Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1. (a) Forecast the next 10 years of Income statements and balance sheets for Larrys business. (b) Calculate the value of Larrys business based

Question 1.

(a) Forecast the next 10 years of Income statements and balance sheets for Larrys business.

(b) Calculate the value of Larrys business based on your forecast.

(c) Discuss the merits of your valuation.

(d) Is there another business model that Larry should consider that may unlock value for Larry? Discuss what this business model is and determine the value that could be unlocked.

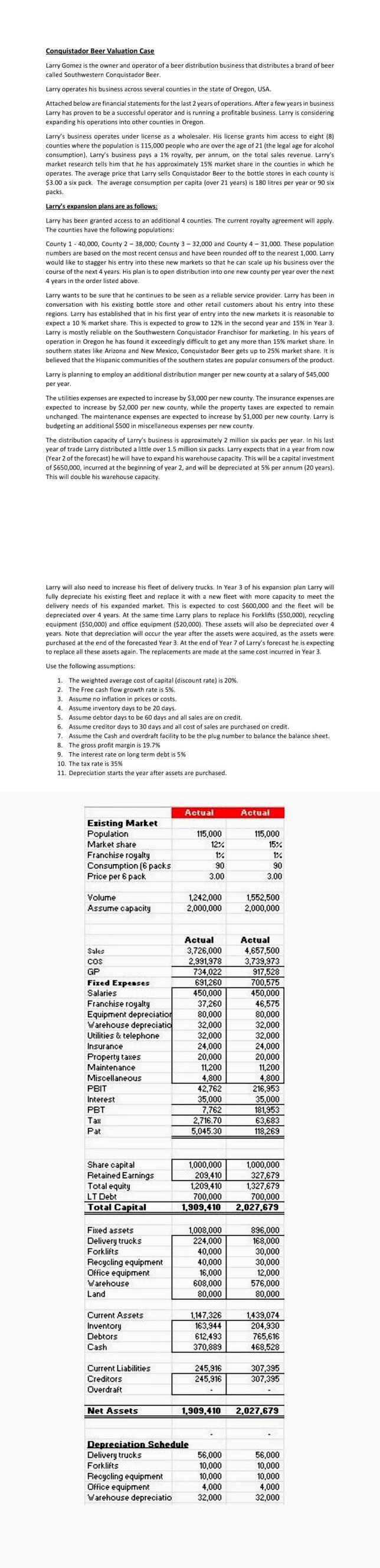

Conquistador Beer Valuation Case Larry Gomez is the owner and operator of a beer distribution business that distributes a brand of beer called Southwestern Conquistador Beer. Larry operates his business across several counties in the state of Oregon, USA. Attached below are financial statements for the last 2 years of operations. After a few years in business Larry has proven to be a successful operator and is running a profitable business. Larry is considering expanding his operations into other counties in Oregon. Larry's business operates under license as a wholesaler. His license grants him access to eight (8) counties where the population is 115,000 people who are over the age of 21 (the legal age for alcohol consumption), Larry's business pays a 1% royalty, per annum, on the total sales revenue. Larry's market research tells him that he has approximately 15% market share in the counties in which he operates. The average price that Larry sells Conquistador Beer to the bottle stores in each county is $3.00 a six pack. The average consumption per capita (over 21 years) is 180 litres per year or 90 six packs. Larry's expansion plans are as follows: Larry has been granted access to an additional 4 counties. The current royalty agreement will apply. The counties have the following populations: County 140,000, County 238,000; County 332,000 and County 431,000. These population numbers are based on the most recent census and have been rounded off to the nearest 1,000. Larry would like to stagger his entry into these new markets so that he can scale up his business over the course of the next 4 years. His plan is to open distribution into one new county per year over the next 4 years in the order listed above. Larry wants to be sure that he continues to be seen as a reliable service provider. Larry has been in conversation with his existing bottle store and other retail customers about his entry into these regions. Larry has established that in his first year of entry into the new markets it is reasonable to expect a 10% market share. This is expected to grow to 12% in the second year and 15% in Year 3. Larry is mostly reliable on the Southwestern Conquistador Franchisor for marketing. In his years of operation in Oregon he has found it exceedingly difficult to get any more than 15% market share. In southern states like Arizona and New Mexico, Conquistador Beer gets up to 25% market share. It is believed that the Hispanic communities of the southern states are popular consumers of the product. Larry is planning to employ an additional distribution manger per new county at a salary of $45,000 per year. The utilities expenses are expected to increase by $3,000 per new county. The insurance expenses are expected to increase by $2,000 per new county, while the property taxes are expected to remain unchanged. The maintenance expenses are expected to increase by $1,000 per new county. Larry is budgeting an additional $500 in miscellaneous expenses per new county. The distribution capacity of Larry's business is approximately 2 million six packs per year. In his last year of trade Larry distributed a little over 1.5 million six packs. Larry expects that in a year from now (Year 2 of the forecast) he will have to expand his warehouse capacity. This will be a capital investment of $650,000, incurred at the beginning of year 2 , and will be depreciated at 5% per annum (20 years). This will double his warehouse capacity. Larry will also need to increase his fleet of delivery trucks. In Year 3 of his expansion plan Larry will fully depreciate his existing fleet and replace it with a new fleet with more capacity to meet the delivery needs of his expanded market. This is expected to cost $600,000 and the fleet will be depreciated over 4 years. At the same time Larry plans to replace his forklifts ($50,000), recycling equipment ($50,000) and office equipment ($20,000). These assets will also be depreciated over 4 years. Note that depreciation will occur the year after the assets were acquired, as the assets were purchased at the end of the forecasted Year 3. At the end of Year 7 of Larry's forecast he is expecting to replace all these assets again. The replacements are made at the same cost incurred in Year 3. Use the following assumptions: 1. The weighted average cost of capital (discount rate) is 20%. 2. The Free cash flow growth rate is 5%. 3. Assume no inflation in prices or costs. 4. Assume inventory days to be 20 days. 5. Assume debtor days to be 60 days and all sales are on credit. 6. Assume creditor days to 30 days and all cost of sales are purchased on credit. 7. Assume the Cash and overdraft facility to be the plug number to balance the balance sheet. 8. The gross profit margin is 19.7% 9. The interest rate on long term debt is 5% 10. The tax rate is 35% 11. Depreciation starts the year after assets are purchased. Conquistador Beer Valuation Case Larry Gomez is the owner and operator of a beer distribution business that distributes a brand of beer called Southwestern Conquistador Beer. Larry operates his business across several counties in the state of Oregon, USA. Attached below are financial statements for the last 2 years of operations. After a few years in business Larry has proven to be a successful operator and is running a profitable business. Larry is considering expanding his operations into other counties in Oregon. Larry's business operates under license as a wholesaler. His license grants him access to eight (8) counties where the population is 115,000 people who are over the age of 21 (the legal age for alcohol consumption), Larry's business pays a 1% royalty, per annum, on the total sales revenue. Larry's market research tells him that he has approximately 15% market share in the counties in which he operates. The average price that Larry sells Conquistador Beer to the bottle stores in each county is $3.00 a six pack. The average consumption per capita (over 21 years) is 180 litres per year or 90 six packs. Larry's expansion plans are as follows: Larry has been granted access to an additional 4 counties. The current royalty agreement will apply. The counties have the following populations: County 140,000, County 238,000; County 332,000 and County 431,000. These population numbers are based on the most recent census and have been rounded off to the nearest 1,000. Larry would like to stagger his entry into these new markets so that he can scale up his business over the course of the next 4 years. His plan is to open distribution into one new county per year over the next 4 years in the order listed above. Larry wants to be sure that he continues to be seen as a reliable service provider. Larry has been in conversation with his existing bottle store and other retail customers about his entry into these regions. Larry has established that in his first year of entry into the new markets it is reasonable to expect a 10% market share. This is expected to grow to 12% in the second year and 15% in Year 3. Larry is mostly reliable on the Southwestern Conquistador Franchisor for marketing. In his years of operation in Oregon he has found it exceedingly difficult to get any more than 15% market share. In southern states like Arizona and New Mexico, Conquistador Beer gets up to 25% market share. It is believed that the Hispanic communities of the southern states are popular consumers of the product. Larry is planning to employ an additional distribution manger per new county at a salary of $45,000 per year. The utilities expenses are expected to increase by $3,000 per new county. The insurance expenses are expected to increase by $2,000 per new county, while the property taxes are expected to remain unchanged. The maintenance expenses are expected to increase by $1,000 per new county. Larry is budgeting an additional $500 in miscellaneous expenses per new county. The distribution capacity of Larry's business is approximately 2 million six packs per year. In his last year of trade Larry distributed a little over 1.5 million six packs. Larry expects that in a year from now (Year 2 of the forecast) he will have to expand his warehouse capacity. This will be a capital investment of $650,000, incurred at the beginning of year 2 , and will be depreciated at 5% per annum (20 years). This will double his warehouse capacity. Larry will also need to increase his fleet of delivery trucks. In Year 3 of his expansion plan Larry will fully depreciate his existing fleet and replace it with a new fleet with more capacity to meet the delivery needs of his expanded market. This is expected to cost $600,000 and the fleet will be depreciated over 4 years. At the same time Larry plans to replace his forklifts ($50,000), recycling equipment ($50,000) and office equipment ($20,000). These assets will also be depreciated over 4 years. Note that depreciation will occur the year after the assets were acquired, as the assets were purchased at the end of the forecasted Year 3. At the end of Year 7 of Larry's forecast he is expecting to replace all these assets again. The replacements are made at the same cost incurred in Year 3. Use the following assumptions: 1. The weighted average cost of capital (discount rate) is 20%. 2. The Free cash flow growth rate is 5%. 3. Assume no inflation in prices or costs. 4. Assume inventory days to be 20 days. 5. Assume debtor days to be 60 days and all sales are on credit. 6. Assume creditor days to 30 days and all cost of sales are purchased on credit. 7. Assume the Cash and overdraft facility to be the plug number to balance the balance sheet. 8. The gross profit margin is 19.7% 9. The interest rate on long term debt is 5% 10. The tax rate is 35% 11. Depreciation starts the year after assets are purchasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started