Answered step by step

Verified Expert Solution

Question

1 Approved Answer

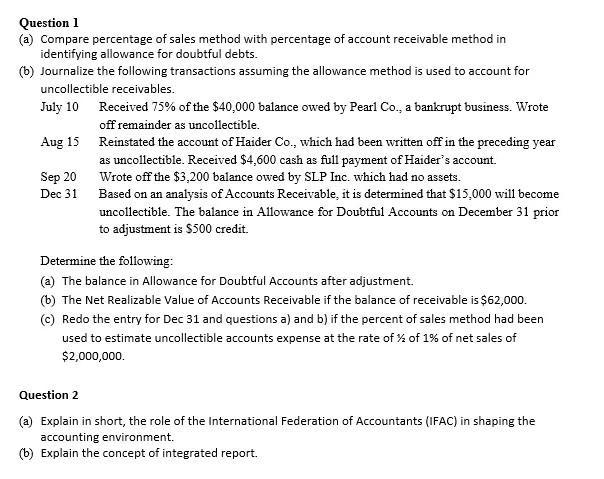

Question 1 (a) Compare percentage of sales method with percentage of account receivable method in identifying allowance for doubtful debts. (b) Journalize the following

Question 1 (a) Compare percentage of sales method with percentage of account receivable method in identifying allowance for doubtful debts. (b) Journalize the following transactions assuming the allowance method is used to account for uncollectible receivables. July 10 Received 75% of the $40,000 balance owed by Pearl Co., a bankrupt business. Wrote off remainder as uncollectible. Aug 15 Reinstated the account of Haider Co., which had been written off in the preceding year as uncollectible. Received $4,600 cash as full payment of Haider's account. Wrote off the $3,200 balance owed by SLP Inc. which had no assets. Sep 20 Dec 31 Based on an analysis of Accounts Receivable, it is determined that $15,000 will become uncollectible. The balance in Allowance for Doubtful Accounts on December 31 prior to adjustment is $500 credit. Determine the following: (a) The balance in Allowance for Doubtful Accounts after adjustment. (b) The Net Realizable Value of Accounts Receivable if the balance of receivable is $62,000. (c) Redo the entry for Dec 31 and questions a) and b) if the percent of sales method had been used to estimate uncollectible accounts expense at the rate of of 1% of net sales of $2,000,000. Question 2 (a) Explain in short, the role of the International Federation of Accountants (IFAC) in shaping the accounting environment. (b) Explain the concept of integrated report.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Q2 A iThe International Federation of Accountants IFAC is the global organization for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started