Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 a & b The partnership fiem of Maria, Mida and Muas clones its annual accounts os 31 December every year. Musa ceased to

question 1

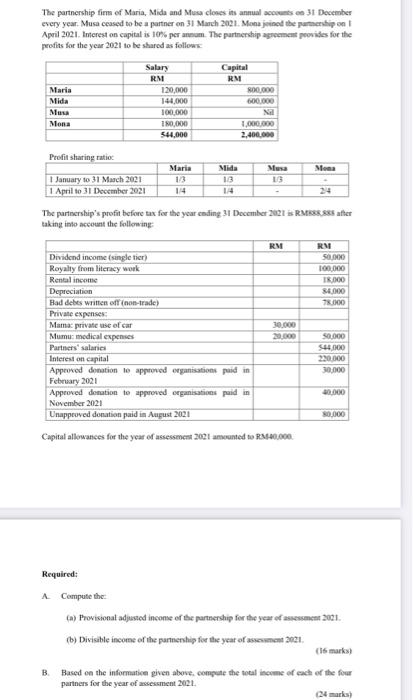

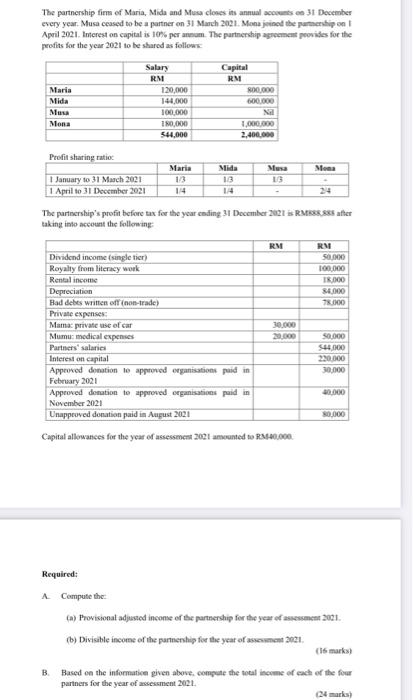

The partnership fiem of Maria, Mida and Muas clones its annual accounts os 31 December every year. Musa ceased to be a partner on 31 Manch 2021 . Mona jeinod the partacrip on If April 2021. Interest on capital is 10hs per annum. The partnership agrecracat peosises for the peofits for the year 2021 to be sharod as follows: The partncrship's profit before tax for the year coding 31 Docember 2021 is Reses ses affer taking inde aceount the folloraring: Capital allowances for the year of assessencen 2021 amounted to PMStio00. Required: A. Compute the: (a) Provisional adjusted inconse of the partnership for the year of assessencen zog1. (b) Divisible income of the partnenhip for the year of assesencat 3021 . (165 marks) B. Based oa the informatice given alowe. compete the tocal income of each of the four partners for the year of assessment 2021. (24 marksh The partnership fiem of Maria, Mida and Muas clones its annual accounts os 31 December every year. Musa ceased to be a partner on 31 Manch 2021 . Mona jeinod the partacrip on If April 2021. Interest on capital is 10hs per annum. The partnership agrecracat peosises for the peofits for the year 2021 to be sharod as follows: The partncrship's profit before tax for the year coding 31 Docember 2021 is Reses ses affer taking inde aceount the folloraring: Capital allowances for the year of assessencen 2021 amounted to PMStio00. Required: A. Compute the: (a) Provisional adjusted inconse of the partnership for the year of assessencen zog1. (b) Divisible income of the partnenhip for the year of assesencat 3021 . (165 marks) B. Based oa the informatice given alowe. compete the tocal income of each of the four partners for the year of assessment 2021. (24 marksh a & b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started