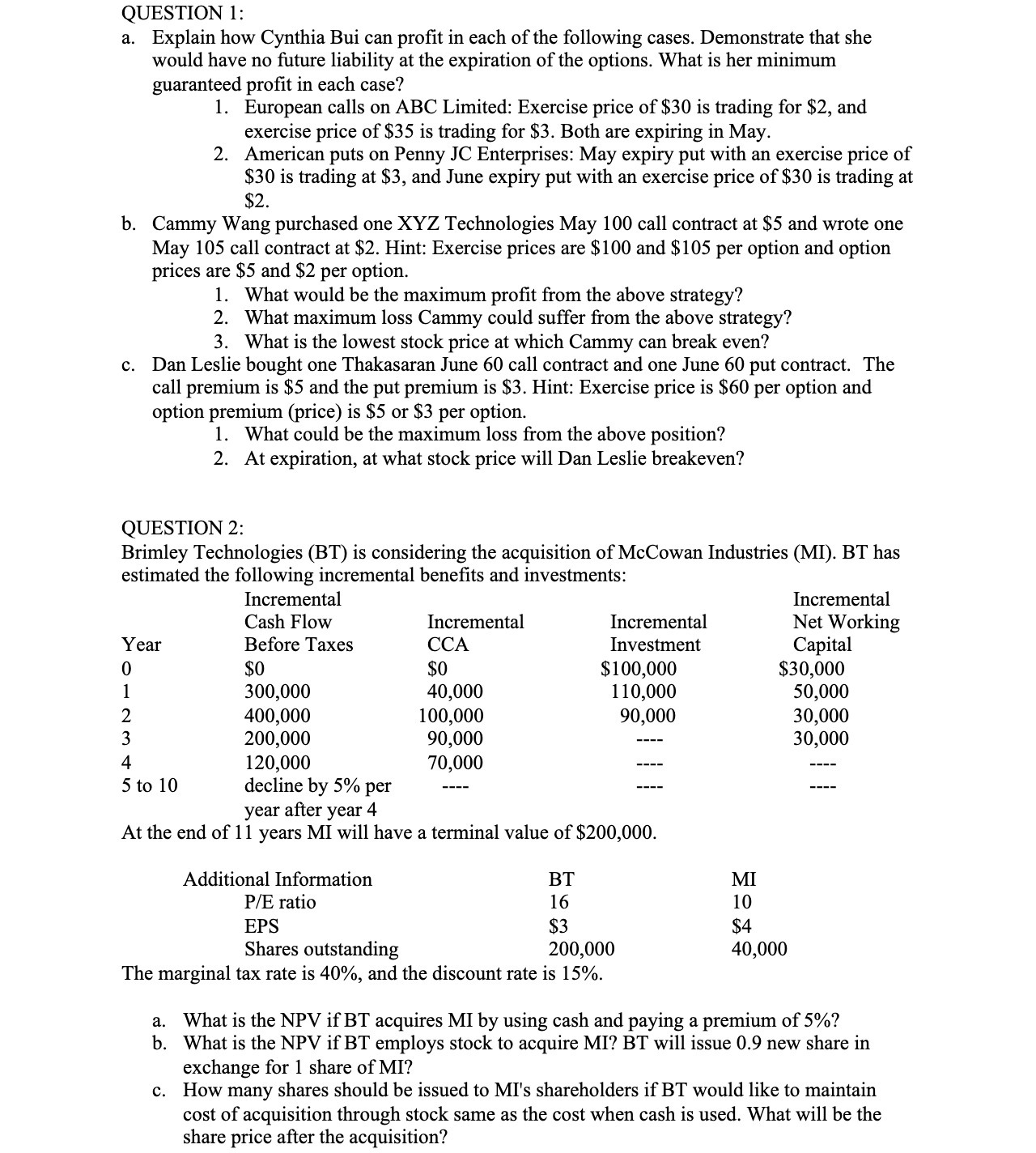

QUESTION 1: a. Explain how Cynthia Bui can prot in each of the following cases. Demonstrate that she would have no future liability at the expiration of the options. What is her minimum guaranteed prot in each case? 1. European calls on ABC Limited: Exercise price of $30 is trading for $2, and exercise price of $35 is trading for $3. Both are expiring in May. 2. American puts on Penny J C Enterprises: May expiry put with an exercise price of $30 is trading at $3, and June expiry put with an exercise price of $30 is trading at $2. b. Cammy Wang purchased one XYZ Technologies May 100 call contract at $5 and wrote one May 105 call contract at $2. Hint: Exercise prices are $100 and $105 per option and option prices are $5 and $2 per option. 1. What would be the maximum prot from the above strategy? 2. What maximum loss Cammy could suffer from the above strategy? 3. What is the lowest stock price at which Cammy can break even? c. Dan Leslie bought one Thakasaran June 60 call contract and one June 60 put contract. The call premium is $5 and the put premium is $3. Hint: Exercise price is $60 per option and option premium (price) is $5 or $3 per option. 1. What could be the maximum loss 'om the above position? 2. At expiration, at what stock price will Dan Leslie breakeven? QUESTION 2: Brimley Technologies (ET) is considering the acquisition of McCowan Industries (MI). BT has estimated the following incremental benets and investments: Incremental Incremental Cash Flow Incremental Incremental Net Working Year Before Taxes CCA Investment Capital 0 $0 $0 $100,000 $3 0,000 1 300,000 40,000 110,000 50,000 2 400,000 100,000 90,000 30,000 3 200,000 90,000 ---- 30,000 4 120,000 70,000 ---- --- 5 to 10 decline by 5% per year after year 4 At the end of 11 years MI will have a terminal value of $200,000. Additional Information BT MI P/E ratio 16 10 EPS $3 $4 Shares outstanding 200,000 40,000 The marginal tax rate is 40%, and the discount rate is 15%. a. What is the NPV if BT acquires MI by using cash and paying a premium of 5%? b. What is the NPV if BT employs stock to acquire MI?| BT will issue 0.9 new share in exchange for I share of MI? c. How many shares should be issued to MI's shareholders if BT would like to maintain cost of acquisition through stock same as the cost when cash is used. What will be the share price after the acquisition