Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 A Credit Default Swaps (CDS) is a contract where one party (credit protection buyer) pays the other one (credit protection seller) a

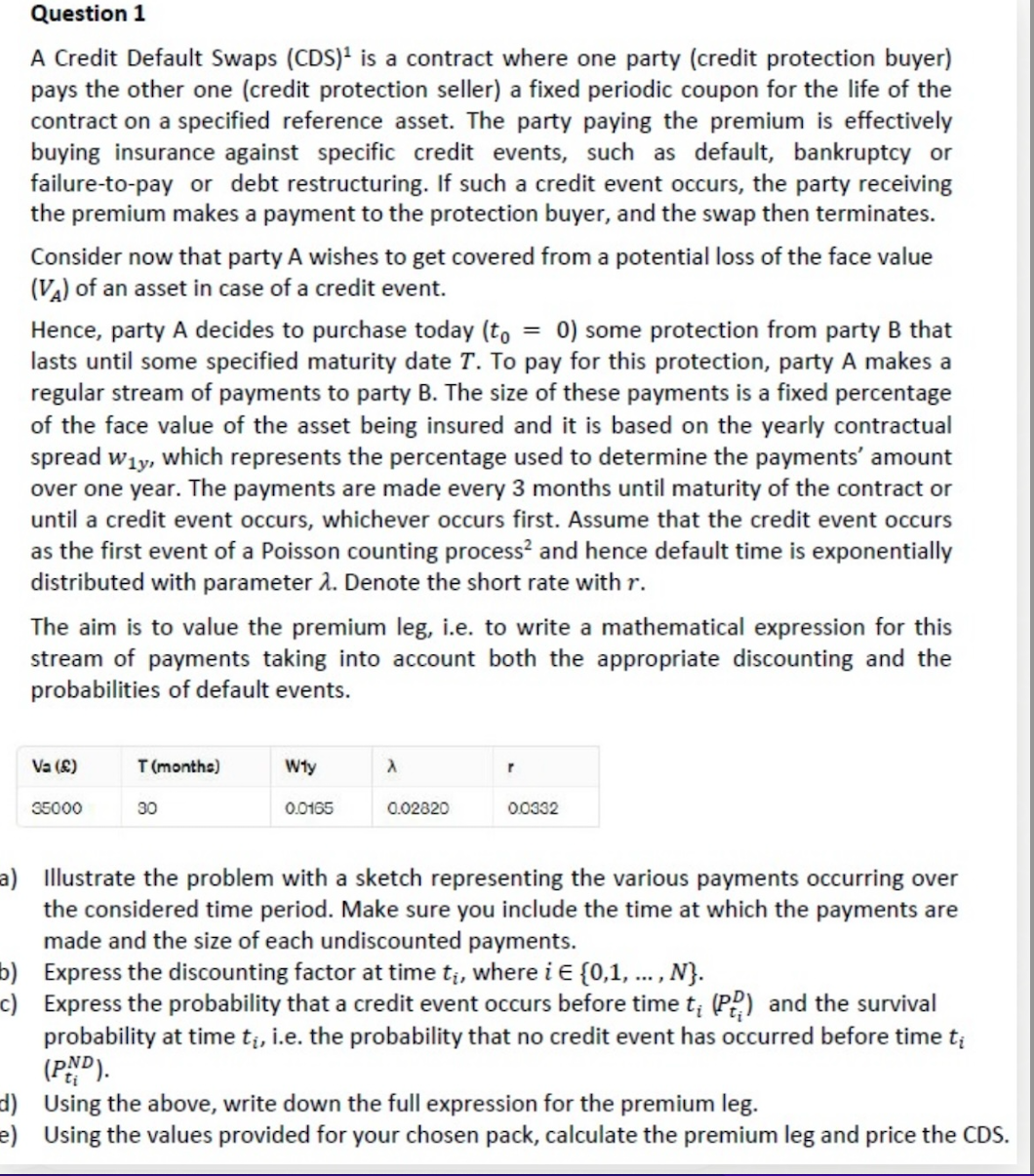

Question 1 A Credit Default Swaps (CDS) is a contract where one party (credit protection buyer) pays the other one (credit protection seller) a fixed periodic coupon for the life of the contract on a specified reference asset. The party paying the premium is effectively buying insurance against specific credit events, such as default, bankruptcy or failure-to-pay or debt restructuring. If such a credit event occurs, the party receiving the premium makes a payment to the protection buyer, and the swap then terminates. Consider now that party A wishes to get covered from a potential loss of the face value (VA) of an asset in case of a credit event. Hence, party A decides to purchase today (to = 0) some protection from party B that lasts until some specified maturity date T. To pay for this protection, party A makes a regular stream of payments to party B. The size of these payments is a fixed percentage of the face value of the asset being insured and it is based on the yearly contractual spread wy, which represents the percentage used to determine the payments' amount over one year. The payments are made every 3 months until maturity of the contract or until a credit event occurs, whichever occurs first. Assume that the credit event occurs as the first event of a Poisson counting process and hence default time is exponentially distributed with parameter A. Denote the short rate with r. The aim is to value the premium leg, i.e. to write a mathematical expression for this stream of payments taking into account both the appropriate discounting and the probabilities of default events. Va () T (months) Wty 35000 30 0.0165 0.02820 r 0.0332 a) Illustrate the problem with a sketch representing the various payments occurring over the considered time period. Make sure you include the time at which the payments are made and the size of each undiscounted payments. b) Express the discounting factor at time ti, where i {0,1,..., N}. c) Express the probability that a credit event occurs before time t (P+) and the survival probability at time ti, i.e. the probability that no credit event has occurred before time ti (PND). d) Using the above, write down the full expression for the premium leg. e) Using the values provided for your chosen pack, calculate the premium leg and price the CDS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started