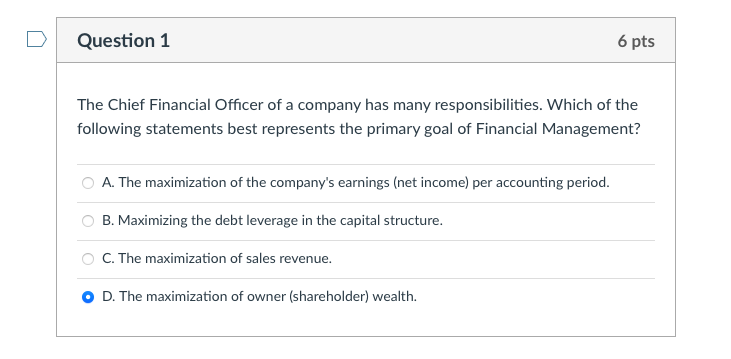

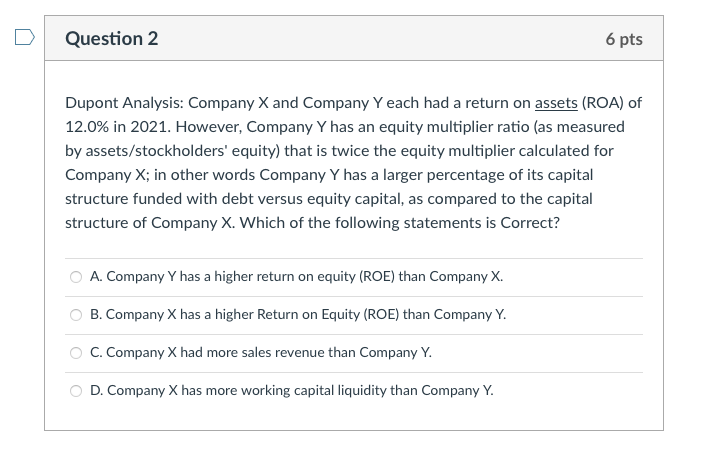

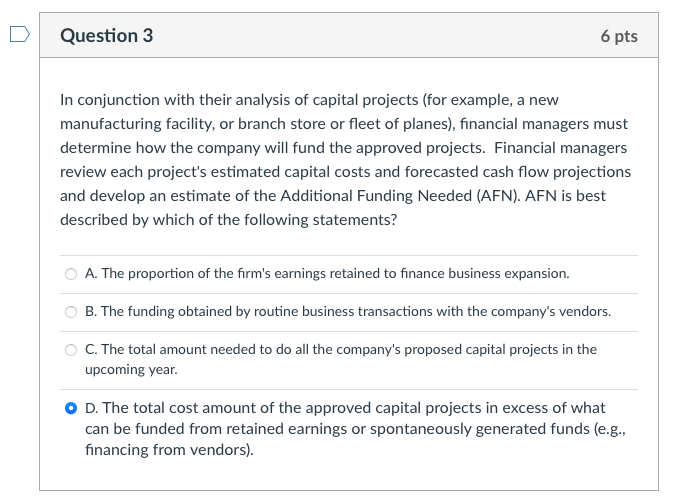

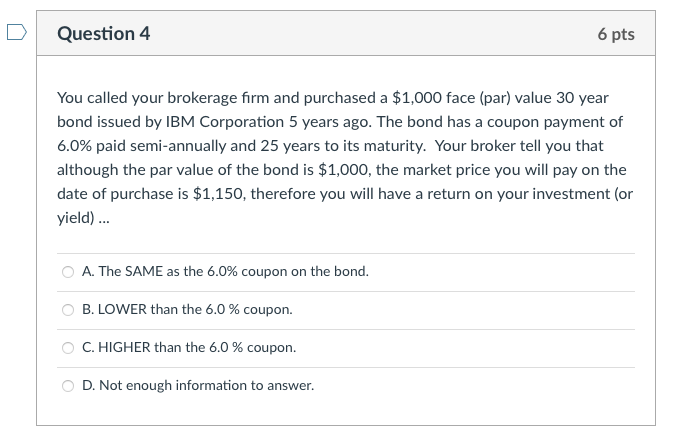

Question 1 6 pts The Chief Financial Officer of a company has many responsibilities. Which of the following statements best represents the primary goal of Financial Management? A. The maximization of the company's earnings (net income) per accounting period. B. Maximizing the debt leverage in the capital structure. C. The maximization of sales revenue. O D. The maximization of owner (shareholder) wealth. Question 2 6 pts Dupont Analysis: Company X and Company Y each had a return on assets (ROA) of 12.0% in 2021. However, Company Y has an equity multiplier ratio (as measured by assets/stockholders' equity) that is twice the equity multiplier calculated for Company X; in other words Company Y has a larger percentage of its capital structure funded with debt versus equity capital, as compared to the capital structure of Company X. Which of the following statements is Correct? A. Company Y has a higher return on equity (ROE) than Company X. B. Company X has a higher Return on Equity (ROE) than Company Y. O C. Company X had more sales revenue than Company Y. D. Company X has more working capital liquidity than Company Y. Question 3 6 pts In conjunction with their analysis of capital projects (for example, a new manufacturing facility, or branch store or fleet of planes), financial managers must determine how the company will fund the approved projects. Financial managers review each project's estimated capital costs and forecasted cash flow projections and develop an estimate of the Additional Funding Needed (AFN). AFN is best described by which of the following statements? A. The proportion of the firm's earnings retained to finance business expansion. B. The funding obtained by routine business transactions with the company's vendors. C. The total amount needed to do all the company's proposed capital projects in the upcoming year. O D. The total cost amount of the approved capital projects in excess of what can be funded from retained earnings or spontaneously generated funds (e.g., financing from vendors). Question 4 6 pts You called your brokerage firm and purchased a $1,000 face (par) value 30 year bond issued by IBM Corporation 5 years ago. The bond has a coupon payment of 6.0% paid semi-annually and 25 years to its maturity. Your broker tell you that although the par value of the bond is $1,000, the market price you will pay on the date of purchase is $1,150, therefore you will have a return on your investment (or yield)... A. The SAME as the 6.0% coupon on the bond. B. LOWER than the 6.0 % coupon. C. HIGHER than the 6.0% coupon. D. Not enough information to