Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 71/76 Sam Hill has just won the state lottery, paying $250,000 a year for the next 30 years. Sam will receive his

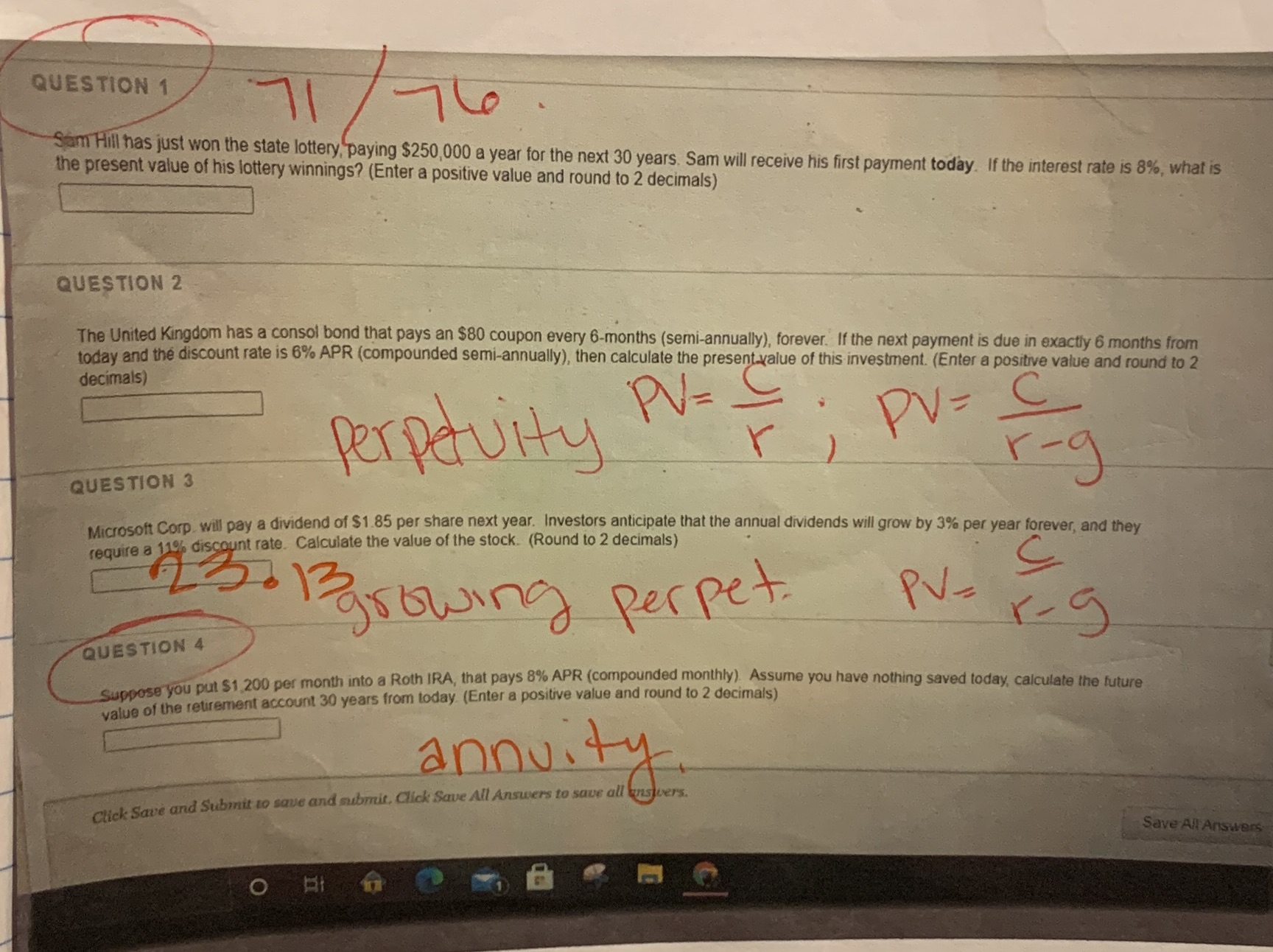

QUESTION 1 71/76 Sam Hill has just won the state lottery, paying $250,000 a year for the next 30 years. Sam will receive his first payment today. If the interest rate is 8%, what is the present value of his lottery winnings? (Enter a positive value and round to 2 decimals) QUESTION 2 The United Kingdom has a consol bond that pays an $80 coupon every 6-months (semi-annually), forever. If the next payment is due in exactly 6 months from today and the discount rate is 6% APR (compounded semi-annually), then calculate the present value of this investment. (Enter a positive value and round to 2 decimals) QUESTION 3 Perpetuity PV= PV= C r-g Microsoft Corp. will pay a dividend of $1.85 per share next year. Investors anticipate that the annual dividends will grow by 3% per year forever, and they require a 11% discount rate. Calculate the value of the stock. (Round to 2 decimals) 13. 13 growing QUESTION 4 13growing perpet. PV= r-g Suppose you put $1,200 per month into a Roth IRA, that pays 8% APR (compounded monthly). Assume you have nothing saved today, calculate the future value of the retirement account 30 years from today. (Enter a positive value and round to 2 decimals) annuity. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To solve these financerelated questions we will use the formulas for present value present value of perpetuity stock valuation and future value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started