Answered step by step

Verified Expert Solution

Question

1 Approved Answer

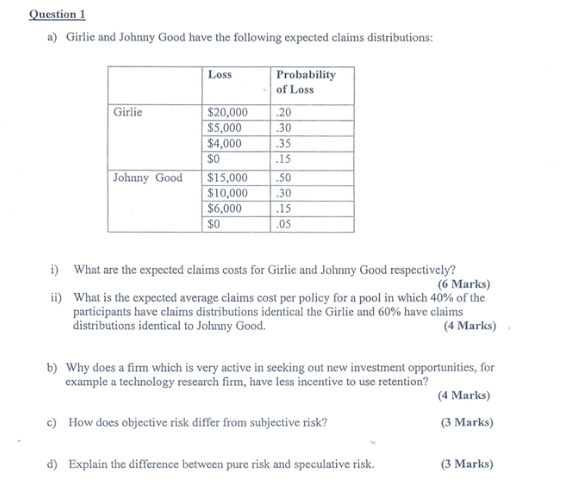

Question 1 a) Girlie and Johnny Good have the following expected claims distributions: Girlie Johnny Good Loss $20,000 $5,000 $4,000 $0 Probability of Loss

Question 1 a) Girlie and Johnny Good have the following expected claims distributions: Girlie Johnny Good Loss $20,000 $5,000 $4,000 $0 Probability of Loss .20 .30 .35 .15 $15,000 .50 $10,000 .30 .15 $6,000 $0 .05 i) What are the expected claims costs for Girlie and Johnny Good respectively? (6 Marks) ii) What is the expected average claims cost per policy for a pool in which 40% of the participants have claims distributions identical the Girlie and 60% have claims distributions identical to Johnny Good. (4 Marks) b) Why does a firm which is very active in seeking out new investment opportunities, for example a technology research firm, have less incentive to use retention? c) How does objective risk differ from subjective risk? d) Explain the difference between pure risk and speculative risk. (4 Marks) (3 Marks) (3 Marks) *

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started