Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (a) Explain how the venture capital industry works. In your answer, discuss Entrepreneurs, Venture Capitalists, Private Investors and Investment Banks. (b) Consider a

Question 1

(a) Explain how the venture capital industry works. In your answer, discuss

Entrepreneurs, Venture Capitalists, Private Investors and Investment Banks.

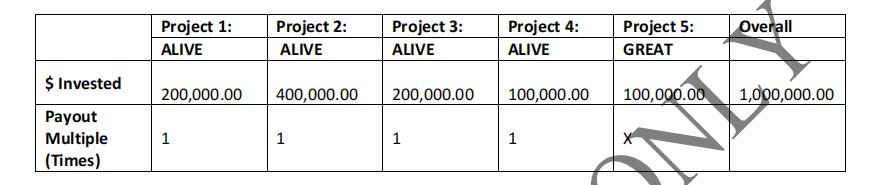

(b) Consider a VC fund that provides funding to 5 companies (as per the table

below). If 4 companies have a one times (1 X) exit multiple, what must the exit multiple

be for the 5th company be, in order for the fund to achieve a 30% overall rate of return?

Assume that all projects and the VC fund itself last for 5 years.

(c) What is the exit multiple for the overall VC fund?

$ Invested Payout Multiple (Times) Project 1: ALIVE 200,000.00 1 Project 2: ALIVE 400,000.00 1 Project 3: ALIVE 200,000.00 1 Project 4: ALIVE 100,000.00 1 Project 5: GREAT 100,000.00 Overall 1,000,000.00 $ Invested Payout Multiple (Times) Project 1: ALIVE 200,000.00 1 Project 2: ALIVE 400,000.00 1 Project 3: ALIVE 200,000.00 1 Project 4: ALIVE 100,000.00 1 Project 5: GREAT 100,000.00 Overall 1,000,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started