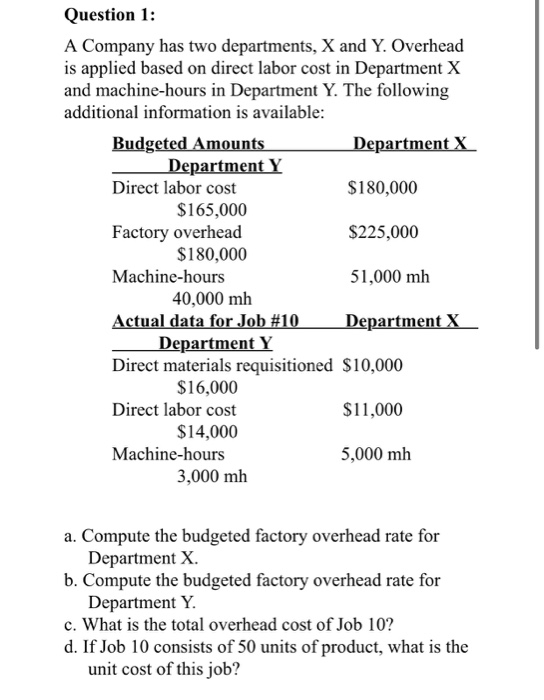

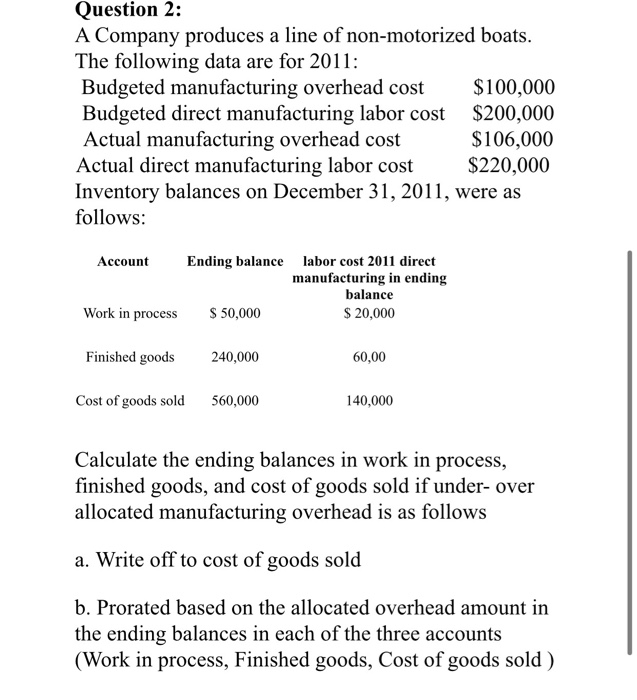

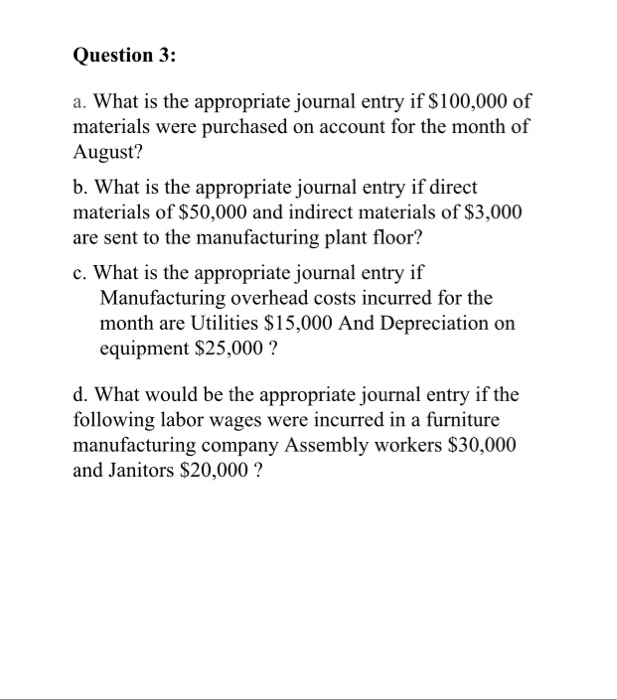

Question 1: A Company has two departments, X and Y. Overhead is applied based on direct labor cost in Department X and machine-hours in Department Y. The following additional information is available: Budgeted Amounts Department X Department Y Direct labor cost $180,000 $165,000 Factory overhead $225,000 $180,000 Machine-hours 51,000 mh 40,000 mh Actual data for Job #10 Department X Department Y Direct materials requisitioned $10,000 $16,000 Direct labor cost $11,000 $14,000 Machine-hours 5,000 mh 3,000 mh a. Compute the budgeted factory overhead rate for Department X b. Compute the budgeted factory overhead rate for Department Y. c. What is the total overhead cost of Job 10? d. If Job 10 consists of 50 units of product, what is the unit cost of this job? Question 2: A Company produces a line of non-motorized boats. The following data are for 2011: Budgeted manufacturing overhead cost $100,000 Budgeted direct manufacturing labor cost $200,000 Actual manufacturing overhead cost $106,000 Actual direct manufacturing labor cost $220,000 Inventory balances on December 31, 2011, were as follows: Account Ending balance labor cost 2011 direct manufacturing in ending balance $ 50,000 $ 20,000 Work in process Finished goods 240,000 60,00 Cost of goods sold 560,000 140,000 Calculate the ending balances in work in process, finished goods, and cost of goods sold if under- over allocated manufacturing overhead is as follows a. Write off to cost of goods sold b. Prorated based on the allocated overhead amount in the ending balances in each of the three accounts (Work in process, Finished goods, Cost of goods sold ) Question 3: a. What is the appropriate journal entry if $100,000 of materials were purchased on account for the month of August? b. What is the appropriate journal entry if direct materials of $50,000 and indirect materials of $3,000 are sent to the manufacturing plant floor? c. What is the appropriate journal entry if Manufacturing overhead costs incurred for the month are Utilities $15,000 And Depreciation on equipment $25,000 ? d. What would be the appropriate journal entry if the following labor wages were incurred in a furniture manufacturing company Assembly workers $30,000 and Janitors $20,000