Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #1 (a) Assume that you want to purchase 1,000 shares of Evil Empire stock. It currently sells for $57 per share. The initial

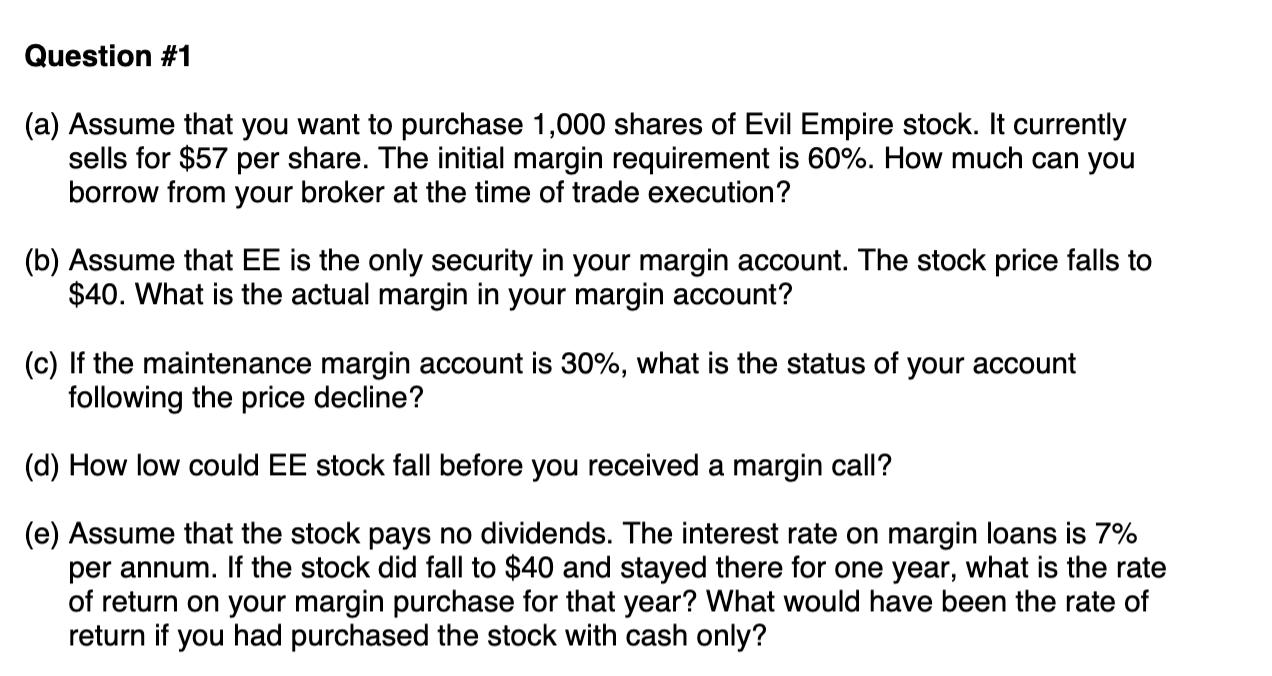

Question #1 (a) Assume that you want to purchase 1,000 shares of Evil Empire stock. It currently sells for $57 per share. The initial margin requirement is 60%. How much can you borrow from your broker at the time of trade execution? (b) Assume that EE is the only security in your margin account. The stock price falls to $40. What is the actual margin in your margin account? (c) If the maintenance margin account is 30%, what is the status of your account following the price decline? (d) How low could EE stock fall before you received a margin call? (e) Assume that the stock pays no dividends. The interest rate on margin loans is 7% per annum. If the stock did fall to $40 and stayed there for one year, what is the rate of return on your margin purchase for that year? What would have been the rate of return if you had purchased the stock with cash only?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate how much you can borrow from your broker at the time of trade execution for the purchase of 1000 shares of Evil Empire stock at 57 per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started