Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (A) MFRS 13 Fair Value Measurement standard outlines the guidelines pertaining to the measurement of fair value of assets and liabilities. Required :

Question 1

(A) MFRS 13 Fair Value Measurement standard outlines the guidelines pertaining to the measurement of fair value of assets and liabilities.

Required :

a) Explain "fair value" in accordance with the definition contained in MFRS 13 Fair Value Measurement standard. (2 marks)

b) Discuss why fair value measurement is gaining importance in accounting. (4 marks)

c) Elaborate how the measurement of fair value is applied for the following types of asset: Property, Plant and Equipment (PPE), Investment Property (IP) and financial instruments. (6 marks)

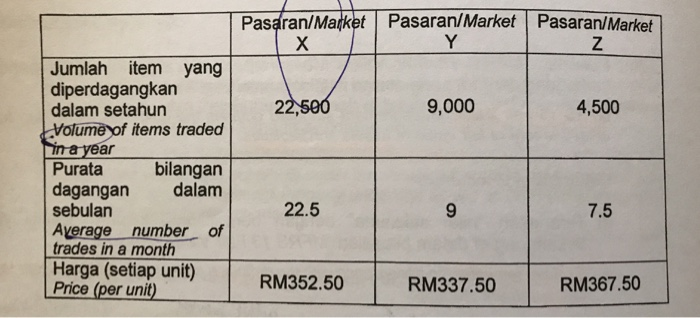

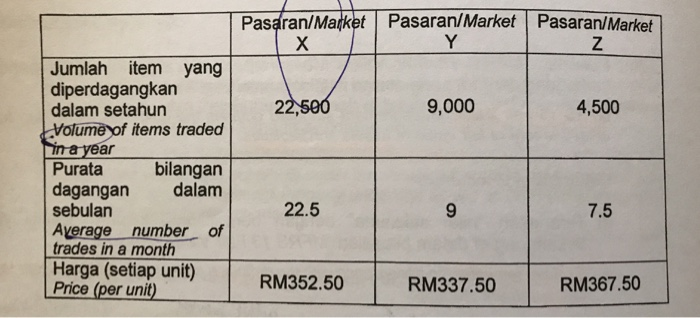

(B) Company A holds an asset, its inventory which is traded in all three markets, namely Market X, Y and Z although it is very usual for the company to undertake buying and selling transaction of the inventory items in Market Z. The information about the three markets are as follows: (the below picture)

Required :

a) Explain the meaning of "principal" market in accordance with the provisions in MFRS 13 Fair Value Measurement. (2 marks)

b) Based on the information presented above, discuss how Company A determines the principal market for its inventory in accordance with the guidelines contained in the standard, MFRS 13 Fair Value Measurement. State the principal market for inventory of Company A. (3 marks)

c) Determine the fair value of the inventory (per unit) for Company A based on the answer on part b) ii) above. (1 mark)

d) Discuss how and in what way fair value measurement would be applicable for measuring the value of an inventory in accordance with the provision in MFRS 102 Inventory standard. (2 marks)

Question 2

(A) Harta Sakti Berhad produces a wide range of cosmetic products to be distributed all around Malaysia. The fierce competition faced by Harta Sakti has forced the company to undertake reorganisation exercise within the company. This arrangement is somewhat expected to affect the financial position of the company. Information about the properties owned by Harta Sakti on 1 April 2015 are as follows:

Property 1: An office building used by Harta Sakti for administrative purposes with a depreciated historical cost of RM2 million. At 1 April 2015, it 'had a remaining useful life of 20 years. After a reorganisation on 1 October 2015 the property was let to a third party and reclassified as an investment property, applying the company's policy of the fair value model. An independent valuer assessed the property to have a fair value of RM2.3 million at 1 October 2015, which had risen to RM2.34million at 31 March 2016. 2016.

Property 2: Another office building sub-let to a subsidiary of Harta Sakti. At 1 April 2015 it had a fair value of RM1.5 million, which had risen to RM1.65million at 31 March 2016.

Required:

a) Based on MFRS 140 Investment Property, explain how an investment property accounted under the fair value model differs from an owner-occupied property accounted under the revaluation model. (5 marks)

b) Prepare extracts from Harta Sakti Berhad's statement of profit or loss and other comprehensive income and statement of financial position for the year ended 31 March 2016 in respect of the above properties. Note: Ignore deferred tax. (6 marks)

(B) Mekar Berhad is another subsidiary of Harta Sakti Berhad, which involves in landscape design and installation business for over 10 years. Mekar Berhad offers comprehensive landscape design and installation services for planting, irrigation systems, landscape lighting, seeding and more. The company serves the residential and commercial sectors. Mekar Berhad owns several properties and has a financial year end of 31 December. Whenever possible, Mekar Berhad considers investment properties using the fair value model. The list of properties owned by Mekar Berhad are as follows:

Property A was acquired on 1 January 2011. It had a cost of RM1 million, comprising of RM500,000 for land and RM500,000 for buildings. The buildings have a useful life of 40 years. Mekar Berhad uses this property as its head office.

Property B was acquired many years ago for the price of RM1.5 million for its investment potential. On 31 December 2017, it hada fair value of RM2.3 million. By 31 December 2018, its fair value had risen to RM2.7 million. This property has a useful life of 40 years.

Property C was acquired on 30 June 2012 for the price of RM2 million for its investment potential. The directors of Mekar Berhad's company believe that the fair value of this property was RM3 million on 31 December 2017 and RM3.5 million on 31 December 2018. However, due to the specialised nature of this property, these figures cannot be corroborated. This property has a useful life of 50 years.

Required :

a) For each of the above properties, briefly explain how it would be treated in the financial statements of Mekar Berhad for the year ended 31 December 2018, by identifying any impact on profit or loss (if any). (9 marks)

b) Prepare an analysis of property, plant and equipment for Mekar Berhad for the year ended 31 December 2018, by showing the value of each of the above properties separately. (10 marks)

Question 3

Pembinaan Teguh Berhad enters into a nine-year noncancelable lease agreement with Star Machine Berhad on 1 January 2018. According to the agreement, Pembinaan Teguh Berhad get the right to use an equipment supplied by Star Machine Berhad, with an option that allow the lessor to extend the lease for one year beyond the lease term. The equipment has an estimated useful life of 10 years and a fair value to the lessor at the inception of the lease of RM4 million. Pembinaan Teguh Berhad has an incremental borrowing rate of 8% and uses the straight-line method to depreciate its assets. The lease agreement also contains the following provisions:

Rental payments of RM266,000(nett of property taxes) is payable at the beginning of each SIX-month period.

A guarantee by Pembinaan Teguh Berhad that Star Machine Berhad will realise RM200,000 from selling the asset at the expiration of the lease. However, the actual residual value is expected to be RM120,000.

Required :

a) According to MFRS 16 Leases, explain FIVE (5) tests used in determining whether a lessor should use the finance lease or operating lease approach. (5 marks)

b) State the type of this lease to Pembinaan Teguh Berhad. Justify your answer. (2 marks)

c) Determine the number of years should be considered as the lease term. (1 markah/mark)

d) Calculate the present value of the lease payments for Pembinaan Teguh Berhad (round off to the nearest Ringgit Malaysia):

(i) for classification of the lease (3 marks)

(ii)for measurement of the lease liability. (3 marks)

e) Prepare the journal entries in the book of Pembinaan Teguh Berhad during the first year of the lease. (Prepare an amortization schedule till 1 January 2019 and round off to the nearest Ringgit Malaysia.) (7 marks)

f) Discuss the differences between a direct-financing lease and a sales-type lease. (6 marks)

g) Explain the major difference in MFRS 16 Leases in comparison to MFRS 117 Leases (3 marks)

all questions... 1,2, and 3

Pasaran/Market Pasaran/Market Pasaran/Market 1 x 7 22,500 9,000 4,500 Jumlah item yang diperdagangkan dalam setahun Volume of items traded in a year Purata bilangan dagangan dalam sebulan Average number of trades in a month Harga (setiap unit) Price (per unit) 22.5 7.5 RM352.50 RM337.50 RM367.50 Pasaran/Market Pasaran/Market Pasaran/Market 1 x 7 22,500 9,000 4,500 Jumlah item yang diperdagangkan dalam setahun Volume of items traded in a year Purata bilangan dagangan dalam sebulan Average number of trades in a month Harga (setiap unit) Price (per unit) 22.5 7.5 RM352.50 RM337.50 RM367.50 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started