Answered step by step

Verified Expert Solution

Question

1 Approved Answer

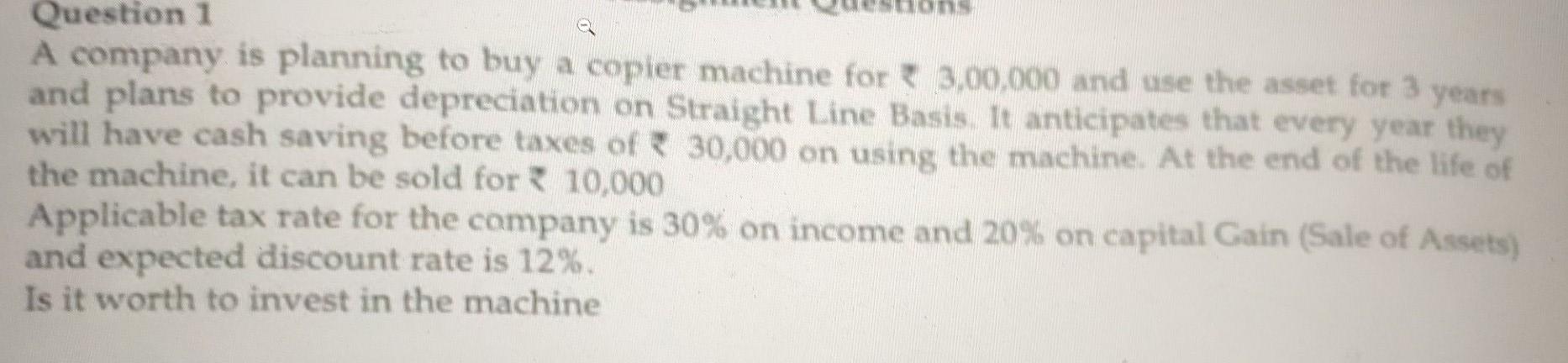

Question 1 A company is planning to buy a copier machine for 3.00.000 and use the asset for 3 years and plans to provide depreciation

Question 1 A company is planning to buy a copier machine for 3.00.000 and use the asset for 3 years and plans to provide depreciation on Straight Line Basis. It anticipates that every year they will have cash saving before taxes of 30,000 on using the machine. At the end of the life of the machine, it can be sold for 10,000 Applicable tax rate for the company is 30% on income and 20% on capital Gain (Sale of Assets) and expected discount rate is 12%. Is it worth to invest in the machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started