Question: You are a contractor for a client. Listed as Cost below you find your projected cost expenditures for this project. Using the assumptions listed

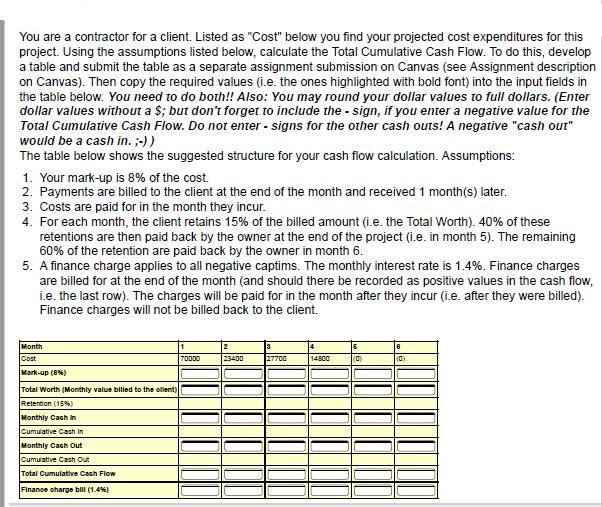

You are a contractor for a client. Listed as "Cost" below you find your projected cost expenditures for this project. Using the assumptions listed below, calculate the Total Cumulative Cash Flow. To do this, develop a table and submit the table as a separate assignment submission on Canvas (see Assignment description on Canvas). Then copy the required values (i.e. the ones highlighted with bold font) into the input fields in the table below. You need to do both!! Also: You may round your dollar values to full dollars. (Enter dollar values without a $; but don't forget to include the - sign, if you enter a negative value for the Total Cumulative Cash Flow. Do not enter - signs for the other cash outs! A negative "cash out" would be a cash in. ;-)) The table below shows the suggested structure for your cash flow calculation. Assumptions: 1. Your mark-up is 8% of the cost. 2. Payments are billed to the client at the end of the month and received 1 month(s) later. 3. Costs are paid for in the month they incur. 4. For each month, the client retains 15% of the billed amount (i.e. the Total Worth). 40% of these retentions are then paid back by the owner at the end of the project (i.e. in month 5). The remaining 60% of the retention are paid back by the owner in month 6. 5. A finance charge applies to all negative captims. The monthly interest rate is 1.4%. Finance charges are billed for at the end of the month (and should there be recorded as positive values in the cash flow, ie. the last row). The charges will be paid for in the month after they incur (i.e. after they were billed). Finance charges will not be billed back to the client. Month 2 23400 Cost 70000 27700 14800 (0) (0) Mark-up (8%) Total Worth (Monthly value billod to the ollent) Retention (15%) Monthly Cach in Cumulative Cash in Monthly Cach Out Cumulative Cash Out Total Cumulative Cash Flow Finanoe oharge bill (1.4)

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

To solve this problem we need to follow the instructions and fill in the table as detailed in the question considering each assumption and calculation ... View full answer

Get step-by-step solutions from verified subject matter experts