Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (a) Haruto is a Japanese who serves at Meiji Ltd in Japan. He has been seconded to the Malaysian subsidiary to act

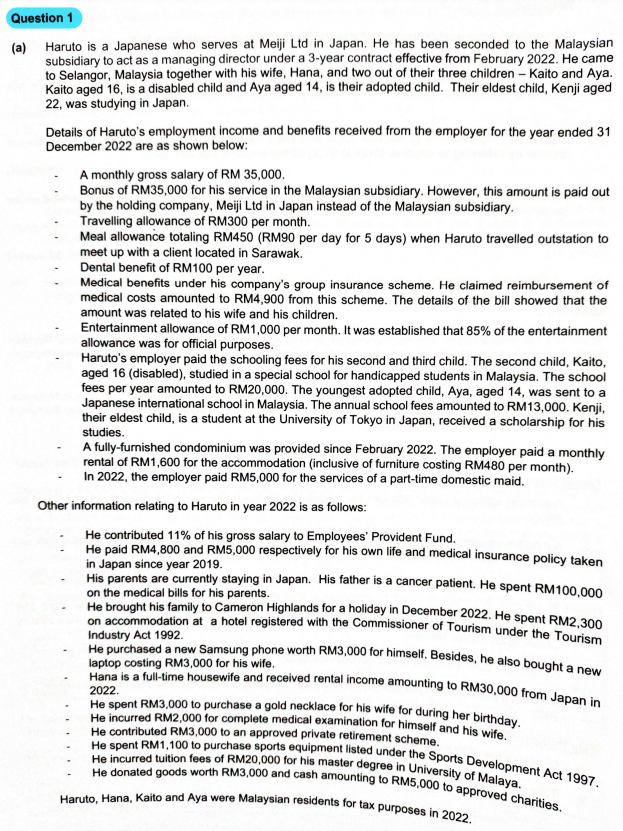

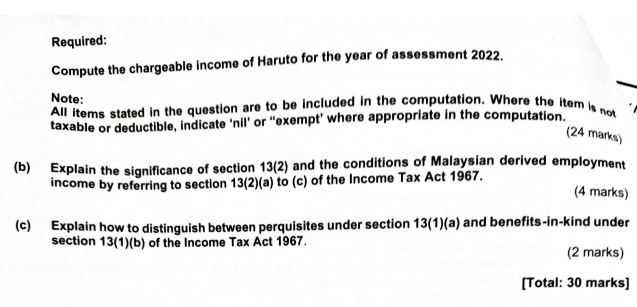

Question 1 (a) Haruto is a Japanese who serves at Meiji Ltd in Japan. He has been seconded to the Malaysian subsidiary to act as a managing director under a 3-year contract effective from February 2022. He came to Selangor, Malaysia together with his wife, Hana, and two out of their three children - Kaito and Aya. Kaito aged 16, is a disabled child and Aya aged 14, is their adopted child. Their eldest child, Kenji aged 22, was studying in Japan. Details of Haruto's employment income and benefits received from the employer for the year ended 31 December 2022 are as shown below: A monthly gross salary of RM 35,000. Bonus of RM35,000 for his service in the Malaysian subsidiary. However, this amount is paid out by the holding company, Meiji Ltd in Japan instead of the Malaysian subsidiary. Travelling allowance of RM300 per month. Meal allowance totaling RM450 (RM90 per day for 5 days) when Haruto travelled outstation to meet up with a client located in Sarawak. Dental benefit of RM100 per year. Medical benefits under his company's group insurance scheme. He claimed reimbursement of medical costs amounted to RM4,900 from this scheme. The details of the bill showed that the amount was related to his wife and his children. Entertainment allowance of RM1,000 per month. It was established that 85% of the entertainment allowance was for official purposes. Haruto's employer paid the schooling fees for his second and third child. The second child, Kaito, aged 16 (disabled), studied in a special school for handicapped students in Malaysia. The school fees per year amounted to RM20,000. The youngest adopted child, Aya, aged 14, was sent to a Japanese international school in Malaysia. The annual school fees amounted to RM13,000. Kenji, their eldest child, is a student at the University of Tokyo in Japan, received a scholarship for his studies. A fully-furnished condominium was provided since February 2022. The employer paid a monthly rental of RM1,600 for the accommodation (inclusive of furniture costing RM480 per month). In 2022, the employer paid RM5,000 for the services of a part-time domestic maid. Other information relating to Haruto in year 2022 is as follows: He contributed 11% of his gross salary to Employees' Provident Fund. He paid RM4,800 and RM5,000 respectively for his own life and medical insurance policy taken in Japan since year 2019. His parents are currently staying in Japan. His father is a cancer patient. He spent RM100,000 on the medical bills for his parents. He brought his family to Cameron Highlands for a holiday in December 2022. He spent RM2,300 on accommodation at a hotel registered with the Commissioner of Tourism under the Tourism Industry Act 1992. He purchased a new Samsung phone worth RM3,000 for himself. Besides, he also bought a new laptop costing RM3,000 for his wife. Hana is a full-time housewife and received rental income amounting to RM30,000 from Japan in 2022. He spent RM3,000 to purchase a gold necklace for his wife for during her birthday. He incurred RM2,000 for complete medical examination for himself and his wife. He contributed RM3,000 to an approved private retirement scheme. He spent RM1,100 to purchase sports equipment listed under the Sports Development Act 1997. He incurred tuition fees of RM20,000 for his master degree in University of Malaya. He donated goods worth RM3,000 and cash amounting to RM5,000 to approved charities. Haruto, Hana, Kaito and Aya were Malaysian residents for tax purposes in 2022. Required: Compute the chargeable income of Haruto for the year of assessment 2022. Note: All items stated in the question are to be included in the computation. Where the item is not taxable or deductible, indicate 'nil' or "exempt' where appropriate in the computation. (24 marks) (b) Explain the significance of section 13(2) and the conditions of Malaysian derived employment income by referring to section 13(2)(a) to (c) of the Income Tax Act 1967. (4 marks) (c) Explain how to distinguish between perquisites under section 13(1)(a) and benefits-in-kind under section 13(1)(b) of the Income Tax Act 1967. (2 marks) [Total: 30 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started