Answered step by step

Verified Expert Solution

Question

1 Approved Answer

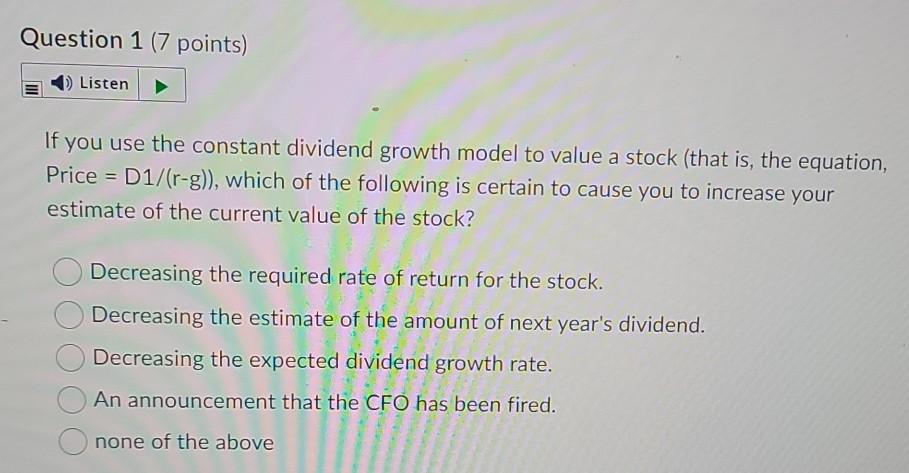

Question 1 (7 points) Listen If you use the constant dividend growth model to value a stock (that is, the equation, Price =D1/(r-g)), which of

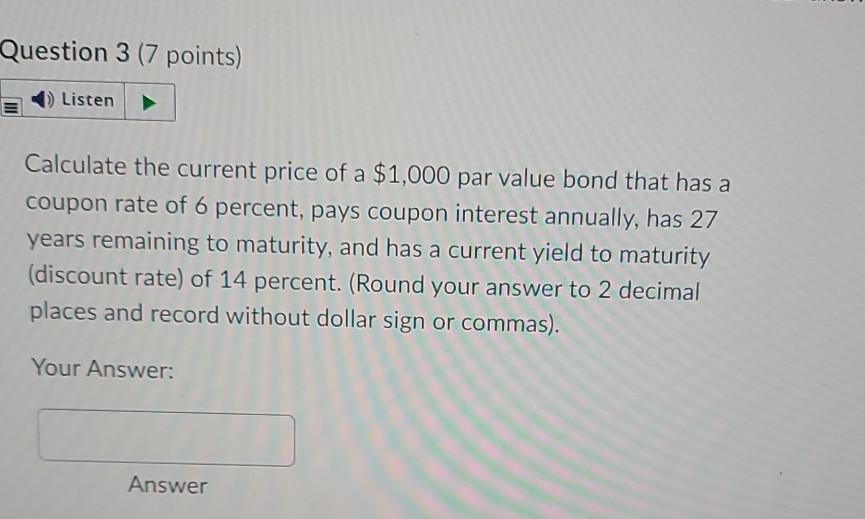

Question 1 (7 points) Listen If you use the constant dividend growth model to value a stock (that is, the equation, Price =D1/(r-g)), which of the following is certain to cause you to increase your estimate of the current value of the stock? Decreasing the required rate of return for the stock. Decreasing the estimate of the amount of next year's dividend. Decreasing the expected dividend growth rate. An announcement that the CFO has been fired. none of the above Question 3 (7 points) Listen Calculate the current price of a $1,000 par value bond that has a coupon rate of 6 percent, pays coupon interest annually, has 27 years remaining to maturity, and has a current yield to maturity (discount rate) of 14 percent. (Round your answer to 2 decimal places and record without dollar sign or commas). Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started