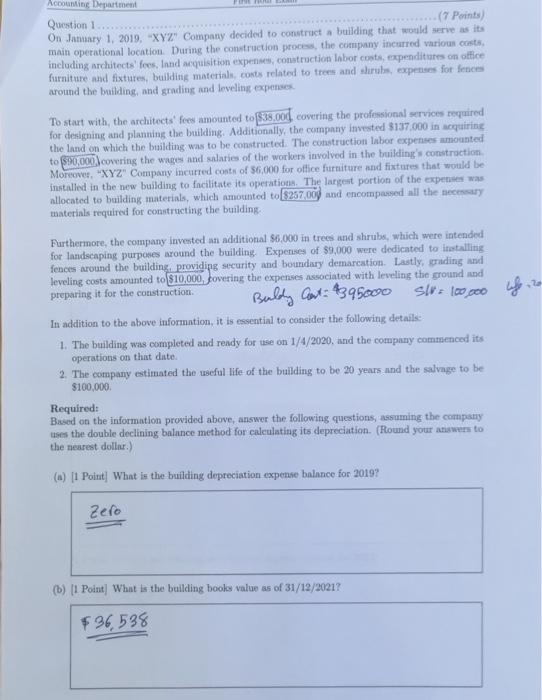

Question 1 (7 Points) On .hanary 1, 2019, \"XYZ\" Company decided to construct a building that would serve as its main operational location. During the constraction process, the company incurred varioun costs, including architects' foes, Innd acyuisition expenas, construction inbor coets, expenditures on office furniture and fixtures, building materials, costs related to trees and shruls, expetises for fenees around the boilding, and grading and leveling expenses To start with, the architects' fees amounted to \\( \\$ 38,000 \\) covering the professional services required for designing and planning the building. Additionally, the company invested 3137.000 in acquiring the land on which the building was to be constructed. The construction labor expenses amounted to 590,000 J covering the wages and salaries of the workers involved in the building's construction. Moreoves, \"XYZ\" Company inctarred conts of 56,000 for office furtuiture and fixtures that would be installed in the new building to facilitate its operations. The largest portion of the expenses was allocated to building materials, which amotuted to \\( [8257,000] \\) and encompassed all the necencary. materials required for constructing the building- Eurthermore, the company invested an additional \\$6,000 in trees and shrubs, which were intended for landscaping purposes around the building. Expenses of \\( \\$ 9,000 \\) were dedicated to installing fences around the building, providing security and boundary demarcation. Lastly, grading and leveling costs amounted to \\( \\$ 10,000 \\), covering the expenses associated with leveling the ground and preparing it for the coustruction. Bulty \\( \\operatorname{Cox}: \\$ 395000 \\) siv 100,000 In addition to the above information, it is essential to consider the following details: 1. The building was completed and ready for use on \\( 1 / 4 / 2020 \\), and the company commenced its operations on that date. 2. The company estimated the useful life of the building to be 20 years and the salvage to be \\( \\$ 100,000 \\). Required: Based on the information provided above, answer the following questions, assuming the company uses the double declining balance method for calculating its depreciation. (Round your ataswess to the nearest dollar.) (a) [1 Point] What is the building depreciation expense balance for 2019? zero (p) It Pnint Whit ts the huildine hooke value as of \\( 31 / 12 / 2021 \\)