Answered step by step

Verified Expert Solution

Question

1 Approved Answer

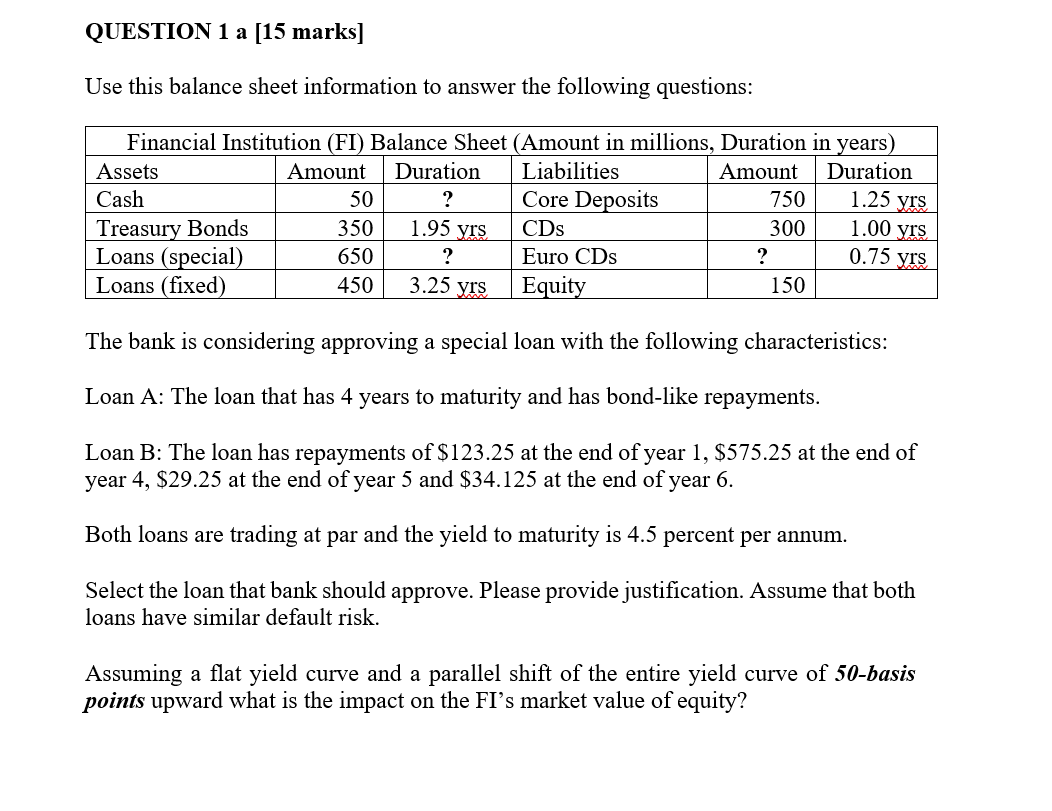

QUESTION 1 a [15 marks] Use this balance sheet information to answer the following questions: Financial Institution (FI) Balance Sheet (Amount in millions, Duration

QUESTION 1 a [15 marks] Use this balance sheet information to answer the following questions: Financial Institution (FI) Balance Sheet (Amount in millions, Duration in years) Assets Amount Duration Cash 50 ? Liabilities Core Deposits Amount Duration 750 1.25 yrs Treasury Bonds 350 Loans (special) 650 1.95 yrs ? CDs 300 1.00 yrs Euro CDs ? 0.75 yrs Loans (fixed) 450 3.25 yrs Equity 150 The bank is considering approving a special loan with the following characteristics: Loan A: The loan that has 4 years to maturity and has bond-like repayments. Loan B: The loan has repayments of $123.25 at the end of year 1, $575.25 at the end of year 4, $29.25 at the end of year 5 and $34.125 at the end of year 6. Both loans are trading at par and the yield to maturity is 4.5 percent per annum. Select the loan that bank should approve. Please provide justification. Assume that both loans have similar default risk. Assuming a flat yield curve and a parallel shift of the entire yield curve of 50-basis points upward what is the impact on the FI's market value of equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started